As we start 2023, it’s important for us to take some time to reflect on this past year before turning the page.

That way, we can bring in the new year with a fresh perspective on where the opportunities are.

In addition to investment opportunities, the SECURE Act 2.0 passed in December, which brings about some exciting tax and retirement planning strategies.

Let’s start with a recap of 2022!

2022 Was a Tough Year for Investors

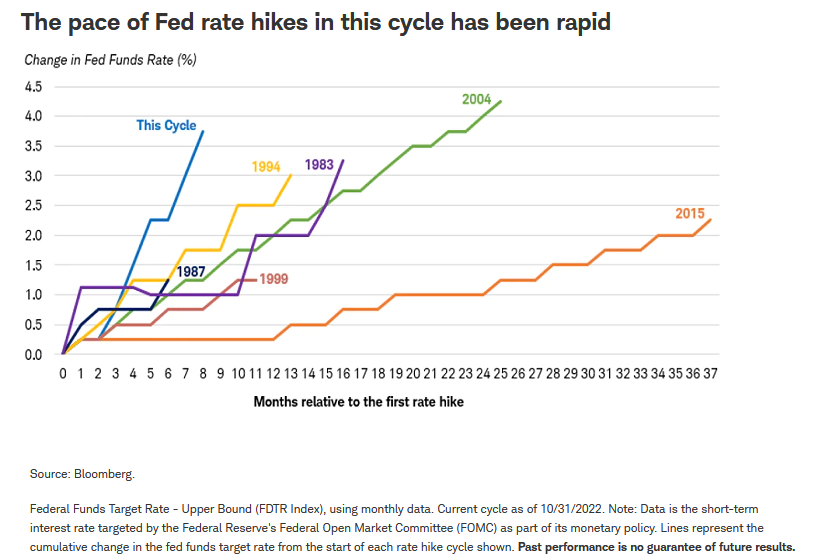

We started out 2022 with record-high inflation at 7.5%, but the Fed Funds rate was still at 0%. In order to respond to the COVID-19 pandemic in 2020, the Feds not only cut interest rates but also injected mass amounts of stimulus into the economy. The more money in people’s hands, the more inflation you get. Additionally, unemployment skyrocketed in the short-term following temporary layoffs in 2020, but those workers were largely seasonal and got their jobs back later in 2020 and early 2021. Many worked remotely and never skipped a beat. As a result of record stimulus coupled with historically low unemployment, inflation began to persist in the summer of 2021. Instead of the Fed acting at that point (potentially increasing rates and/or reducing their balance sheet), they insisted that inflation was transitory and that it would be short-lived. After several months of PERSISTENT inflation, the Fed announced its strategy for 2022: Rate Hikes and Quantitative Tightening (reducing the assets on the Fed’s balance sheet).

Meanwhile, Russia invades Ukraine, which is of course a tragedy simply due to the unnecessary loss of life. Financially, this sent an energy shortage throughout Europe and Asia that impacted the global economy (and fuels MORE inflation).

And finally, the second largest economy in the world, China, continued its improbable journey to a zero-tolerance policy for COVID-19.

In essence, the biggest global economies in the world each had their own economic headwinds to deal with, which has now led us to where we are today.

After raising rates by 4.25% in 2022, the Fed feels like its work is starting to pay off. However, Jay Powell believes more work needs to be done and needs “substantially more evidence” that inflation is abating. Therefore, we should expect to see more rate hikes this year, but not as steep. This year, the market is pricing in two 25 basis point rate hikes which will bring the Fed funds target to nearly 5%.

The ongoing conflict in Ukraine as well as China’s rocky start to “reopening” will not help the fight against inflation. Additionally, unemployment FELL in December to 3.5% from 3.6% in November. Wage growth also remains above historical averages at 5.8% given the tight labor market.

Therefore, despite further rate hikes, inflation might remain above the Fed’s goal of 2% for quite some time.

For some positive news of 2022, let’s remember that the pandemic has brought about a tough 2 1/2 years. But finally, it looks like everyone is moving forward into the new “post-pandemic normal.”

