What are the rules for Required Minimum Distributions?

Congratulations! Lots of blood, sweat, and tears went into a successful career, and you have saved enough to start thinking about when to retire. If you’ve been saving into a 401k, 403b, or another retirement plan through work, you’ve probably heard of Required Minimum Distributions or “RMDs.” You might be wondering;

“What are the rules for required minimum distributions?”

“How do RMDs impact my taxes?

Or, “What can I do now to prepare for RMDs?”

This article is for you! We’ll unpack all of this and provide REAL-LIFE action items to help you plan for RMDs and save in taxes!

What are RMDs and when do they start?

Simply put, RMDs are the IRS’s way of saying, “the party is over.” Or in this case, the tax party is over!

When you contributed to your 401k, IRA, or 403b, you likely took advantage of a generous tax deduction up front and have never paid taxes year over year on earnings. Pretty powerful, right?

The IRS has been patiently waiting for you to start withdrawals, and RMDs are their way of starting to collect their tax revenue.

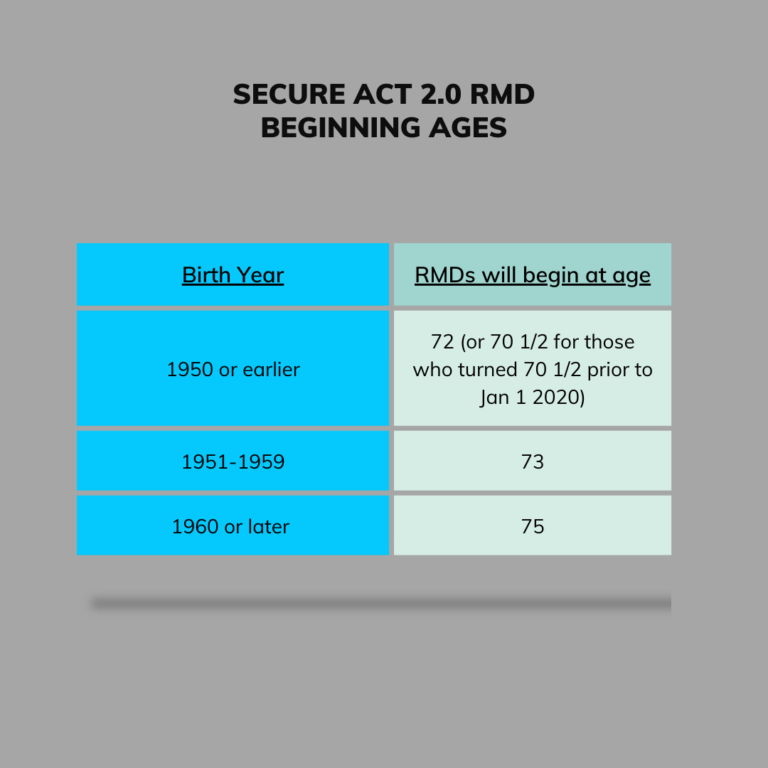

Starting in 2023, the RMD age, or “beginning date,” is the year in which you turn 73 (for individuals born before 1960). For those born in 1960 or later, the beginning date is the year you turn 75.

Just a few short years ago, the beginning date was the year you turned 70 ½. The SECURE Act of 2019 pushed the RMD age back to 72, and the SECURE Act 2.0 (just passed in December 2022) pushed it back even further. With many retirees living well into their 90s, that’s potentially 20+ years of RMDs!

These qualified plans have such powerful tax advantages because the growth year over year is not taxable! This allows for compounding interest to avoid tax drags altogether, which is unique in the investment world. However, there is a reason why our clients’ largest expense during retirement is TAXES! Our job is to minimize taxes, legally, as much as possible. Part of that job is to minimize the tax impact of RMDs in retirement.+

How are RMDs calculated?

