Benjamin Franklin said “the only two certainties in life are death and taxes.”

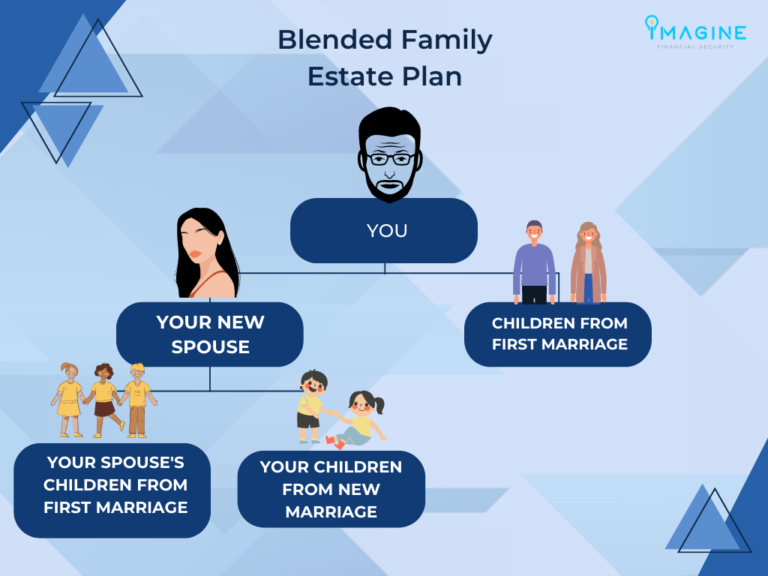

As a fiduciary financial advisor, one of the most important topics to address is how to divide assets in a blended family.

If something were to happen to you, how do things play out? How do you divide an estate with step children? How do you protect your assets from stepchildren? What about the effects of an unequal inheritance? What about estate planning for a blended family with adult children?

Each situation is unique. Take what applies to you, and make a plan!

How to divide your estate with stepchildren?

The reality is that blended families are almost as common as a traditional family. A blended family is a marriage that involves children from a previous marriage or relationship.

It’s important to consider your own family dynamics when dealing with retirement and estate planning issues.

A remarriage when children are young is very different than becoming a blended family when the children are adults.

You might think if the children are young, it’s more likely you will handle your estate planning and wealth transfer strategies like your “traditional family.” And that may be correct in the sense that you want to divide your assets equally to your biological children and stepchildren.

One potential hurdle to look out for is guardianship issues of your minor children. If something unexpected happened to you and your spouse, it’s possible that an ex-spouse might have guardianship rights over your child or stepchild. Additionally, if your children are minors, the guardian will take custody of their assets until they are age of majority.

You probably want to avoid your ex spouse taking custody over your children’s inheritance. Instead, consider setting up a trust and naming a successor trustee (someone other than your ex of course).

How to protect assets from stepchildren

The most basic form of an estate plan is a will. A will allows you to name specific beneficiaries that will inherit your assets when you die (among other important decisions). You could name your spouse, children from your previous marriage, and even perhaps your stepchildren. You can also exclude anyone you wish within certain limitations.

The issue with having a basic will is that if you do predecease your spouse, all of the assets you leave to your new spouse will be his/her property outright. This means that after his/her death, the remaining estate will be property of their beneficiaries, likely their children (your stepchildren).

This could be problematic if your ultimate goal was to leave your remaining estate to your children, not your stepchildren.

The way to get around this issue is to set up some sort of marital trust, the most common being a Marital Bypass Trust. This can allow you to name the trust as beneficiary of your assets. The trust could be the beneficiary of all, or a portion of your estate.

First and foremost, this type of trust will ensure your spouse is taken care of for their lifetime.

Once your spouse passes away, the remaining trust proceeds will then be left to your children (or other remaining designated beneficiaries). This will prevent any other “unwanted beneficiaries” from receiving your estate.