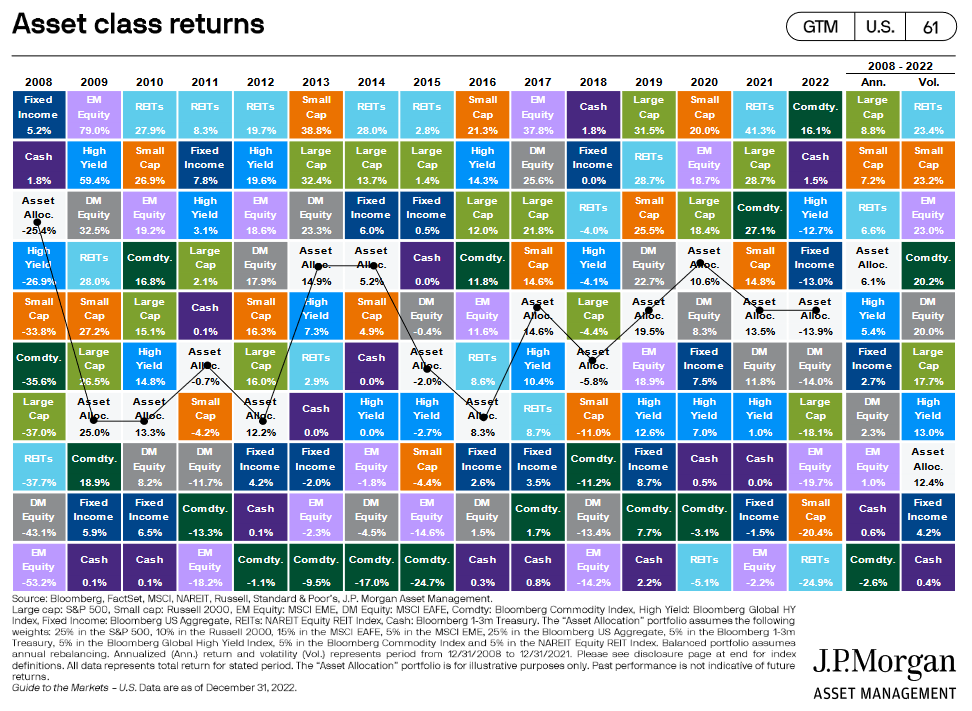

Asset Class Returns 2008 - 2022

Here is a summary of the asset class returns from 2008 – 2022. For your reference, here is some clarification on some of the acronyms:

- “Comdty.” = commodities

- “EM Equity” = emerging markets

- “DM Equity” – developed markets (excluding US)

- “Asset Alloc.” = 60% equity / 40% fixed income portfolio

2022 was a tough year. All of the major asset classes were negative, and mostly by double digits. However, looking at the past 15 years since 2008, a 60/40 portfolio (“asset alloc.”) returned 6.1%/year, and Large Cap US Stocks returned close to 9%/year! I would argue the last 15 years the market has outperformed its historical average, so it’s not unreasonable to think we might have a down year (or two). After all, when we have a long-term investment strategy, we are signing for up occasional volatility. However, the only way to guarantee not getting to your destination is by bailing out of your long-term plan.

Despite these factors, here are the opportunities we see for 2023 and beyond. Additionally, the SECURE Act 2.0 passed in December of 2022 and brings about new tax planning opportunities for retirees and pre-retirees. We’ll discuss all of this below.