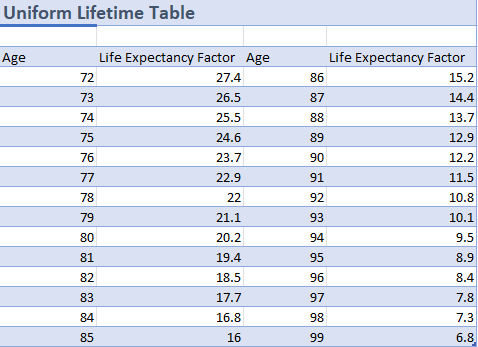

The IRS has life expectancy tables that are updated (not so frequently), and each age has an assigned “life expectancy factor.” Once you reach your beginning date, the account balance at the previous year’s close (December 31st) is divided by the life expectancy factor in the IRS tables.

Example:

You have a $1,000,000 IRA balance as of December 31st of 2022.

Assuming you turn 75 in 2023 and you use the Uniform Lifetime Table (more on this in a moment), your life expectancy factor would be 24.6.

To calculate the RMD for 2023, you would divide $1,000,000 by 24.6, which would equate to $40,650.40.

There are three types of life expectancy tables. The Uniform Life Expectancy table (used above) is for single or married account owners. However, if you are married, your spouse is the sole beneficiary of your account, AND is more than 10 years younger than you, you can use the Joint Life and Last Survivor Life Expectancy Table.

The “Single Life” expectancy is for beneficiaries of IRAs that were not the spouse and inherited the account before January 1st of 2020. For account owners who have inherited IRAs or other retirement accounts beginning in 2020, the new 10-year rule applies, which we will discuss shortly.

The older you get the higher the rate of withdrawal gets. By the time you reach 80, the distribution percentage is close to 5%/year! At 85, it’s 6.25%!

An RMD for a $1,000,000 IRA at age 85 is $62,500!

If you add in Social Security income, perhaps a pension, and other investment income, you can see how this could create a tax burden during the RMD phase. The IRS does not care if you need the income, they just want their tax revenue. And not only will your taxable income in retirement go up, but could impact how much Social Security is taxed and how much you are paying for Medicare premiums!

If you miss an RMD, there are penalties. The SECURE Act 2.0 changed the penalty to 25% from 50%, and that applies to the amount you failed to withdraw. Using our example above with a $40,650.40 RMD, a 25% penalty would equate to $10,162.60 assuming you withdrew nothing!

Needless to say, make sure you satisfy this important rule for required minimum distributions or pay the price.

The first RMD can be delayed until April 1st of the following year!

RMDs need to be satisfied by December 31st each year. Some of our clients elect to take the RMD monthly in 12 equal payments; others elect quarterly. And some take it as a lump sum. The decision is cash flow driven and how much you need the RMD for income (or not). There is one exception that applies to your FIRST RMD. The first required minimum distribution can be delayed until April 1st of the following year.

Let’s say you turn 73 in the year 2024, which would make 2024 your beginning date. However, you also plan to retire in 2024 and might still have high wages to report for that tax year. In 2025, you will be fully retired and will have ZERO wages, so you decide you want to take advantage of delaying the first RMD until 2025. In this scenario, you would take the 2024 distribution by April 1st (of 2025) and of course the 2025 distribution by December 31st! In this scenario, you have two RMDs on your 2025 tax return, but your overall income perhaps is still lower because of no W2!

Are there RMDs on my current employer plan?

If you are still actively employed and have a qualified plan you are participating in, you can avoid RMDs from those plans only. Let’s say you plan to work until 75, and you have a large 401k with your current employer and an IRA from previous retirement plans. You will still be required to make an RMD from your IRA, but you can avoid the RMD on your 401k altogether. Once you are officially separated from service, that will trigger the “beginning date” for that 401k plan.

It’s also important to note that separation from service triggers the “beginning date” for that 401k. So, assuming you deferred RMDs in your current 401k plan, and retire at 75, you can still take advantage of deferring the first RMD until April 1st following the year you separated from service.

Finally, this rule does NOT apply to Solo 401ks or SEP IRAs. These plans are for self-employed individuals, and RMDs can’t be delayed simply because they are still working.

