Q1 2023 Market Update

Despite two major US banks failing, coupled with central banks’ attempt to fight persistent inflation, the US and International markets experienced some positive momentum!

The Banking System

One of our recent articles was about the collapse of Silicon Valley Bank (SVB), the 2nd largest US bank failure in history. This sent a ripple effect into the banking system, particularly a flight of deposits from smaller regional banks to big banks.

JP Morgan posted a 52% jump in its first-quarter profits.

Wells Fargo topped analysts’ projections by 10 cents a share in Q1.

Citigroup also beat analysts’ estimates on revenue.

In short, customers were worried that their bank might also fail following SVB and Signature’s collapse. As I discussed in our previous post, which you can read here, SVB and Signature were heavily concentrated on client bases that had unique challenges in this economy (tech industry and crypto).

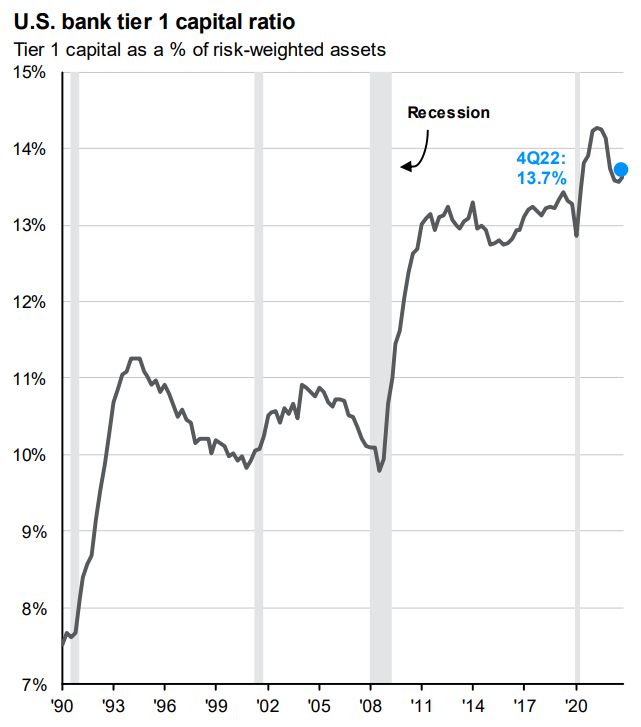

However, bank capitalization looks very healthy and has been on the uptrend since 2008 following the Global Financial Crisis. This is one positive impact of tighter regulation on big banks following The Great Recession.

The real fallout

Despite big banks experiencing an inflow of deposits from smaller banks, they are still facing tighter lending standards and rapidly increasing interest rates. They now have to pay us all higher yields in return for their money market or CD accounts. Smaller and more regional banks, however, will face a reduction in deposits AND increased lending standards. Regulators and board members are going to be watching like a hawk to ensure more banks don’t have the same risks that SVB and Signature Banks did.

As banks tighten their lending standards, individuals and businesses are going to struggle to get loans. Individuals who could previously afford that new or used vehicle might not qualify any longer. Or, people shopping for their first home can’t afford the mortgages given the rapid uptick in rates.

Businesses that rely on these smaller and regional banks for loans to keep their lights on or survive this challenging market will find it harder to get capital.

All of these ripple effects will contribute to a slowing economy.

But after all, this was the Fed’s goal ever since they announced their rate hike and quantitative tightening strategy back in 2021. Their main objective was to fight inflation, and they needed to slow the economy in the short run to win the battle in the long run.

Speaking of inflation...

