Nobody wants to think of themselves as getting old or frail. In fact, many retirees in their 60s, 70s, and even 80s are still traveling the world. The risk of extended care will never impact them. But if you need extended care, what are the consequences to your loved ones? They are not just financial but physical and emotional.

We are honored to have Harley Gordon join us on this episode, “The Consequences of Extended Care in Retirement.”

Harley is a founding member of the National Academy of Elder Law Attorneys (NAELA), and the founding principal of the CLTC, or Certification in Long-Term Care designation. He’s recognized as one of the top 10 most influential people in the Long-term Care Industry.

We hope you enjoy this episode and hope you learn something that makes an impact.

Easy money policy beginning in 2009 led to a historical run in tech companies. Companies that rely on leverage to aggressively grow were borrowing money for next to nothing! Investors weren’t even concerned with cash flows, or healthy balance sheets. If the idea seemed like it could stick, they would take their bets. Some paid off, and some flopped. But the overall sentiment was “risk-on.”

These policies led to the success of Silicon Valley Bank, or SVB. Out of all of the start-ups in the US, SVB provides banking services to nearly half of them. Whether it was providing them loans or deposits, they were the go-to Bank for start-ups.

Instead of borrowing “free money,” they begin to use their own cash (really their investor’s cash) for operations. Why would they borrow for 8% or 9% when their cash is only earning 1% or 2%? At some point, the interest on debt isn’t sustainable.

So, they go to their bank and pull funds for their operations. After all, they still have payroll and other overhead to keep the business going.

Remember the run-on banks in “It’s a Wonderful Life?” No, they don’t keep your money in the bank! It’s invested somewhere!

In SVB’s case, over half of their assets were invested in bonds! What’s more is that the majority of these bonds had long-term maturities, over 10 years, instead of shorter-term maturities.

We talked about interest rate risk in several of our market commentaries over the last couple of years, and SVB completely missed the mark on hedging interest rate risk. Maybe they should’ve been reading our blog!

So how did they raise cash to give to their depositors?

They had to sell their bonds…

They go down, simple as that. Think about it. If you bought a 10-year treasury 3 years ago, it was yielding less than 1%. Today, new issues of 10-year Treasuries are yielding 3.7%! So, for anybody to want to buy your bond, you would need to discount it significantly. Otherwise, they will just buy a new issue for almost 4x the interest!

So, instead of SVB holding their bonds to maturity, as they intended to, they needed to sell (at a significant loss) to meet their obligations. The loss realized was $15b, which was equivalent to nearly all of its tangible capital. This led to their ultimate collapse and is the second-largest bank failure in US history (second to Washington Mutual in 2008).

I’m not putting the blame on one individual, but it’s no coincidence that the CFO of Lehman Brothers (who left Lehman right before their bankruptcy in 08) is now an executive at SVB. Additionally, the Chief Risk Officer of SVB worked for Deutsche Bank during the subprime-mortgage crisis in 2008.

Some banks are more conservative. They lend to small businesses or individuals. SVB, on the other hand, catered to start-ups in Silicon Valley. These tech start-ups have significantly more risk than the bakery shop next door. Additionally, their deposits were padded over the last two years because of the easy money policy over the last decade coupled with record amounts of stimulus.

The bottom line is that SVB got greedy. Instead of looking at the interest rate environment as a risk, they ignored it. They sought higher yields in longer-term bonds without hedging the need for short-term cash flows. They never expected a “run on the bank.”

The Federal Deposit Insurance Commission, or FDIC, officially announced on Friday that SVB was closed. This led to a selloff in stocks and of course, those holding SVB stock will lose their investment.

