How to self insure for long term care

The numbers don't add up...

These three statistics don’t add up to me!

1. 70% of Americans over 65 will need long-term care during their lives.

2. Fewer than half of you over the age of 65 own insurance to pay for long-term care. Essentially, you are planning to self-insure for long term care.

3. This is the crazy part. 70% of the care being provided is done by unpaid caregivers! Aka. family members…🤔

I wrote about long-term care planning before, but my convictions on this have only increased over the years.

In my previous article, I talked about considerations on whether or not you should purchase insurance.

We also just finished recording a three-part series on The Planning for Retirement Podcast (PFR) about how to fund long-term care costs. Episodes 22 and 23 were about using long-term care insurance and episode 24 was about how to self fund long-term care.

So why do these statistics bother me?

If the majority of retirees will need care, and they are intentionally not buying insurance, that means they plan to self fund for long term care (by default). However, why are family members providing the majority of long term care and not hired help!?

The answer: because there was no real plan to begin with. In reality, it was a decision that was never addressed, or perhaps in their mind they decided to “self fund.” However, that decision was never communicated to their loved ones.

Let me ask you. If you are in the majority that plans to self fund, what conversations have you had with your spouse? Your power(s) of attorney? Your trustee(s)? Do they know how much you’ve set aside if long term care was ever needed? Do they know which accounts they should “tap into” to pay for long-term care?

The chances are “no,” because I’ve never met a client who did this proactively on their own. Ever. And I’ve been doing this for 15 years.

So, this article is for you if you are planning to bypass the insurance route and use your own assets to “self fund long-term care.” I believe this is one of the most important decisions you can make when planning for retirement because it can save how you are remembered.

How much should I set aside to self insure long term care?

It is impossible to pinpoint the exact number YOU will need for care. But let’s pretend your long-term care need will fall within the range of averages.

On average, men need care 2.2 years and women 3.7 years.

The 2021 cost of care study by Genworth found that private room nursing homes cost $108,405/year. Assisted living facilities cost $54,000/year. These are national averages, and the cost of care varies drastically based on where you live.

So let’s use this ballpark figure of $118,800 – $238,491 for men, and $199,800 – $401,098 for women (2.2x the averages for men and 3.7x the averages for women).

The major flaw in using this math is that most people have some sort of guaranteed income flowing into their bank accounts.

- Social Security Income

- Pensions

- Required Minimum Distributions

Of course, not all of that income could be repurposed, especially if you are married. However, perhaps 25%, 50% or 75% of that income could be repurposed for caregivers.

Let’s say you are bringing in $100k/year between Social Security, Pension, and Required Minimum Distributions. Let’s say you are married, and all of a sudden need long term care. For simplicity’s sake, your spouse needs $50k for the household expenses. The other $50k could be repositioned to pay for long-term care. After all, if you need care, you probably are not traveling any longer, or golfing 5 days/week. This unused cash flow can now be dedicated to hiring professional help and protecting your spouse from mental and physical exhaustion.

If we assume the high-end range for men of $238,491, but we assume that $110,000 could come from cash flow (2.2 years x $50k of income), then only $128,491 of your assets need to be earmarked to self fund long term care.

Hopefully, that’s a helpful framework and reassurance that trying to come up with the perfect number is virtually impossible. After all, you may never need care. Or, perhaps you will need care for 5+ years because of Alzheimer’s.

My key point in this article is to address this challenge early (before you turn 60), and communicate your plan to your loved ones.