Can I aggregate my RMDs into one plan?

You might be wondering if you have multiple retirement plans, can you just pull the RMDs from one account?

My favorite answer is, “it depends.”

If the multiple retirement plans have identical plan types (perhaps they are all 401ks or all 403bs), then “yes, you can aggregate the RMDs.” If there are different plan types, like one IRA and one 401k, those plans each have their own RMD and must be satisfied separately. Let’s look at two examples:

Scenario 1: Joe has two IRAs, each with RMDs:

IRA RMD #1: $10,000

IRA RMD #2: $25,000

Total IRA RMD = $35,000

He can satisfy the entire $35,000 from either or both accounts.

Scenario 2: Joe has one IRA and one 401k each with RMDs:

IRA RMD #1: $10,000

401k RMD #2: $20,000

Each RMD would need to be satisfied separately because they are not identical account types.

SECURE Act’s elimination of the Stretch IRA for (MOST) beneficiaries

In January 2020, the SECURE Act of 2019 went into law. Part of the plan to pay for the bill was to accelerate distributions for beneficiaries of IRAs and 401k plans.

Under the previous law, a beneficiary other than the spouse could “stretch” the IRA based on THEIR life expectancy. Assuming the non-spouse beneficiary was much younger (like an adult child), the RMD would be reduced significantly after the original owner’s death. This is when the Single Life Expectancy table is used, as we alluded to earlier.

Let’s look at an example:

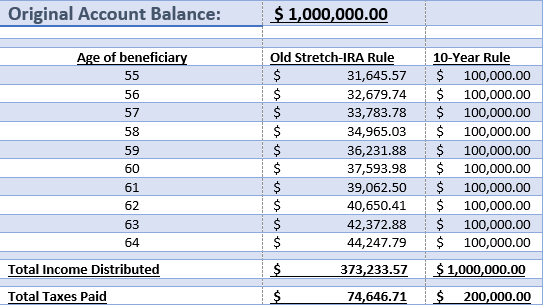

An original account holder has a $1mm IRA and is 80 years old. Their RMD would be $1,000,000 / 20.2 = $44,504.96. Before 2020, if that account owner passed away and their 55-year-old daughter inherited the account, her RMD would be $31,645.57. That’s a reduction of almost $13,000 of taxable income! In essence, it allowed the new owner to “stretch out” the distributions over a much longer period of time and thus preserving the tax-deferred status for longer.

The SECURE Act of 2019 eliminated the stretch IRA for MOST beneficiaries. I wrote about this in a previous post, “The Tax Trap of Traditional 401ks and IRAs,” but most beneficiaries other than the spouse will follow the “10-year rule.”

What is the 10-year rule?

The 10-year rule states that a retirement account must be fully liquidated by the end of the 10th year following the owner’s death. The exception to the 10-year rule is for those who are “eligible designated beneficiaries.” These individuals are essentially a spouse, a beneficiary who is disabled or chronically ill, or a beneficiary who is fewer than 10 years younger than the IRA owner.

Everyone else will follow the 10-year rule.

If the IRA owner passed away on or after the beginning date, RMDs must continue during years 1-9, and then the full balance must be liquidated in year 10. If the IRA owner passed away before their beginning date, there are no RMDs until year 10, when the account needs to be fully liquidated.

It might be tempting to stretch the 10-year rule until the 10th year, but this would result in significant taxes owed that year. Instead, you might consider taking somewhat equal distributions in years 1-9 and distributing the remaining account balance in year 10 to avoid a huge tax bill.

As you can see by the (overly simplified) chart below, this has significantly increased the size of distributions required after the account owner’s death and ultimately results in higher taxes.

What can you do to minimize the tax impact of RMDs?

If you are like many of our clients, the bulk of your retirement savings might be in tax-deferred 401ks or IRAs. However, newer plans like Roth IRAs and other Roth retirement plans have NO RMDs! Therefore, one way to minimize the RMD impact is to increase the proportion of Roth accounts on your balance sheet. There are two ways to do this:

- If you are still working, change the contribution allocation to Roth vs. Traditional (401ks, 403bs, TSPs, etc). If your employer does not have a Roth option, you might consider a Roth IRA.

