Our Fees and Service Models

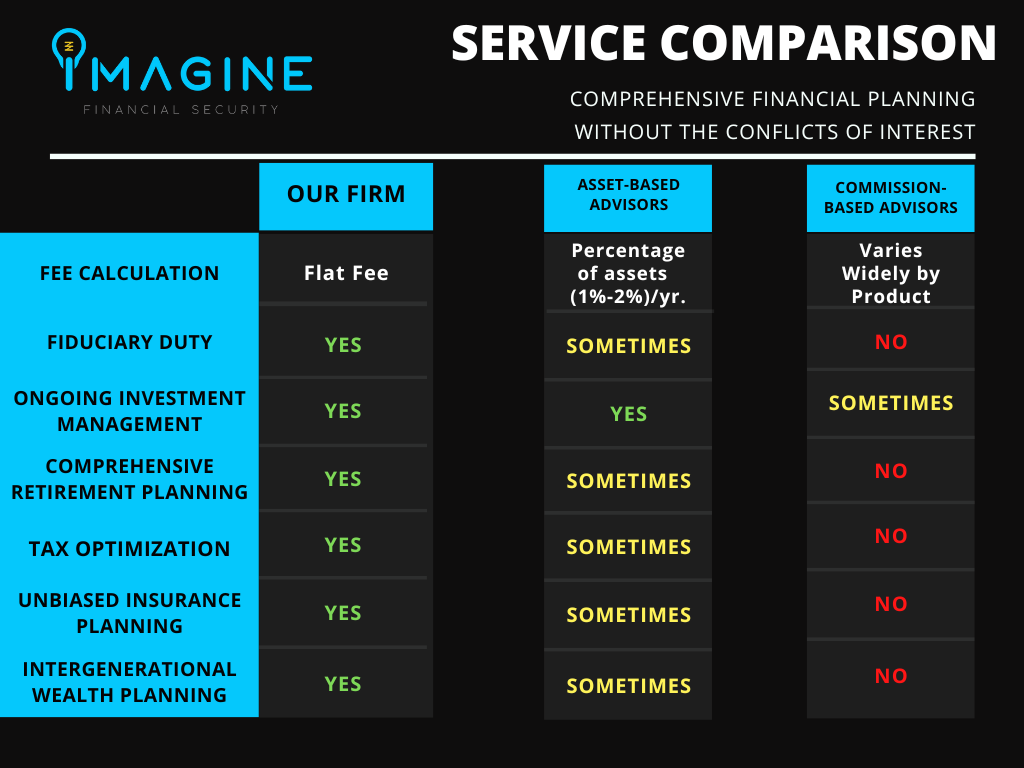

Traditional fee structures at the big box firms are as clear as mud. In addition, their focus on sales and volume will inevitably get in the way of receiving the advice you NEED.

WE ARE DIFFERENT.

We provide comprehensive retirement planning, tax optimization and ongoing investment management for a transparent, flat fee. No third party kick backs. No commissions. No product pushing. Just one clearly defined fee for the services we provide.

Oh, and we will cap the number of clients we serve in order to focus on quality, not quantity.

So, what services do we provide?

Ongoing Financial Planning and Investment Management

- In Depth Retirement Planning Analysis

- Customized Ongoing Investment Management

- Income Distribution Planning

- Social Security Optimization

- Tax Optimization

- Long-Term Care and Life Insurance Review

- Roth Conversion Analysis

- Charitable Giving

- IRMAA Mitigation

- Pension Maximization

- Required Minimum Distribution Planning

- Major Asset Purchase or Sale

- Financial Legacy

*We charge an initial start up fee of $1,000 (Due up front). The ongoing quarterly fee ranges from $2,500/quarter – $6,000/quarter (based on your financial situation), debited from the investment accounts directly. This service is designed for those who have a minimum of $1mm of investible assets, excluding their primary residence.

This fee covers all of the investment management and financial planning costs for the duration of the relationship.

Bonus points if you love to travel and/or play golf!

One-Time Financial Planning

- In Depth Retirement Planning Analysis

- Asset Allocation Review

- Cash Flow Analysis

- Social Security Optimization

- Tax Optimization

- Insurance Review

- Roth Conversion Analysis

- Major Asset Purchase or Sale

- Estate Planning Coordination

*Our one-time planning fee is $5,000. Half is due up front and half is due at the plan delivery meeting. The fee is paid through a third party platform via ACH.

*If you decide to sign up for the “Ongoing Financial Planning and Investment Management” relationship AFTER completing the “One-Time Financial Planning” process, we will issue a partial credit against your first quarter’s fee. You must take action within 30 days of the plan delivery to take advantage of the partial credit.

Which is better suited for you?

The One-Time Financial Planning option is great for sophisticated DIYers who are comfortable managing the implementation process on their own. This includes implementing asset allocation, investment selection, Roth conversions, asset location and tax efficiency.

It is also a great option for those who want to engage with us before hiring us on an ongoing basis. This is a business based on trust, so sometimes people need to get comfortable with our advice before handing over their life savings. We get it!

The Ongoing Financial Planning and Investment Management option is great for those who want to have an ongoing relationship (duh) and delegate the complexities around asset allocation, investment selection, income distribution, Roth conversions, and tax optimization. You want to spend more time with your loved ones, traveling the world, playing more golf, and certainly NOT worrying about the markets. Did I mention bonus points if you love to play golf?

As mentioned, this service is perfect for those who have a minimum of $1mm of investible assets for retirement. Are there exceptions? Of course, but you better be fun to work with! Start with an application to work with us and we’ll take it from there.

*fees are calculated based on complexity factors including, but are not limited to; life stage, family situation, tax situation and investment portfolio.

*fees are debited from the investment accounts held with our Custodian, Charles Schwab, or paid through our third party provider via ACH or Credit Card.