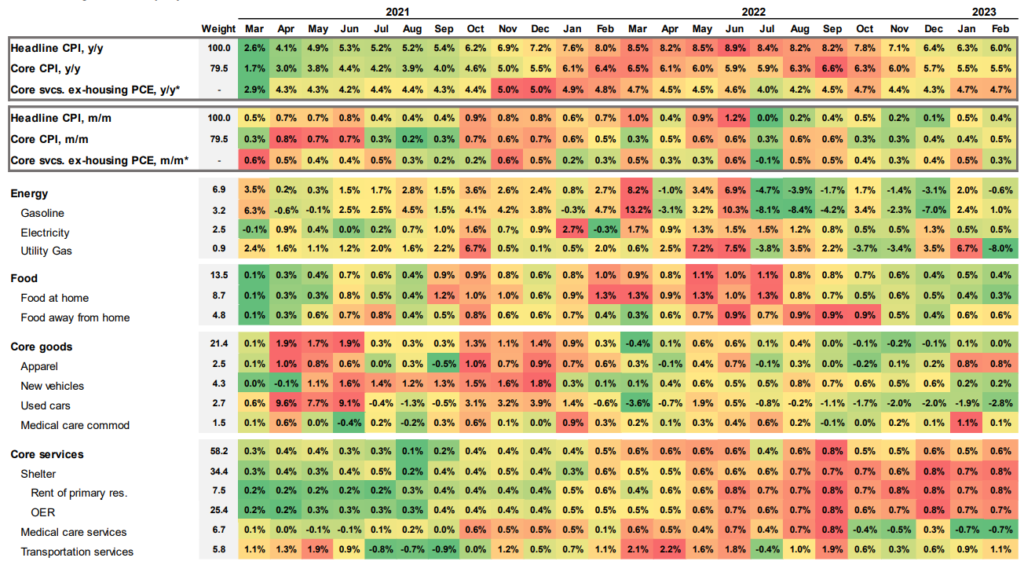

After setting 40-year highs in 2022, inflation is finally cooling a bit. The peak was 8.9% in June, but we’ve seen a gradual decline ever since. The March numbers were just released and showed a 5% year-over-year CPI figure. The Fed’s target overall is 2%, so we are still a ways from that number. Despite the trend going in the “right” direction, I don’t believe the Fed will get all the way to their 2% goal unless unemployment falls exponentially over the coming months. The cooling inflation story is the primary reason the market has rallied since the start of 2023. Inflation under check means the Feds might actually STOP raising interest rates very soon. The market is pricing in one more 0.25% rate hike and then the expectation is rates will level off and eventually fall in 2024.

The real question is, has the Fed done so much damage with its policy that they send the economy into a recession? If this happens, they could even pivot to rate cuts as early as the end of 2023 or the beginning of 2024. My hope is that they take a pause and let the economy settle itself out.

Unemployment and Wages

The unemployment story has been a big part of why inflation has been so sticky.

We entered 2020 with a 3.5% unemployment rate, which was a 50-year low. After topping over 10% unemployment (briefly) in 2020, the US now has a 3.6% rate. Additionally, wage growth is at 5.3%, which is above the historical average of 4%. So, if people are “working” and wages are still growing, it’s no wonder inflation has been so tough to fight. People did not stop spending money in 2022 because of prices going up. Sure, consumer discretionary categories took a hit, but the core goods and services were still being purchased at elevated prices. This is a big reason I don’t believe prices are going to come down as much as the Feds want them to. Why would corporations cut prices when their consumers have the wages to buy them?

One of the chips likely to fall is the unemployment story in big tech firms. Since 2018, Amazon and Meta (Facebook’s parent) have almost doubled their workforce. During that same period, Microsoft increased its workforce by 53%, and Alphabet by 60%! Meanwhile, Apple only grew its workforce at a moderate 20% rate.

Remember the Paycheck Protection Program in 2020? This was a federal loan to corporations to keep their employees on payroll during COVID. All they had to do was use at least 60% of those loans to cover payroll and the “loan” was forgiven. The word on the street is that big tech used their loans to go on massive hiring sprees. Not because they NEEDED that many more workers, but to reduce the talent pool for their competitors and have their PPP loans forgiven! Now that the economy is slowing, we’re seeing big tech begin layoffs. Coincidently, Apple hasn’t laid anyone off just yet.

Look at this headline from a Fortune article:

‘Penned’ tech specialists are earning six-figure salaries to ‘do nothing’ and string out 10-minute tasks. Some are even using the time to scuba dive

Some of the highest unemployment numbers by industry are:

- Farming – 7.4%

- Mining, quarrying, oil and gas extraction – 6.5%

- Construction – 5.6%

- Leisure and Hospitality – 5%

- Transportation and utilities – 4.6%

Meanwhile, big tech unemployment is only at 2.6%, up from 1.5% to start the year. All of the remote workers that migrated out of the big cities during the pandemic are now experiencing some layoff concerns, and it will be very interesting to follow that narrative as big tech continues to cut their unnecessarily large workforces.