- If you are retired or perhaps not contributing to a retirement plan, you could consider Roth conversions. This allows for money to be moved from tax-deferred accounts to tax-free accounts by paying taxes on the amount converted.

Why would I want to pay more taxes now?

Perhaps you believe your tax bracket will go up due to RMDs. Maybe you saved diligently into 401ks and IRAs and your RMD will be high enough to push you into the next tax bracket.

Also, healthcare is a big expense in retirement! Many people don’t realize that your Modified Adjusted Gross Income (“MAGI”) will impact how much you pay in Medicare Part B and D premiums (known as “IRMAA”)! The base premium for Medicare Part B is $164.90, but this can increase as high as $560.50 depending on your MAGI! Multiply this by 2 for Married Couples and we are talking over $12k/year in premiums alone!

Therefore, you might consider taking small bites at the apple now (pay some additional taxes now), so you don’t have a huge tax drag when RMDs kick in.

Consider taking advantage of "Qualified Charitable Distributions" or QCDs

This is perhaps my favorite tax strategy for retirees. QCDs allow for up to $100,000 to be donated to a qualified charity from your IRA. You have to be at least 70.5 years old, and it has to come from YOUR IRA (not an inherited IRA). This also means you cannot use 401ks or 403bs for QCDs!

While you can start this strategy at 70.5, this has the most impact on those already taking RMDs.

Because of the increase in the standard deduction, the majority of taxpayers are NOT itemizing deductions. If you’re not itemizing deductions, the gift you made to your favorite charity is NOT deductible! Instead of donating cash, a QCD will allow you to use some (or all) of your RMD to contribute to your favorite charity (or charities). The best part; is there is NO impact on itemizing or using the standard deduction! The amount donated via QCD reduces your RMD dollar for dollar (up to $100,000), which is in essence BETTER than a tax deduction! Let’s look at how this works.

Bill’s RMD for 2023 is $50,000.

Bill loves donating to his local animal shelter which is a qualified 501(c)(3). He typically sends a check for $5,000, but he does not have enough deductions to itemize on his tax return. Instead of sending a check, Bill fills out a QCD form with Charles Schwab (where his IRA is) and tells them to send $5k from his IRA directly to the shelter. The QCD is processed, and now Bill’s remaining RMD is only $45,000 for 2023! See, better than a tax deduction!

It’s important to note that the charity has to be a US 501(c)(3) to be eligible for a QCD, and this excludes Donor Advised Funds and certain charities.

Action Items

RMDs will likely always be a part of our tax code. As you can see, however, the rules are changing frequently! Instead of being reactive, begin planning for how to deal with your RMDs well before you start them!

Here are some action items and questions to consider:

1. Run a projection for what your RMD will be at your beginning date

2. Does your RMD provide a surplus of income? Or, do you need your RMD to maintain your retirement lifestyle?

3. If your RMD provides a surplus of income, consider increasing Roth contributions and reducing Pre-tax contributions. Or, consider converting some of your pre-tax balance to Roth when the timing is right. Typically a great time to look at this is when you retire and have a window of time (let’s say 4-5 years) before starting RMDs!

4. If you are already taking RMDs, determine if QCDs are a viable option for you to consider

5. If leaving a financial legacy is important, consider the tax implications of leaving retirement accounts to the next generation. Are your children in higher tax brackets? If so, you might want to consider the impact the 10-year rule will have on their tax bill.

6. Do you believe your tax rate (or perhaps tax rates in general) will be higher or lower in the future?

It’s important to have a plan and consult with a financial professional who understands taxes in retirement! If you have questions about how to address your RMD strategy, reach out to us and schedule an initial “Zoom” meeting! We would love to get to know you and learn how we can help with your retirement journey.

And as always, make sure to subscribe to our newsletter to stay up to date with all of our latest retirement planning content!

Until next time, thanks for reading!