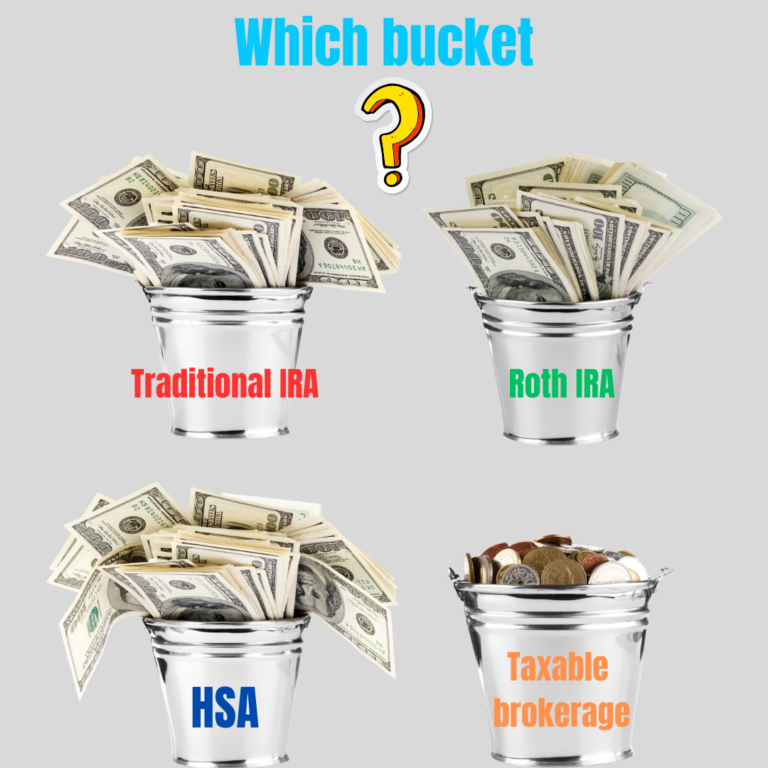

What accounts are the best to self insure long term care?

My personal favorite is the Health Savings Account, or HSA. I wrote in detail about HSA’s in another blog post that you can read here.

Here’s a brief summary:

- You can qualify to contribute to an HSA if you have a high-deductible health plan.

- The contributions are “pre-tax.”

- Earnings and growth are tax-free (you can invest the unused HSA funds like a 401k or other retirement plan).

- Distributions can also be tax-free if they are used for “qualified healthcare costs.”

What is a qualified healthcare cost?

Look up IRS publication 502 here, which is updated annually.

One of the categories for qualified healthcare costs is in fact long-term care! This means you can essentially have a triple tax-advantaged account that can be used to self insure long-term care in retirement.

However, you need to build this account up before you retire and go on Medicare. Medicare is not a high-deductible health plan!

But, if you have 5+ years to open and fund an HSA, it can be a great bucket to use in your retirement years, particularly long-term care costs.

The 2023 contribution limits are $7,750 if you are on a family plan and $3,850 if you are on a single plan. There is also a $1k/year catch-up for those over 55.

So, if you’re 55, you could add up to $43,750 in contributions for the next 5 years. If you add growth/compounding interest on top of this, you are looking at 6 figures + by the time you need the funds for care in your 80s. Not bad, right?

Taxable brokerage accounts or "cash"

This bucket is another great option. Mostly because of the flexibility and the tax advantages of taking distributions. Unlike a 401k or IRA, these accounts have capital gains tax treatment. For most taxpayers that would be 15%, which could be lower than your ordinary income tax rate (it could also be as low as 0% and as high as 20%+).

If you are earmarking some of these dollars for care, I would highly recommend two things:

- Separate the dollars you intend to spend for care and give this new account a name (“long-term care account”)

- Invest the account assuming a time horizon for your 80s instead of your 60s. In essence, you can make this account more aggressive in order to keep pace with the inflation rate for long term care expenses.

What’s nice about this bucket is that it’s not a “use it or lose it.” Just because you segregated some assets to pay for care, doesn’t mean those dollars have to be used for care. When these dollars pass on to the next generation, they should receive a step up in cost basis for your beneficiaries. If the dollars are in fact needed for care, you will only pay taxes on the realized gains in the portfolio.

🤔 Remember when we talked about tax loss harvesting in episode 19? Well, this strategy could also apply to help reduce the tax impact if this account is used to self-insure long-term care.