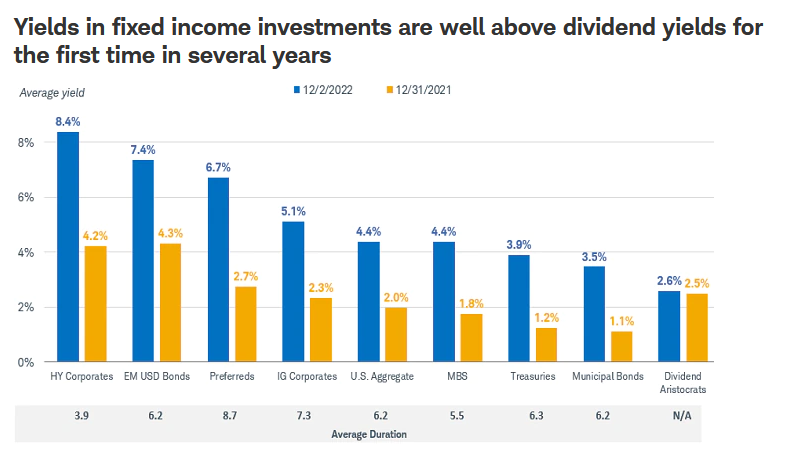

Yield is Back in Fixed Income

Since 2008, we have seen rate cuts to historic lows, which remained unnecessarily low for too long. As a result, yields on bonds were paying next to nothing, unless you were willing to take on substantial risk. As a result, you were lucky to earn 2% on an investment-grade portfolio over the last decade. Now that rates have skyrocketed, we are seeing yields on bonds push past the 4% and even the 5% range! At the beginning of 2022, I talked about the risk of rate hikes on existing bond portfolios. For this reason (among others), we elected to stay short term in duration within the fixed income positions for our clients. This didn’t eliminate the volatility within bonds, but it reduced the price risk substantially and paid off well. Now that these bonds are maturing, we have an opportunity to reinvest at the highest rates we’ve seen since before the global financial crisis in 2008.

For retirees out there, this is a great opportunity to take advantage of purchasing bonds that can not only act as a stabilizer from equity volatility but provide meaningful returns for retirement income. After all, inflation is expected to abate, which could lead to an intermediate to long-term term bond strategy outpacing inflation by 2% or even 3% per year!

I wrote about 4 bear market income strategies in my last article where I also discussed the value of a bond ladder as part of a retirement income plan. Given the expectation that rates are likely not to remain this high for very long, the next 1-3 years will be a great opportunity to add duration and yield to your fixed-income portfolios.

I might add that shorter-term bonds are yielding higher coupon payments than longer-term bonds. As of today, the 2-year treasury is yielding 4.157%, compared to the 10-year treasury yielding only 3.449%. This means that the market is pricing in rate decreases over the next few years. As we mentioned earlier, bond prices go down when rates go up. The opposite is true when rates go down, bond prices go up. This means that fixed-income investors will not only benefit from higher yields but might also benefit from potential appreciation if/when bond prices do go up.

Value Stocks vs. Growth Stocks

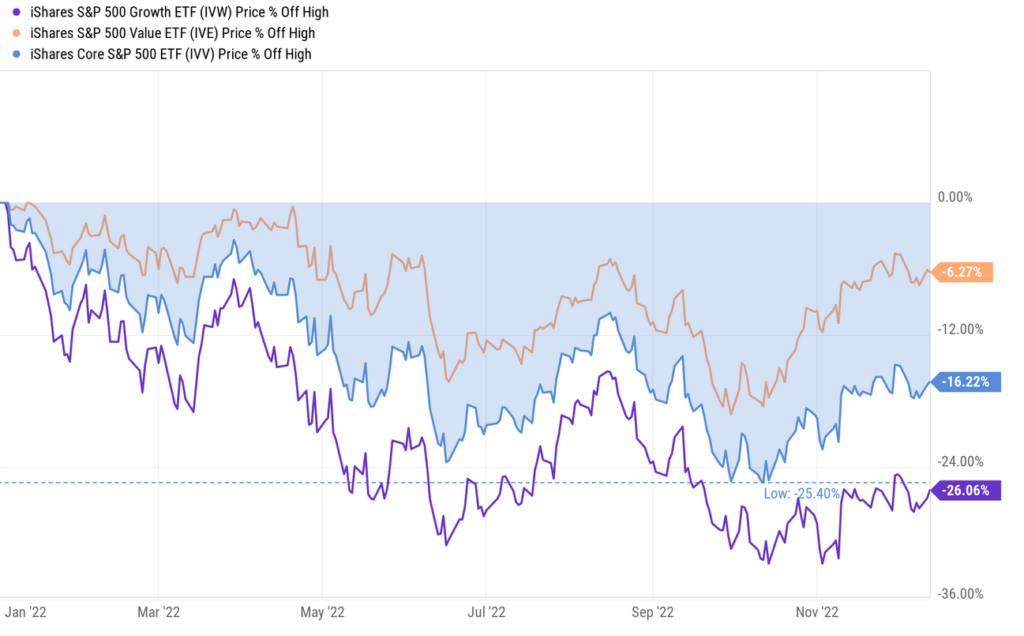

With all of the talk about how great yields are on bonds and how poorly stocks did in 2022, we love the outlook for stocks over the next 5 years. The question is, what kind of stocks will outperform? Well, being an advocate for a well-diversified portfolio, we won’t be taking any big bets on any one asset class. However, we talked about overweighting toward value stocks in 2022, and we think the same for 2023.

