"What are I-Bonds and should I invest in them?"

Let’s talk about the hottest investment of 2022. No, I’m not talking about cryptocurrency, digital assets, meme stocks or FAANG, I am talking about I-Bonds! I was interviewed about this seemingly boring investment on USA Today (read it here) back in December of 2022 when the 12 month rate hit 7.12%. With the annual rate currently paying 6.89%, I-Bonds have become even more attractive to incorporate into your financial plan. After over a decade in this business fielding zero questions about I-Bonds, I’m now getting peppered with texts from friends, family and clients about I-Bonds. Therefore, I figured I would write this article to address your questions, and ultimately help you think about how this could fit into your financial picture. Of course, please consider tax, investment, liquidity and interest rate risk as you assess this strategy, and any other investment strategy for that matter.

What is an I-Bond?

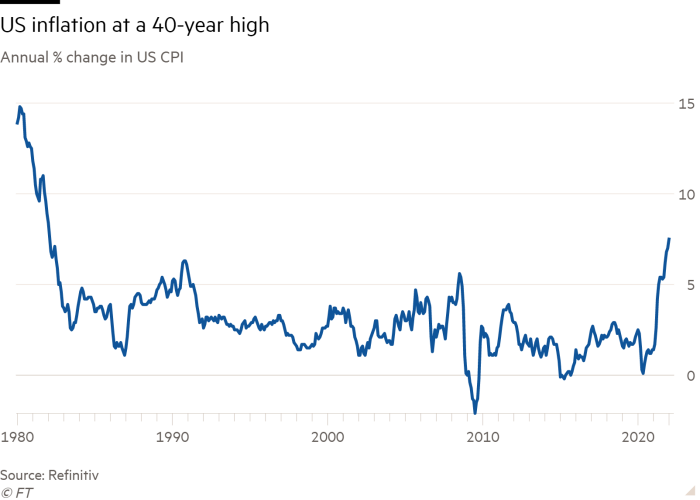

Also known has Series I Savings Bonds, they are issued by the US Government directly to retail investors. There are other denominations ranging from $50-$1,000, depending on how much you invest. The goal of I-Bonds is principal preservation, in addition to earning a reasonable interest rate, adjusted for inflation. Before 2021, inflation was relatively tame (see chart below).

Given the low rate of inflation combined with historically low interest rates, the interest payment on these bonds has been next to nothing for over a decade. Therefore, these bonds haven’t been an attractive offer for clients, until this past year as inflation really began to run hot, and stay hot. In summary, think of the US Government as one of the most secure institutions to back your investment (low risk), and the yield on these bonds are tied to inflation. When inflation is low, the yield is low. However, when inflation is abnormally high, like in today’s environment, yields can look much more attractive.

How is the interest credited on an I-Bond?

There are two components to how your interest rate is determined. The first component is called the “fixed rate.” This applies for the life of the bond, which is 30 years, unless you cash it in early. I’ll talk more about liquidity later. Right now, the fixed rate on bonds issued between November 1st and May 1st is a whopping 0%. However, the second component is the inflation adjustment, which is re-evaluated each 6 month period. Given the high inflation numbers we’ve seen, this component for I-Bonds issued during the same 6 month interval (November 2021 through April 2022) is 3.56%! What’s more, is that the adjusted semi annual rate for I-Bonds for the next 6 month period is 4.81%! Therefore, bonds that are purchased before May 1st will receive the 3.56% in the first 6 months after issue and 4.81% for the next 6 months after issue, which totals 8.37% for the first 12 months of the bond! The average 1-year CD is currently 0.22%. So if you had $1,000 and invested in a 1-year CD, you would earn a total of $2.2 of annual interest. This would be enough to buy a half a cup of Starbucks coffee on your way to work. On the contrary, if you took that same $1,000 and invested in an I-Bond before the May 1st cutoff, you would earn approximately $83.7, which is 37 times higher the return with essentially equivalent risk to a 1-year CD.