Of course, cash is cash. No taxes are due when you withdraw money from a savings account or a CD. Now, I wouldn’t suggest using a CD or cash to self-insure care, simply because it’s very likely that account won’t keep pace with inflation. However, if there is some excess cash in the bank when you need care, this could be a good first line of defense before the more tax-advantaged accounts are tapped into.

Traditional 401ks and IRAs

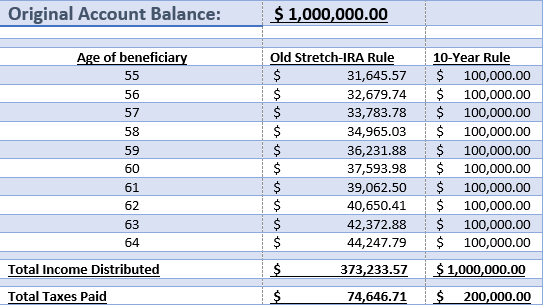

This bucket is often the largest account on the balance sheet when you are 55+. However, many advisors and financial talking heads recommend against tapping these accounts to self insure long term care because of the tax burden.

Well of course, it may not be ideal as a first line of defense to pay for care, but if it’s your only option, “it is what it is.”

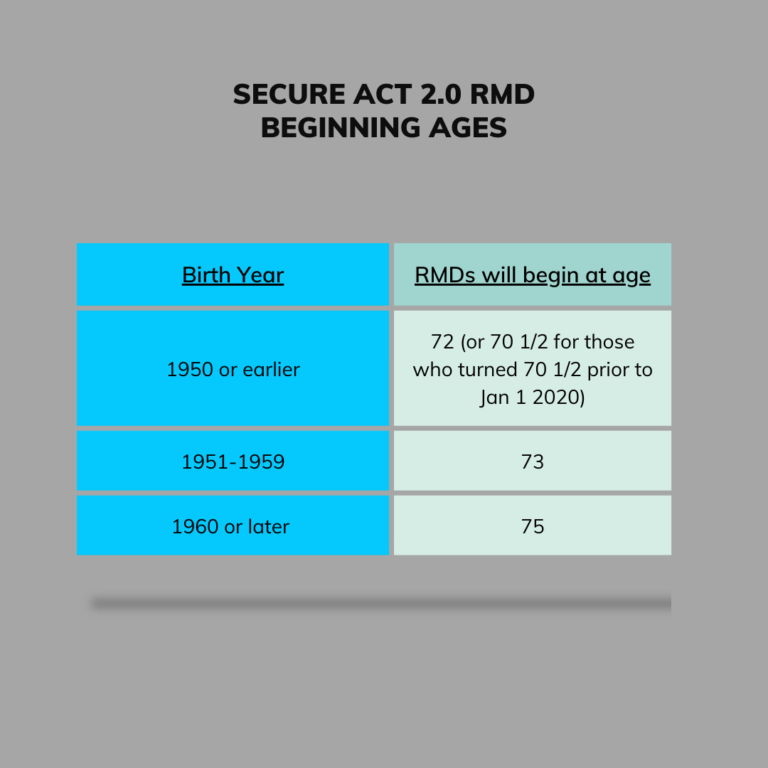

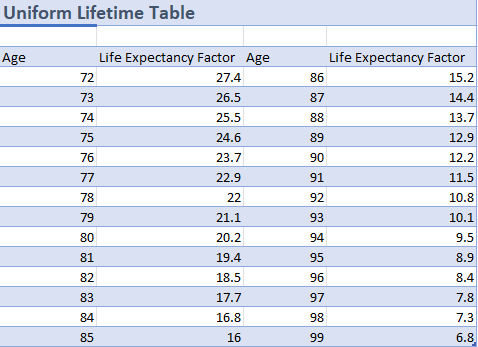

But here’s the thing. If you are needing long term care, you’re most likely over the age of 80. This means you are already taking Required Minimum Distributions or RMDs. If you have a $1mm IRA, your RMD would be $62,500 at age 85. Let’s say you also have Social Security paying you $24,000/year. That’s a total income of $86,500 that is coming into the household to pay the bills. This was my point earlier in that you likely have income coming in that can be repurposed from discretionary expenses to hiring some professional help for care.