If you have an existing trust, make sure it’s been reviewed and updated in accordance with the SECURE Act rules. Otherwise, there could be some unfavorable tax consequences for your beneficiaries.

What about adult children in a blended family?

If you are a blended family with adult children, it’s possible one or more of the following might apply:

- An age gap with your new spouse

- You or your spouse have accumulated substantial assets before your remarriage

- You and your new spouse might have children together and separately

- Your new spouse might be closer in age to your adult children

If there is an age gap in the remarriage, it’s likely that you will have two separate estate planning and wealth transfer strategies.

- Take care of your spouse for their lifetime

- Leave a financial legacy to your children

As discussed earlier, the likely solution here is to set up a trust that allows for your spouse to benefit, and then ultimately your children.

However, you may consider leaving some or all of your assets to your adult children if:

- your spouse is financially independent

- you don’t want your children to wait until your spouse dies to receive their inheritance

If this is appealing, you must be aware of the elective share rules in your state.

Elective Share

For community property states, assets accumulated jointly are assumed to be owned by both parties. However, in non-community property states you can own assets separately despite being married. You can leave those assets to another beneficiary other than your spouse, as long as you leave your spouse a certain % of your total estate (this is known as the Elective Share).

Florida, for example, has an Elective Share rule stating 30% of your assets must be left to your spouse, regardless of what your estate plan says. Additionally, there is no requirement for how long that new marriage lasted!

Even if you set up a trust, certain trusts might fail the elective share test. Therefore, be careful if you have goals to leave a larger portion of your estate to your children instead of your spouse.

If you and your spouse are financially independent, you might consider signing a prenup or a postnup. This will ensure that you have the legal right to “disinherit” your spouse and overrides the elective share rules.

Consider Life Insurance

Life Insurance is a great tool if you have multiple estate planning and wealth transfer goals.

Here’s an example:

Let’s say the bulk of your assets are inside of a 401k or IRA and you get remarried.

Let’s say your adult children are on their own, building their careers and growing their families.

Because of this, you’d like to leave your kids money when you die, but you also want to make sure your new spouse is taken care of during retirement.

First, you may consider setting up a trust for the benefit of your spouse and naming that trust the beneficiary of your 401k or IRA. Your children would be the contingent beneficiary of the new trust. This will protect against any stepchildren or new spouses from inheriting your assets.

If the trust is set up properly, your spouse can maintain favorable life expectancy rules when it comes to required minimum distributions.

Now that your spouse is covered, you buy a new life insurance policy with your children as primary beneficiaries. This way, they aren’t waiting for stepmom/stepdad to pass away to receive their inheritance. If you already have life insurance, you could make sure it’s structured properly and simply name your children as primary beneficiaries.

This also gets around the issue of the elective share. The calculation for the elective share will typically not include death benefits from life insurance. However, it might count cash value, so make sure you structure the policy properly in accordance with your state’s rules.

If the goal is to own the policy throughout retirement, you will want to make sure it’s a permanent policy, not term. Term insurance is more likely to expire before it pays the death claim, and you don’t want to be shopping for permanent insurance when you’re 70.

Effects of an unequal inheritance

If you have multiple sets of beneficiaries, you might be thinking of the effects of an unequal inheritance.

Let’s say you have adult children that are well off financially. However, you also have children with your new spouse that are still 100% dependents.

In this scenario, you might consider leaving a larger percentage of your estate to the side of the family that needs it most.

If you consider this strategy, I highly recommend setting up a trust. This will reduce the likelihood of issues being contested in court, and the terms of the trust remain private. Additionally, it’s likely your dependent children are minors and would need someone to oversee their inheritance (a trustee) until they are responsible adults.

Another consideration for an unequal inheritance is the impact of income sources that will be lost for the surviving spouse. This could include Social Security, pensions, annuities, distributions from IRA’s and investment accounts.

Upon the first spouse passing away, the surviving spouse is entitled to the larger of the two Social Security benefits. However, this still results in a reduction of Social Security income for the survivor.