Companies that rely on leverage for growth typically reap the rewards of the low-rate environment we saw since the Great Recession. Therefore, the “growth” sectors within equities outperformed for much of the last decade. Towards the end of 2021, we talked about the risk of being overexposed to growth-oriented stocks (tech stocks, consumer cyclical stocks) during a rising rate environment. Just think about it; the more expensive debt becomes, the tougher it is for these companies to borrow at the pace they need for growth.

Instead, we liked value stocks to be overweight in the portfolio, as investors would flock to safety during volatile times (think dividend-oriented, cash-flow healthy companies).

Growth stocks took the biggest hit in 2022 and lost about 30%. Some of the biggest names in tech were down even more.

- Google (GOOG): -39.1%

- Amazon (AMZN): -49.6%

- Tesla (TSLA): -65%

- Facebook (META): – 65%

- Netflix (NFLX): -50%

On the contrary, value stocks were down only 6% in 2022.

We do believe there is more volatility ahead, as corporate earnings might disappoint in the first half of 2023. However, when stocks take a big hit like this, it’s a buying opportunity, NOT a selling opportunity. As we re-balanced portfolios in 2022 and at the beginning of 2023, we were buying stocks, not selling! And if history is an indicator, after we hit bear markets, the performance of stocks tends to be very promising in the years ahead. After all, bear markets typically experience a -37% decline, but bull markets experience a 209% increase, on average!

Don't ignore International Stocks!

International stocks have been underperforming relative to US stocks for over a decade. However, international companies have looked relatively cheap for quite some time now. These stocks were set to outperform in 2020 until COVID-19 shut down the global economy. International stocks have taken a bigger hit since the pandemic but outperformed US stocks in the second half of 2022. With cheap valuations, a stronger outlook for growth relative to the US, and a strong dollar, it’s important NOT to ignore international exposure within your portfolio. For our clients, we are focusing on quality companies with steady cash flows and strong balance sheets, very similar to the story for the US sectors. Additionally, we are limiting our exposure to companies that are owned by foreign governments, as they create additional geopolitical risk.

Of course, there are still significant risks with China’s reopening, as well as the Russian invasion of Ukraine. These factors could certainly create lots of volatility for the asset class, which is why US stocks will continue to remain the majority asset class within our equity portfolios.

