Why Flat Fee-Only!?

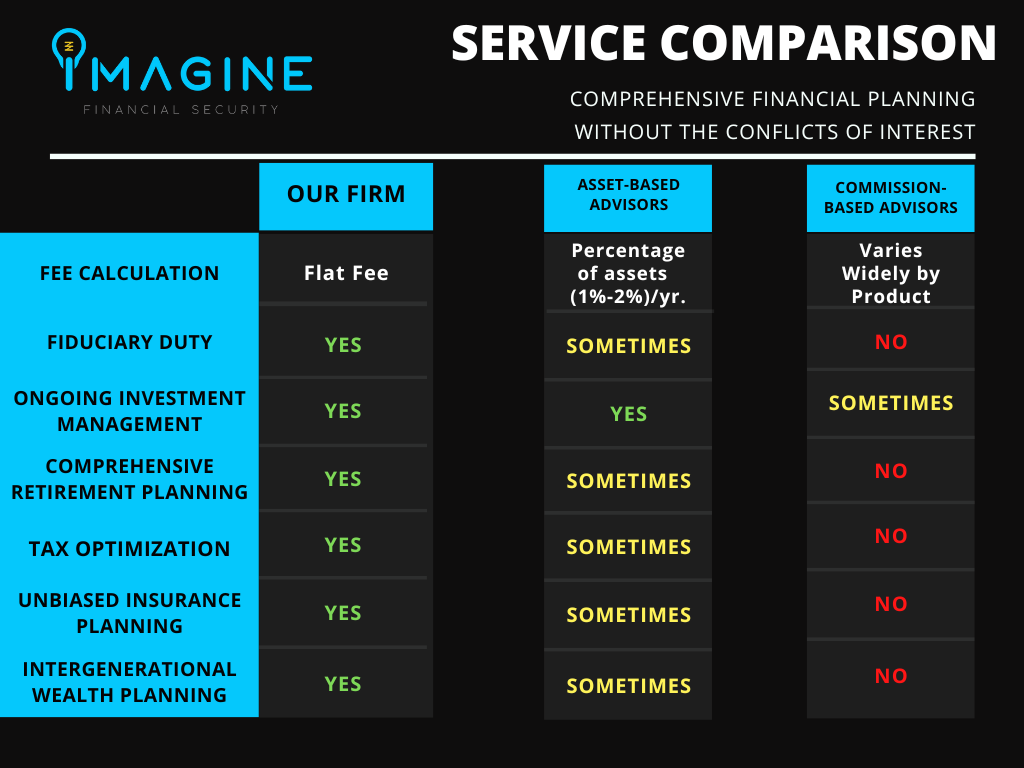

You are probably used to paying a commission for a product, or a percentage to your advisor based on assets they manage.

We believe the fee you pay should be based on how we can help achieve your financial goals, not whether you have $1 million saved or $5 million saved.

The “traditional” fee structures inherently have conflicts of interest that typically don’t work in your favor. For example, if you wanted to buy a vacation home which would require liquidating some of your assets, will the asset-based or commission based advisor truly provide unbiased advice? Not likely, as that might impact their ongoing compensation.

WE ARE DIFFERENT.

We provide comprehensive retirement planning, tax optimization and ongoing investment management for one flat fee. The fee is not based on how much your portfolio is worth! As a fiduciary financial advisor, we believe the flat fee-only model allows us to provide you with comprehensive advice without conflicts of interest.

Retirement Planning for ages 50+

- In Depth Retirement Planning Analysis

- Customized Ongoing Investment Management

- Income Distribution Planning

- Social Security Optimization

- Tax Optimization

- Long-Term Care and Life Insurance Review

- Roth Conversion Analysis

- Charitable Giving

- IRMAA Mitigation

- Pension Maximization

- Required Minimum Distribution Planning

- Major Asset Purchase or Sale

- Estate Planning Coordination

*The fee starts at $2,500/quarter+. The quote depends on the complexity of your situation and will be provided after your Mutual Fit Meeting.

Early Retirement Planning (under age 50)

- Financial Independence to Retire Early Analysis (FIRE Analysis)

- Ongoing Investment Management

- Tax Efficient Wealth Accumulation

- Debt and Cash Flow Analysis

- Mortgage Review

- Basic Insurance Review

- Major Asset Purchase or Sale

- Estate Planning Coordination

*The fee starts at $2,500/quarter+. The quote depends on the complexity of your situation and will be provided after your Mutual Fit Meeting.

One-Time Financial Planning

Comprehensive Financial Planning

- In Depth Retirement Planning Analysis

- Asset Allocation Review

- Cash Flow Analysis

- Social Security Optimization

- Tax Optimization

- Insurance Review

- Roth Conversion Analysis

- Major Asset Purchase or Sale

- Estate Planning Coordination

We also offer insurance-only planning including;

-Life Insurance

-Long-term Care Insurance

-Annuities

*Our average one-time planning fee is $4,000 and for insurance-only planning is $3,000. The quote depends on the complexity of your situation and will be provided to you after your Mutual Fit Meeting.

*fees are calculated based on complexity factors including, but are not limited to; life stage, family situation, tax situation and investment portfolio.

*fees are debited from the investment accounts held with our Custodian, Charles Schwab, or paid through our third party provider via ACH or Credit Card.