If you have a pension or annuity that stops at your death, you also need to consider the impact of this lost income.

If your IRAs or 401ks are left to your children instead of your spouse, could your surviving spouse maintain their standard of living for years or even decades to come?

Additionally, would your surviving spouse be able to pay for long-term care if a large portion of your estate was left to your children?

These are all issues you should think through to help divide your assets within your blended family.

One final thought on this topic is that it’s not just about how much you leave, but how you are remembered.

The act of making things easy to manage for your loved ones is a big part of how you will be remembered! Leaving a big mess to clean up won’t help that cause, regardless of how much money you leave behind.

Tax Considerations

The types of assets that are left to children, your spouse or a trust are all important from a tax standpoint.

Qualified Retirement Accounts

Leaving your qualified retirement accounts to your spouse outright will create the optimal tax benefits. These include IRAs, 401ks, 403bs, 457bs, TSPs etc.

On the other hand, leaving qualified assets to your children will likely trigger the new 10-year rule. With the SECURE Act coming into effect in 2019, these accounts can no longer be stretched according to the child’s life expectancy. This will likely result in an acceleration of taxes that could have been minimized had these accounts been left to a spouse.

Naming a trust as beneficiary of a qualified plan also presents some challenges. Tax brackets are significantly higher for trusts versus an individual.

In 2022, a Married Filing Joint taxpayer would have to earn over $647,850 in taxable income to cross the highest tax bracket at 37%.

For trusts, the highest tax bracket threshold is only $13,450!

If you name a trust as beneficiary of a retirement plan, make sure your attorney has revised or drafted the documents to align with the SECURE Act rules. This could mitigate unnecessary tax implications.

Taxable Investments

Investments including stocks, bonds, mutual funds, ETFs, real estate, tangible property and even crypto assets would fall under this category. This assumes these investments are held outside of an IRA, 401k or other qualified retirement plan.

The major tax benefit for these assets is the step up in cost basis after death.

How does the step up in cost basis rule work?

Let’s say you bought $100k of Apple in 2000 and it’s now worth $500k. If you sold $500k worth of Apple, your capital gain would be $400k (500k – 100k).

If you die before selling it, your beneficiary gets a “step up in the cost basis.” Instead of your beneficiary paying taxes on the gain of $400k, their new cost basis is now $500k. If they sold the stock immediately thereafter, they would have little to no capital gains taxes due!

For married couples, there are some additional rules that are based upon the state you live in. For community property states, assets are assumed to be owned jointly, and therefore only ½ of the basis is assumed to be stepped up upon the death of the first owner. Upon the death of the second owner, than the full step up rule is applied.

In non-community property states, you could in fact own assets separately from your spouse so they can take advantage of the FULL step up at your death. This could be accomplished with a revocable living trust in your name only, OR perhaps individual ownership with your spouse as beneficiary (via TOD or POD designations).

Make sure you consider your estate planning and wealth transfer goals before making any changes to your asset titling!

Life Insurance

We’ve already discussed the functionality of leveraging life insurance to take care of one or more of your wealth transfer objectives.

From a tax standpoint, this is one of the most tax efficient assets to leave a beneficiary. It’s 100% income tax free and probate free! Additionally, you can structure this strategy to pass outside of your estate by way of an Irrevocable Life Insurance Trust (ILIT).

If you have a beneficiary with special needs, you could also fund their “Special Needs Trust” with life insurance.

Action Items

Your estate planning and wealth transfer strategies should be personal to you!

Make sure you are taking care of your loved ones the way you intend to.

Make sure you have the proper documents in place that align with your intentions.

Make sure you update and revise all of your beneficiary designations.

Make sure your financial plan is coordinated with your estate plan and wealth transfer goals.

And finally, do your best to make things simple for your loved ones. Communication and clarity are critical to avoid unnecessary conflict. You don’t want your loved ones to question “why” things were set up a certain way.