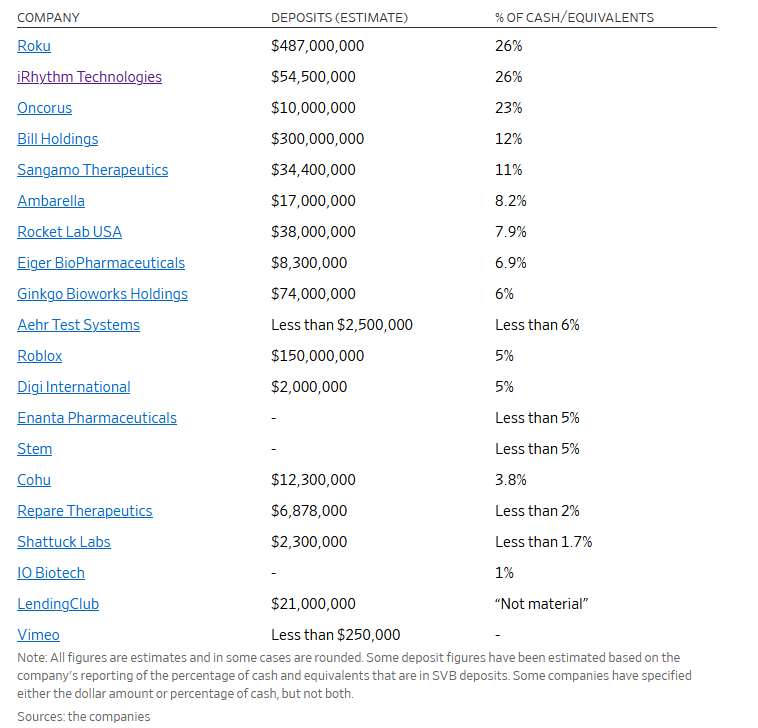

But what about the deposit holders and borrowers? The FDIC typically protects balances up to $250k per entity/bank. In SVB’s case, most of their customers had significantly more than the FDIC limit. After all, these are big wigs out in Silicon Valley. Not surprisingly, here comes the Government to “bail them out.” But they aren’t calling it a bailout, as we saw in 2008/2009, because they say that stock and bondholders in SVB are not protected. However, they are using “emergency-lending authorities” to make funds available to meet bank withdrawals, even those that exceed FDIC limits! In fact, 85% of the bank’s deposits were uninsured! And you can’t argue their customers don’t understand FDIC. These are some of the supposed best and brightest innovators in our country. This is absolutely a bailout; they just aren’t calling it one.

After all, SVB is an investor, just like you and me. The principles they failed to adhere to can also lead to an investor running out of money during retirement. The only difference is the Government has no interest in bailing YOU out. So, it’s important to have a plan and process while you are navigating a potential 30+ year retirement!

This is a basic principle of “Investments 101” – Don’t put all of your eggs in one basket! Diversify! In SVB’s case, they put all of their eggs in the tech start-up basket, and they had quite a run-up until 2022.

Coincidently, when I review prospective client portfolios, technology is by far the most concentrated sector. I’m not going to argue the merits of tech companies, but most banks tend to diversify their clientele. This provides less risk of one industry going through hard times.

Oftentimes people bury their heads in the sand in hopes that “things work out.” Well, if you haven’t done anything with your portfolio in a while, there is a good chance you’re overexposed to assets that are overpriced.

SVB chose not to diversify. They decided to stick with their niche, and ultimately the Fed’s aggressive rate hikes put pressure on their customers leading to the run on their bank.

When you are planning for retirement, there are two types of expenses:

For your “Known expenses,” wouldn’t it make sense to match those up with “known cash flows” and not “unknown cash flows”? Well, SVB decided to keep their bond portfolio LONG term. The longer the term of the bond, the more interest rate risk it has. It’s important to not chase rates. Just because a bond is paying a higher coupon, doesn’t mean it aligns with YOUR portfolio goals.

This is why I am a big fan of individual bonds for the “core” bond portfolio. With individual bonds, you can hold them to maturity for the “known expenses.” Sure, there is a time and place for bond mutual funds or bond etfs, but those funds have redemption risk, similar to what SVB experienced. In their minds, they wanted to hold their bonds to maturity to match up with later cash flow needs, but their customers wanted cash now.

With bond funds, what if OTHER investors who own that fund want their cash before you do? Well, these are known as redemptions and ultimately the fund may have to sell at an inopportune time, just like SVB! In essence, you lose one of the most important characteristics of a bond, the maturity date!

So, if you have a bond portfolio and are planning for retirement, you must absolutely match your bond portfolio up with YOUR time horizon and YOUR cash flow needs! This eliminates interest rate risk as much as possible. And for retirees, risk management is the name of the game.

Ok, that’s a great plan for the “known expenses,” but what about the “unknown expenses?” In retirement, things ALWAYS come up. We just don’t know what they will be, and how much they will set us back.

This is why I advocate for an emergency fund OUTSIDE of the retirement portfolio. With high-yield savings accounts offering north of 3% interest, cash can at least earn something while sitting idle. Of course, stick within FDIC limits, but anywhere from 1-2 years worth of FIXED expenses is appropriate for a retiree’s emergency fund. Unlike an investor who is still working and has time to get a new job or allow the portfolio to recover, retirees don’t have those luxuries. Sure, you could beg for your old job back, but that might not be what you WANT to do. Instead, if you have 1-2 years of fixed expenses, this will help preserve your investment portfolio from a larger-than-anticipated withdrawal.

For some, you may not want so much cash sitting around for that “what-if” scenarios, so here are a couple of compliments to a cash reserve fund:

Home Equity Lines of Credit, or HELOCs, are a great way to limit how much you keep in cash. Most people use these for home improvements, but having a HELOC can also help with your emergency fund. Let’s say 1 year of fixed expenses is $100,000. Instead of having $100k-$200k in high-yield savings, you might keep $50,000 in cash, and have a $150k HELOC for the JUST-in-case scenario. That way, your savings account can be your first line of defense. And only if needed, the HELOC can come in as a backup.

Cash Value Life Insurance is probably my favorite emergency fund vehicle in retirement. Unlike term insurance, it can act as a pool of funds available when you really need it.

And unlike a bond which can decline in value based on interest rates, cash values have a minimum guaranteed rate, so the cash can never go down. Think about the power of this tool in the market we are in now where bond prices are down over 15%!