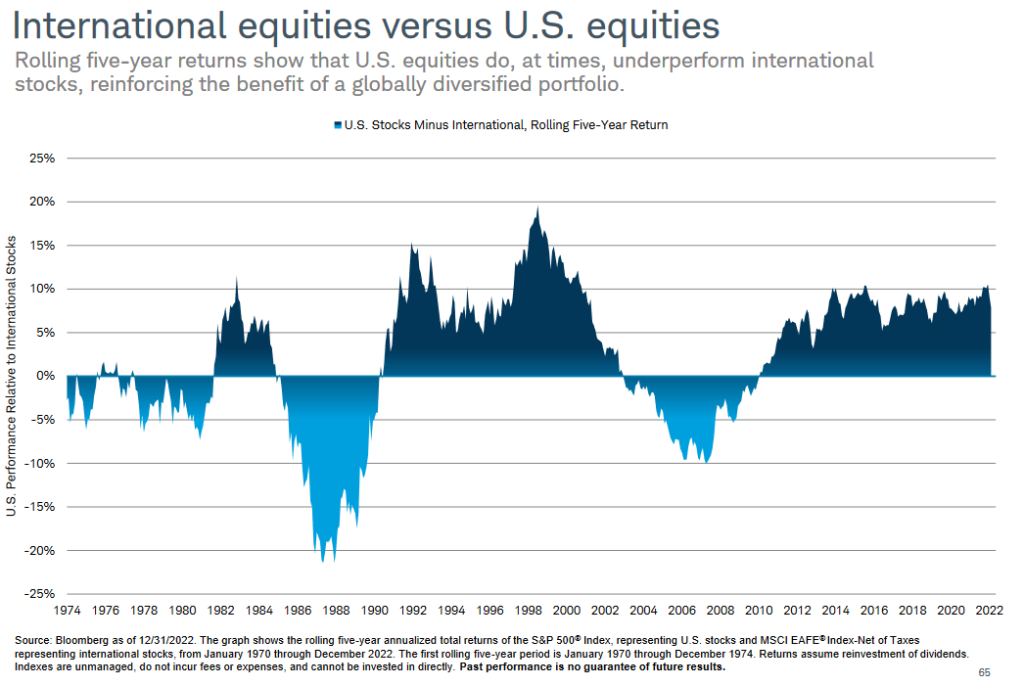

For you historians out there, the chart below shows international stocks outperformed much of the 70s and 80s during hyperinflation. I’m not suggesting this will be the same story, but a prudent investment strategy will certainly incorporate international stocks going forward.

Bottom Line

Stocks and bonds both declining at a double-digit pace is unprecedented. However, staying diversified and disciplined served our clients well in 2022 and will serve them even better when things begin to recover.

It’s important to always start with “why.” Why are you investing?

For our clients, it starts with a financial plan which includes their personalized goals, risk tolerance, and financial assets.

Each investment strategy is tailored to its goals and involves a process to stay on track for those goals. It’s extremely dangerous to try to guess or time the market, as it’s virtually impossible to do consistently over time.

SECURE Act 2.0 Highlights

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was passed in 2019 and went into effect on January 1st of 2020. The SECURE Act 2.0 was officially passed in December 2022. Some aspects go into effect in 2023, whereas others will go into effect in the years to come. We will focus on the SECURE Act 2.0 and the major changes we believe will impact retirees and pre-retirees.

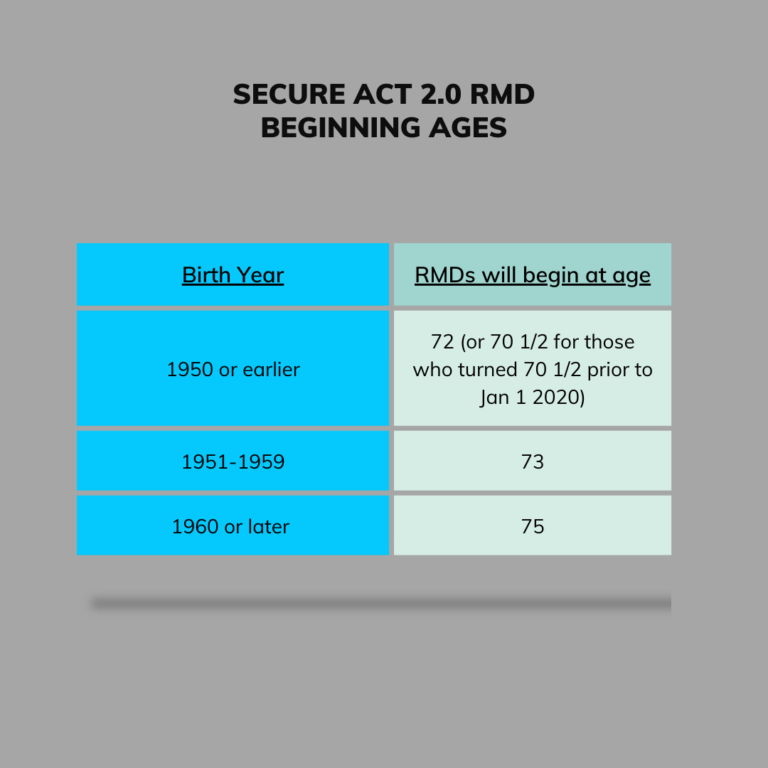

Changes in Required Minimum Distributions

Required Minimum Distributions, or RMDs, is the amount required to be taken out of a qualified retirement plan once the beginning date starts. Before the SECURE Act of 2019 was passed, the RMD beginning date was the year in which you turned 70 1/2 . However, for those who had not yet turned 70 ½ as of January 1st 2020, the new RMD beginning date was the year in which you turned 72.

The SECURE Act 2.0 now pushes the beginning date back further. The table below illustrates the beginning date based on your year of birth.

The amount required for the distribution is based on the IRS life expectancy table. For most participants, the Uniform Lifetime Table will be used. If your spouse is more than 10 years younger, you can use what is called the “Joint Life Expectancy Table.” There is also a single life expectancy for stretch IRAs (no longer allowed after 2020).