As I mentioned, each 6 month interval will have an inflation adjustment. Therefore, if inflation does get under control (which we all hope), you could see your rate drop over time, depending on when you madethe purchase. However, while inflation is wreaking havoc around the globe, this could be an opportune time to look at this strategy as a CD or Money Market alternative.

How much can I invest into an I-Bond?

Some of you were ready to liquidate all of your stocks and invest in I-Bonds. Not so fast. The limit per person, per year, is $10,000 if you buy them electronically. You can also use $5,000 of your tax return each year to buy the paper I-Bonds, so technically you can buy up to $15,000 in I-Bonds each year per person. If you are married, you and your spouse can both take advantage of the maximum $10,000 electronically ($20k total) and $5,000 from a tax return, if applicable.

One way to boost that annual limit is gifting I-Bonds to your children, if you have them. However, these gifts are irrevocable, meaning once your child becomes of age, they own the funds outright. However, this does create opportunity to buy more savings bonds if ultimately part of your financial plan involves paying for your kids education or gifting money on an annual basis.

Another way to increase the limits on I-Bonds is to utilize an entity (LLC, partnership, or a Trust) as the owner of the I-Bonds. This would be another “owner” of the I-Bonds, creating a new set of limits, without impacting the limits of I-Bond purchases individually. If you are married, have children, and own a business, have a living trust, you could have several owners of the bonds, each with their own annual limits.

Are I-Bonds liquid?

I-Bonds are 30-year bonds. Therefore, they fully mature after the 30 year period. However, you can also cash them in early, if you need them for any reason. If you cash them in before 5 years, you will forfeit the previous three months’ worth of interest payments. The main liquidity issue is that I-Bonds are NOT liquid during the first 12 months. Therefore, this should not be used in lieu of short-term reserves or emergency funds. You should still maintain 3-6 months of expenses in liquidity before considering using this strategy. After 5 years, they become fully liquid without penalty, at which point they could be used as a liquidity substitute.

How are I-Bonds taxed?

Income tax applies at the federal level only, not state or local levels. Additionally, you have an option on how you report the interest.

- Option 1: Annually. You can report interest earned on the bond each year and pay the taxes each year.

- Option 2: Maturity, Cash in early or reissue. The alternative is to defer reporting the interest income until you cash in the bond, or it matures (30 years), or you reissue ownership to someone else. At this point, all of the interest earned will be reported on your tax return.

Most people might default to Option 2 as you are essentially enjoying tax deferred income (much like a 401k or Traditional IRA). However, one benefit to reporting the interest annually is if you purchased the bonds for your children. In this instance, your child may have little to no income, and might enjoy a much lower tax bracket now than in the future.

Once you begin reporting annually, you must continue for the life of the bond, so choose wisely!

There is an exclusion to the income taxes on I-Bonds for education planning, only if all of the following apply:

- You cashed the savings bonds the same year for which you are claiming the exclusion.

- You paid qualified higher education expenses in that same tax year for yourself, your spouse, or dependents.

- You filing status is any status except married filing separately.

- Your modified adjusted gross income was less than the cut-off amount set by the IRS. This changes each year, see form 8815.

- You were 24 or older before your savings bonds were issued.

Bottom Line

The opportunity for these securities have become attractive given the recent spike in inflation. The US Government is doing everything in their power to combat inflation, so we do not expect rates to remain this high for the long-term. However, in the short term, it does create a unique opportunity for some of your excess cash reserves or short term money to work for you in lieu of holding those assets in a money market, CD or other short term bonds. Additionally, the stock market is extremely volatile given the crisis in Ukraine, among other concerns, making I-Bonds a nice safe haven if you have a fear of investing at this moment. However, the liquidity aspect is certainly the downside. If there was an opportunity that came up within 12 months, your funds are tied up until after that first year anniversary. Therefore, even if you do take advantage of these bond issues, make sure you have the reserve fund in place to mitigate that risk.

If you are interested in learning more about these bonds or would like to make a purchase, go to the Treasury Direct website. I-Bonds are not available in retirement plans or any brokerage firms, so you will need a separate account with the US Treasury.

Contact me below if you have any questions about I-Bonds or your personal financial planning goals.