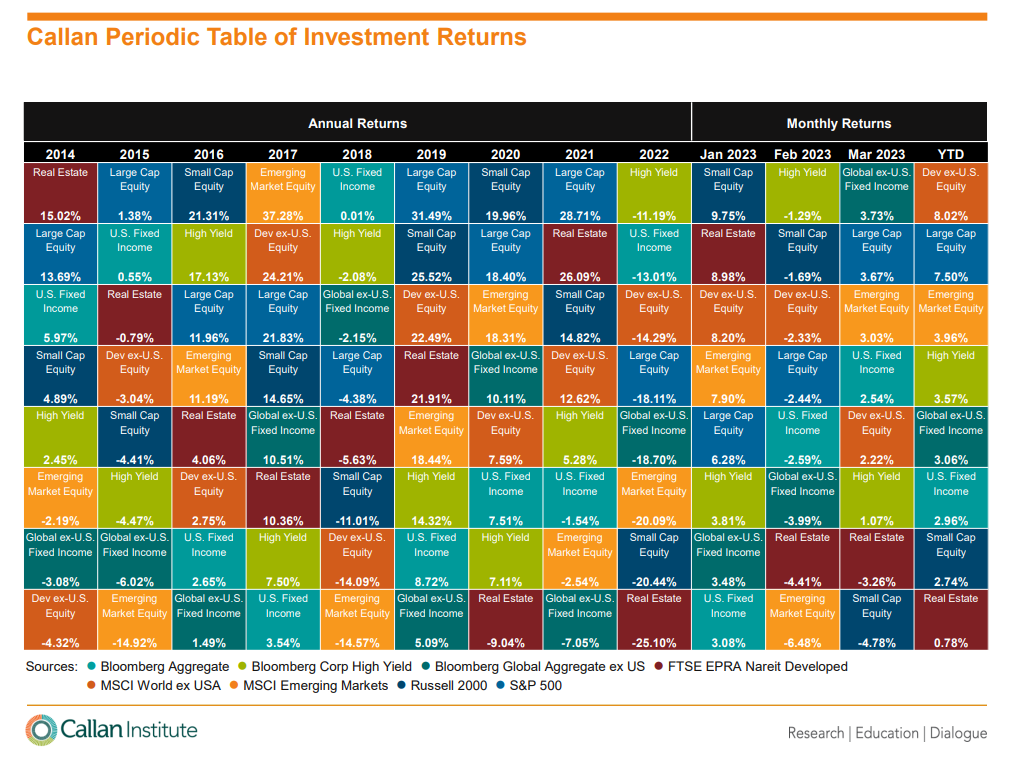

Returns by asset class, YTD

As you can see year to date, all of the major asset classes are positive. International, developed economies are in the top spot, with US Large Cap a close second. What’s very encouraging is that the fixed-income markets are now showing positive returns after a rough 2022.

During the re-balancing process for our clients at the beginning of 2023, the only asset classes we added exposure to were Large Cap Growth companies (big tech) and international equities. This isn’t to pump our chest to say “I told you so.” However, part of our process is to sell the winners and buy the losers. Big tech was the worst-performing asset class in 2022, and stock performance is a leading indicator. What I mean is, the layoffs and bad news for big tech this year were already priced into the market in 2022 (at least we hope so). We talked a lot about interest rate increases during 2021 and 2022 and how it would impact tech companies. After the brutal selloff in 2022, valuations looked much more attractive going into 2023…hence, buying the loser. So far year to date it’s paid off well, but that’s not to say there isn’t more volatility ahead for big tech with the challenging interest rate environment they face.

The same can be said about international equities as they had a rough go in 2022 but are very well positioned from a valuation perspective for the decade ahead. International stocks tend to do well during periods of high inflation, like in the 70s and 80s. However, geopolitical concerns with Russia/Ukraine and China still make international stocks much more volatile.

Final thoughts

Attempting to time the market is very dangerous. If you look back at the past year, consumer sentiment has been at record lows. People have not been feeling good about the economy. This feeling oftentimes leads to investors flighting to safety. How many articles have you seen about I-Bonds or CD Rates over the last 12-18 months? Well, stock market returns typically accelerate very quickly after a recovery. In fact, more than 50% of the best daily S&P 500 returns occur during a bear market. So if you bailed out during 2022, you did not get the benefit of a strong Q1 in 2023!

While we are going to be experiencing a tighter economy for the foreseeable future with higher rates, there is now hope with the inflation story beginning to unfold. Let’s hope the market is correct in that the Fed will only increase rates one last time at 0.25% and be finished. The unemployment and wage growth figures will be key to watch over the coming months as that will dictate how quickly inflation comes down in late 2023.

If you are curious about how the market has impacted your financial goals, we’d love to hear from you! You can either send me an email at kevin@imaginefinancialsecurity.com or book a Zoom call with us.

Until next time, thanks for reading!