This means that you may not need to increase portfolio withdrawals by a huge number if RMDs are already coming out automatically.

But yes, you’ll have taxes due on these accounts based on your ordinary income rates. And yes, if you increase withdrawals from this bucket, this could put you in a position where your tax brackets go up, or your Social Security income is taxed at a higher rate, or perhaps will have Medicare surcharges.

On the flip side, this could also trigger the ability to itemize your deductions due to increased healthcare costs. In fact, any healthcare costs (including long term care) that exceed 7.5% of your adjusted gross income could be counted as a tax deduction (as of 2023).

The net effect essentially could be quite negligible as those additional portfolio withdrawals could be offset with tax deductions, where applicable.

Life Insurance and Annuities

Maybe you bought a life insurance policy back in the day that you held onto. Or you purchased an annuity to provide a guaranteed return or guaranteed income. However, you may find that your goals and circumstances change throughout retirement. Perhaps your kids are making a heck of a lot more money than you ever did, so they don’t have a big need for an inheritance. Or, that annuity you purchased wasn’t really what you thought it was. You could look at these accounts as potential vehicles to self-insure for long term care.

Life Insurance could have two components – a living benefit (cash value) and a death benefit. In this case, you could use either or as the funding mechanism for long term care.

Let’s say you have $150k in cash value and a $500k death benefit. Instead of tapping into your retirement accounts or brokerage accounts, you could look at borrowing or surrendering your life insurance cash value to pay for care. Or, you could look at the death benefit as a way to “replenish” assets that were used to pay for care.

Annuities could be tapped into by turning the account into a life income, an income for a set period of time, or as a lump sum. All of those options could be considered when it comes to raising cash for this type of emergency.

Roth Accounts

This is the second most tax-efficient retirement vehicle behind the HSA. It’s not only a great retirement income tool, but it’s also a great tool to use for financial legacy given the tax-free nature from an estate planning perspective. However, this account could be used to self insure long term care without triggering tax consequences.

Let’s say you need another $30k for the year to pay for care. But an additional $30k withdrawal from your traditional 401k would bump you into the next tax bracket. Instead, you could look to tap into the Roth accounts in order to keep your tax bracket level.

Home equity

The largest asset for most people in the US is their home equity. However, people rarely think of this as a way to self insure long term care. In fact, this is why many caregivers are family members! They want their loved ones to stay at home instead of moving into a nursing home. But perhaps there isn’t a huge nest egg to pay for care. If you have home equity, you could tap into that asset via a reverse mortgage, a cash-out refinance, or a HELOC. There are pros and cons of each of these, but the reverse mortgage (or HECM) is a great tool if you are over the age of 62 and need access to your equity.

The payments come out tax-free, the loan doesn’t need to be repaid (unless the occupant moves, sells, or dies), and there are protections if the value of the home is underwater.

Inform your key decision makers

Now that you have a decent understanding of how much to set aside and which accounts might be viable for you, it’s time to have a family meeting.

If you’re married, have a conversation with your spouse.

If you have children, bring them into the discussion, especially those that will have a key decision-making role (powers of attorney, trustee etc).

You know your family dynamic best. The point you need to get across is that you do have a plan to self insure long term care despite not owning long term care insurance. Your loved ones need to know how much they could tap into (especially the spouse) in the event you need care. This is very important, give your spouse permission to spend! Being a caregiver, especially a senior woman, will very likely result in burnout, stress, physical deterioration, mental exhaustion, and resentment. If you simply leave it to your spouse to “figure out,” they will always resort to doing it themselves in fear of overspending on care.

❌ Don’t do this to them!

I hope you found this helpful! Make sure to subscribe to our newsletter below so you don’t miss any of our retirement planning content! Until next time, thanks for reading!