For illustrative purposes, let’s take a look at the Uniform Lifetime Table below, which also shows the corresponding percentage and dollar amount required to be taken from a $1,000,000 retirement account.

As you can see, for a 72-year-old, the account balance is divided by 27.4 (the divisor balance), which is equal to $36,496.35 (or roughly 3.65% of the account balance).

You will notice the RMD goes up over time. This is because there are fewer years of life expectancy remaining. By the time a retiree reaches 80, the RMD is approximately 5% of the portfolio.

Uniform Lifetime Table | |||

Age | Divisor Balance | % of Account | RMD for a $1,000,000 retirement account |

70 | 29.1 | 3.44% | $ 34,364.26 |

71 | 28.2 | 3.55% | $ 35,460.99 |

72 | 27.4 | 3.65% | $ 36,496.35 |

73 | 26.5 | 3.78% | $ 37,735.85 |

74 | 25.5 | 3.93% | $ 39,215.69 |

75 | 24.6 | 4.07% | $ 40,650.41 |

76 | 23.7 | 4.22% | $ 42,194.09 |

77 | 22.9 | 4.37% | $ 43,668.12 |

78 | 22 | 4.55% | $ 45,454.55 |

79 | 21.1 | 4.74% | $ 47,393.36 |

80 | 20.2 | 4.96% | $ 49,504.95 |

81 | 19.4 | 5.16% | $ 51,546.39 |

82 | 18.5 | 5.41% | $ 54,054.05 |

83 | 17.7 | 5.65% | $ 56,497.18 |

84 | 16.8 | 5.96% | $ 59,523.81 |

85 | 16 | 6.25% | $ 62,500.00 |

86 | 15.2 | 6.58% | $ 65,789.47 |

87 | 14.4 | 6.95% | $ 69,444.44 |

88 | 13.7 | 7.30% | $ 72,992.70 |

89 | 12.9 | 7.76% | $ 77,519.38 |

90 | 12.2 | 8.20% | $ 81,967.21 |

For those of you turning 72 in 2023, you were probably planning to have your beginning date start this year. However, this new legislation is in effect NOW, so your beginning date is 2024 when you turn 73! Happy Birthday to those born in 1951!

The next group of individuals born in 1960 or later will have a beginning date of the year they turn 75.

For the first RMD only, you can delay the distribution until April 1st of the following year.

For example, you turn 73 in 2024 (born in 1951). You can either take your first RMD in the calendar year of 2024 OR take that RMD by April 1st of 2025. Just remember, if you decide to delay until April 1st, you will have TWO RMD’s for 2025 (one for 2024, and one for 2025). However, this is helpful if your taxable income will drop substantially after your beginning date due to retirement or other reasons.

Planning opportunities for RMDs

First and foremost, SECURE Act 2.0 gives account owners more time until they are required to start taking RMDs. For many of you, you might be dreading RMDs as you might not NEED those distributions for income. Perhaps your Social Security, Pension, and other investment income is more than enough to live your lifestyle. Therefore, RMDs are more of a tax liability than anything else.

For some, considering a Roth conversion strategy could be advantageous.

Consider someone who is retiring at 62, and their earned income goes to 0. Perhaps they plan to live on their investment assets until reaching 70 (their Latest Retirement Age for maximum Social Security benefits). Assuming the beginning date is the year in which they turn 75, they have 13 years of potentially low income.

Therefore, instead of continuing to defer their retirement account balances until 75, one might consider converting portions of those existing tax-deferred account balances for the next 13 years. Yes, a Roth conversion would trigger taxes now based on the amount converted, but this also reduces the calculation for the RMD each year. Roth IRAs do not have RMDs, and distributions from Roth IRAs are tax-free (assuming they are qualified). Therefore, this could result in tax savings beginning at age 75, and could potentially last for 20+ years based on one’s life expectancy. I wrote an article on Roth conversions and if you should consider them that you can read here.

Another positive change is the elimination of the RMD from Roth 401ks and other Roth-qualified retirement plans. In the past, ONLY Roth IRAs were excluded from RMD calculations. Beginning in 2024, qualified plans with Roth balances will NOT be required to take an RMD.