And I’m not talking about Indexed Universal Life policies or Variable Life Policies, I’m talking about a traditional fixed product. If you build up enough cash value over time, you may only need 3-6 months of fixed expenses in cash given the rest of your cash buffer is inside of your life insurance policy. I’m going to write another article on Cash Value Life Insurance later, but it’s a great tool for the right person. But for the wrong person, it’s one of the worst products you can buy!

For what it’s worth, our firm does not sell any insurance products and we have no skin in the game. These products should also be gone over with a fine-tooth comb as they can be extremely complex.

As I began writing this piece, Signature Bank became the next casualty of the run on banks Sunday, March 12th. Their Bank was also focused on a niche, commercial real estate. However, in 2018, they decided to chase the shiny new toy, cryptocurrency, or digital assets. As concerns arose from the failure of FTX as well as SVB, customers started to pull their funds from Signature, leading to what is now the 3rd largest Bank to fail in US History.

I repeat, don’t chase the shiny new toy!

It was interesting because the stock market rallied on Monday after both SVB and Signature closed their operations. WHY??

Well, it seems that investors feel the Fed might slow their rate increases in light of the casualties it caused. Slower rate hikes mean potentially less pressure on profits and ultimately earnings. However, I don’t think we’ve seen the end of this narrative. Starting with FTX’s collapse last fall, and now these two large banks failing, other companies that are overweight in speculative investments will continue to unravel. The magnitude of these rate hikes cannot be overstated and this type of carnage has been what we’ve been concerned about since the beginning of 2022.

The story we are very interested in is the impact on small “moms-and-pops” businesses. After all, many of the customers SVB serves provides service to everyday businesses. Whether it’s payroll, cloud services, or other technology, small businesses across the US rely on tech. And if these tech companies are beginning to falter, what does that do to the economic system as a whole? Also, is this going to lead customers of other regional banks to panic? Will they take their money and put it at a larger bank or under the mattress or in cryptocurrency? This could put significant pressure on banks all over the US, which would have a trickle effect on the economy.

In the end, the Fed may not get the soft landing it wanted, but a recession may not be fully priced into the market at this point.

The one silver lining is that inflation does continue to ease, and that’s good news when it comes to what the Fed does next.

1. Are you overweight in speculative investments?

Tech, consumer discretionary, digital assets, or even speculative real estate. These assets have certainly appreciated significantly over the last decade, but things tend to fall in and out of favor. Therefore, it’s important to review and re-balance your portfolio on an ongoing basis to reduce risk. Even if your portfolio consists of several mutual funds or ETFs, it’s also very possible they are concentrated in certain sectors with higher risk.

2. What does your bond portfolio consist of?

Are the time horizons of your bond portfolio consistent with your personal retirement goals and objectives? If you need help reviewing this, consult a professional (we can help you!).

3. What major unexpected expenses might you run into during retirement?

Sure, we may not have a “run-on-your-retirement” as we had with SVB. However, I can guarantee there will be significant unknown expenses during a multiple-decade retirement. One, in particular, I can think of is the need for long-term care. This is perhaps the largest unknown expense for retirees, and the cost can drain a retirement portfolio much sooner than desired. It’s important to have a contingency plan to protect and preserve the retirement portfolio if the need for care arises.

4. Where do you bank?

The notion of FDIC has come back into play with the collapse of SVB. Are you over the $250k FDIC limit with your bank? While the Fed announced it’s going to make customers of SVB and Signature whole, that may not be the case with smaller regional banks, so it’s important to keep your safe money safe.

5. Don’t be reactive, be proactive.

News like this is never good for the markets. We have been talking about the Fed’s rate hikes for over a year and how certain sectors are going to take a hit. Now, the impact is beginning to rear its ugly head, and we might have a few more quarters of continued bad news. However, you are investing for retirement. Retirement is not just a few quarters, it’s a few decades! As long as your portfolio is aligned with your retirement goals, there is no need to make a knee-jerk reaction to the bad news. After all, if you’ve learned from the lessons SVB’s failure taught us, you can implement a successful retirement plan for “all seasons.”

If you have questions about how these lessons can be implemented into your retirement plan, we would love to meet you and learn more about you.

And finally, make sure to subscribe to our newsletter to stay up to date with all of our latest retirement planning content.

Until next time, thanks for reading.

It’s natural for us to think about how to GET to retirement, but not about how retirement will actually work.

The same is true for saving into a 401k or 403b plan. Most think about how to invest their 401k and maximize growth. However, what about the distribution process? And more importantly, what is the tax impact of those distributions?

Taxes are our clients’ #1 expense during retirement, and RMDs play a big part in tax planning. Naturally, I am a big advocate of having an RMD plan.

We will dive into how Required Minimum Distributions (RMDs) work and how to plan for them strategically. Thanks for tuning in!

Copyright © 2020 imagine financial security. All Rights Reserved. Website by Justin Bordeaux