Qualified Charitable Distributions (QCDs)

QCDs are a great tool for those over the age of 70 ½ and are charitably minded. For 2023, the limit for a QCD is still $100,000, which means you can gift up to that amount from your Traditional IRA to a charity without paying taxes. However, this limit will begin to index with inflation beginning in 2024 (finally!). The initial $100,000 limit was set in 2001, so it’s about time they began to increase the amount allowed.

This works extremely well if you are already taking RMDs, as that income is not counted towards your Adjusted Gross Income. Instead, it’s an above-the-line deduction regardless if you itemize or take the standard deduction.

Example: Susan typically donates $10,000/year to her favorite animal shelter, which operates as a 501(c)3 charity. However, her total itemized deductions don’t exceed the standard deduction for her and her spouse, which is $27,700 for 2023. Therefore, she technically does not receive any tax incentive for donating the $10,000. Last year, she turned 72, so she now has an RMD of $50,000 in 2023. Instead of taking the $50,000 as income, paying taxes, and writing a $10k check to the animal shelter, she elects to do a $10k QCD. The QCD form is filled out through the custodian, and the custodian will write the check directly to the charity. Now, her RMD is only $40,000 (instead of the full $50k). The net result is a reduction in taxable income of $10,000, and the standard deduction is still in effect! Win-win!

There is a provision in SECURE Act 2.0 that allows for a $50,000 one-time contribution to fund a Charitable Remainder Trust (CRUT or CRAT). Most individuals funding Charitable Remainder Trusts are funding them with much larger increments, as essentially you are giving away those assets to a charity, in exchange for a lifetime income and a generous tax deduction. In most cases, $50,000 is not going to provide very much in the way of lifetime income, and that asset is no longer available on the balance sheet.

Therefore, QCDs are mostly unchanged with the exception of inflation adjustments, but keep in mind the Charitable Trust strategy as it could come into play for some charitably minded individuals.

Roth SIMPLE IRAs and Roth SEP IRAs

Traditionally, these small business retirement plans could only be funded with pre-tax dollars. With the SECURE Act 2.0, these businesses can now allow for Roth contributions for both SIMPLE IRAs and SEP IRAs. This will be effective immediately starting in 2023. However, I’m expecting some challenges and delays from the custodians of these accounts given the need to update forms, processes, and procedures.

Just remember, a ROTH contribution into a SEP or SIMPLE IRA is non deductible, but can benefit from tax-free growth. A Traditional (pre-tax) contribution into a SEP or SIMPLE IRA is deductible and grows tax deferred.

The driver of what kind of contribution to make is based on what your current tax bracket is vs. what it might be in retirement (any crystal balls?). If you are in a high tax bracket today and don’t plan to be during retirement, you might benefit from Traditional SEP contributions that are deductible. If you are tax neutral or you might be in a higher tax bracket in retirement, you might benefit from tax-free growth (Roth contributions).

If you have no idea, perhaps you should consider contacting a fiduciary financial planner and/or tax professional. (or just split it 50/50!)

529 Rollovers to a Roth IRA

Yes, you read this correctly! Parents tell me all the time that they are worried about overfunding their child’s 529 because their kid is going to be the next Mark Zuckerberg, drop out of college and become a billionaire. So, what about those dollars that are left inside the 529?

Most parents (and grandparents) will just liquidate the account and pay taxes and/or penalties, or simply let the account sit there indefinitely. Beginning in 2024, 529 plans that have unused funds can be rolled over into a Roth IRA. However, it’s NOT too good to be true as there are hoops you need to jump through.

- The Roth IRA receiving the rollover must be the same beneficiary as the 529 plan

- The 529 plan must be open for at least 15 years

- Contributions to the 529 within the last 5 years, and earnings on those contributions, are ineligible for rollover

- The annual limit for how much can be moved to the Roth IRA is the same as Roth IRA contribution limits (not including contributions directly made to the Roth IRA)

- The lifetime maximum that can be moved from a 529 plan to a Roth IRA is $35,000

If your child is the beneficiary, this would mean you would have to rollover their 529 balance to a Roth IRA in THEIR name. However, could the rule allow for a change of beneficiary to name either you or your spouse, then proceed with a rollover to a Roth IRA in one of your names? And if so, does that reset the 15-year clock?

The law is unclear about this, but it should be addressed by the IRS before it comes into effect in 2024. Until then, just know there is a potential solution for these unused 529 funds over time, and is perhaps one of the most interesting developments with the SECURE Act 2.0!

Spouses who inherit IRAs

The current law allows spouses to;

- Rollover the IRA into their own IRA

- Elect to treat the decedent’s IRA as their own

- Or simply remain as the beneficiary of the IRA

Beginning in 2024, the SECURE Act 2.0 will now allow for the surviving spouse to essentially treat the IRA as if they were the deceased spouse.

This could be beneficial if the surviving spouse is older than the deceased spouse, as they could potentially delay RMDs for longer. Additionally, if the surviving spouse passes away before the initial owner would have reached RMD age, their beneficiary would have some flexibility with the 10-year rule.

IRA and 401k Plan Catch-up Contributions

When you are over the age of 50, you are eligible for “catch-up” contributions. IRA catch-up contributions have been $1,000 for 15 years! Finally, they will be indexed for inflation, I guess in response to record-high inflation all around. Makes sense to me!

This will begin in 2024, and adjustments will be made in increments of $100.

Starting in 2025, SECURE Act 2.0 will allow for additional catch-up contributions for certain qualified plan participants. Those who are 60-63 have their plan catch-up contribution limit increased to the greater of $10,000, or 150% of the regular catch-up contribution. This limit applies to plans like 401ks, 403bs, 457bs, and TSP accounts.

SIMPLE IRA participants ages 60-63 also have their catch-up contributions increased to $5,000 or 150% of the regular catch-up contribution.

Catch up contributions for high income earners

Starting in 2024, catch-up contributions for workers with wages over $145,000 during the previous year will be automatically characterized as Roth contributions, not traditional. There are several key planning considerations with this change.

- There are income phaseouts that ultimately eliminate participation in a Roth IRA for individuals (for 2023, a single filer is phased out at $153,000, and married filing jointly at $228,000). Given 401k catch up contributions have NO income phaseouts, this is a BENEFIT to some 401k/403b participants who prefer Roth contributions over Traditional

- If a participant between the age of 60-63 prefers Roth contributions, they could in essence max out approximately $41,250 into Roth accounts starting in 2025!

- $22,500 for Roth 401k/403b (regular deferral max)

- +$11,250 catch up contribution for ages 60-63 (new catch up limit beginning in 2025)

- +$7,500 Roth IRA contribution or backdoor Roth IRA contribution (if done properly)

- If a participant between the age of 60-63 prefers Roth contributions, they could in essence max out approximately $41,250 into Roth accounts starting in 2025!

- If the plan does NOT allow for Roth contributions (which are becoming less and less common), then the catch-up contributions will be pre-tax instead.

Some higher income earners might actually PREFER traditional (pre-tax) contributions, especially those who believe their tax bracket will go down in retirement.

We still need clarity on a few provisions within this section, so stay tuned as we get closer to 2024!

Final word

There are many investment and tax planning opportunities in the years ahead, it makes me excited to serve our clients!

It has been a tough couple of years, and many of you might be wondering if you should be making adjustments to your portfolio. Or, perhaps you have an advisor that focuses mostly on investments and not retirement and/or tax planning.

We will be accepting 12 more clients for 2023, and we would be more than happy to see if you are a good fit to work with us (and vice versa). Feel free to schedule a “Mutual Fit” Zoom Call using the link below.

Also, make sure to subscribe to our newsletter to get our latest insights delivered to your inbox.

Until next time!

Sources:

https://www.schwab.com/learn/story/fixed-income-outlook

https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/economic-and-market-update/

https://www.schwabassetmanagement.com/content/quarterly-chartbook-video?segment=advisor&mkt_tok=MTUzLUhSWS0xOTQAAAGJRvqWZCYGXBuEWVz_t_XSlK7BQxQAOMXvT6fTv83rV-gsKVFRoHkDUz6kKLN0Dr2XVP1hu2NGVBA_byzsRl-MbS8BpR9k0N0DAYvWLe_g5pFg

https://www.kitces.com/blog/secure-act-2-omnibus-2022-hr-2954-rmd-75-529-roth-rollover-increase-qcd-student-loan-match/

https://www.finance.senate.gov/download/retirement-section-by-section-