Blended Families – You Need a Long-term Care Plan!

Don't have a Long-term care plan? You are not alone!

Nobody likes to think about the possibility of a family member caring for them later in life. However, the number one concern I hear from my clients is “I don’t want to be a burden on my children.” When I ask about how a long-term care event would impact the family, most people have never thought about it. Or, they’ve thought about it but have yet to create an actual game plan.

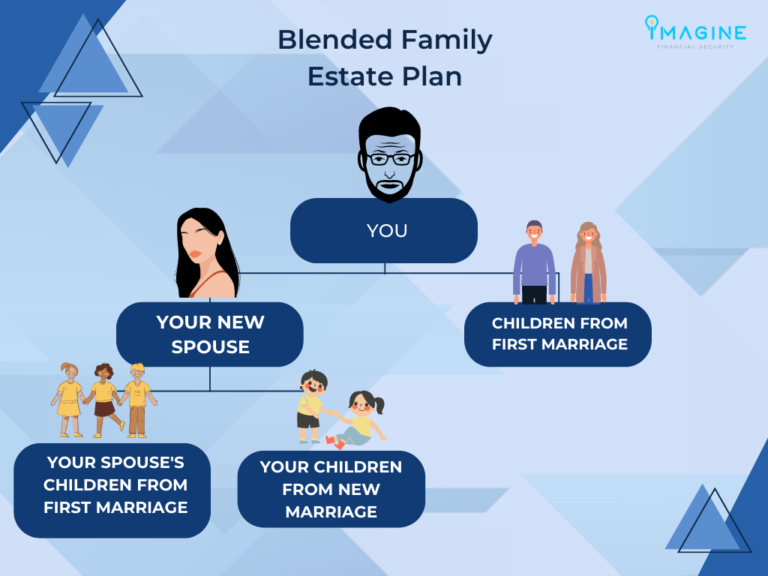

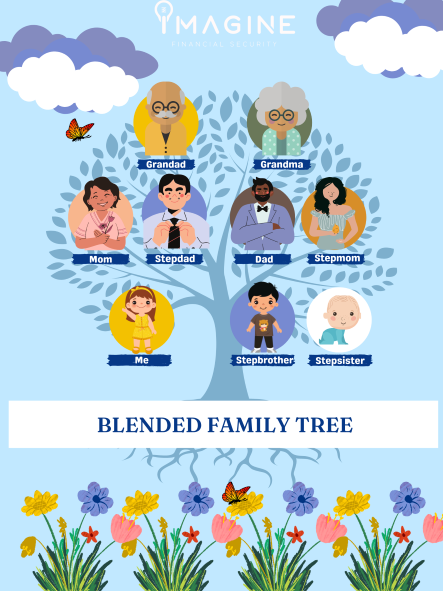

Now, what about long-term care for blended families? If there are adult children from previous marriages, how does that impact the actual long-term care plan for Mom/Dad?

In this article, we will dive into the facts about Long-term Care planning, the challenges for blended families, and the top solutions to consider!

The basics

Despite the fact there is a 70% chance you will need long-term care later in life, less than half of retirees over 65 have Long-term Care insurance. Furthermore, 70% of caregivers are NON paid family members. So what does this mean?

Even though the probability of needing care is high, people simply ignore long-term care planning. Or, they simply assume buying insurance is too expensive or they will simply pay out of pocket.

And despite not wanting to burden their loved ones, they many end up doing just that. In fact, more than 60% of caregivers have other full time jobs in addition to being the primary caregiver!

Many people believe Medicare or Medicaid will cover Long-term Care expenses.

Medicare does not pay for custodial care after 100 days. Sure, if you are in a rehab facility and expect to improve, you can rely on Medicare to help subsidize those costs for a very short period of time. Medicaid, on the other hand, does pay for custodial care. However, most of you will probably not qualify for Medicaid given the financial requirements of income and assets. And sure, you might assume that your family members will hire help, but the reality is they are NOT hiring help. Perhaps they believe they can’t afford it, or they are afraid they will burn through assets too quickly and won’t be able to maintain financial independence for themselves. Both of these are legitimate concerns.

Long-term Care Planning Challenges for Blended Families

Blended families are becoming much more common nowadays. In fact, 40% of weddings today will form a blended family! For blended families planning for retirement with adult children, this can provide challenges in three ways:

- Who’s assets will be used to pay for long-term care expenses?

- How does a long-term care need for your spouse impact your ability to maintain financial independence?

- Who’s children will be available to coordinate care?

Who’s assets will be used to pay for long-term care expenses?

What if you remarried and brought a much larger pool of assets to the marriage than your spouse? You might have the goal of passing on a financial legacy to your children, but at the same time making sure your spouse is taken care of for life.

As I discussed in my previous article, 4 Retirement and Estate Planning Strategies for Blended Families, the functionality of a trust for blended families is important. A trust would allow for you to pass on assets to your spouse, but making sure the next beneficiary is your children once your spouse passes away.

But what if your spouse needs long-term care later in life? Perhaps they don’t have their own pool of funds to pay for that care. Inevitably your trust will have to be invaded to pay for those long-term care costs. The question is, how does this impact your intergenerational wealth planning goals?

What about your financial independence?

If your spouse needs care and you spent down a large chunk of your assets to pay for it, how does this impact your ability to maintain financial independence after your spouse dies?

When your spouses passes away, the household will automatically have a reduction in Social Security income. There could also be a reduction in pension and annuity income, on top of assets being spent down for long-term care.

If you were cruising along and on track to meet your retirement and estate planning goals, how does a long-term care event impact your ability to maintain those goals?

As we illuded to earlier, most of the time the spouse will care for the other. Remember, 70% of long-term care is provided by unpaid caregivers. This means you might forgo hiring professional help in efforts to save your financial resources, but this could negatively impact your mental and physical health. We’ve seen caregivers get sick after their spouse passes away, simply because they took on the lion’s share of caregiving and are flat out worn out.

Who’s children will be available to coordinate care?

This is the most difficult part of the equation. Sure you might have enough resources to pay for care. But, like Jean Ausman shared in our retirement readiness checklist, “a checkbook is not a long-term care plan.”

Who is going to manage the care?

Who is physically going to provide the care? What if that person is a stepchild?

Who is going to manage the financials and decide which accounts to tap into for care?

These are all touchy subjects, especially with a blended family where the adult child handling these issues isn’t the biological child of the one needing care.

What is a Long-term Care Plan?

As I discussed in a previous article, Long-term Care Planning, I mentioned the fact that 40% of retirement aged clients have long-term care insurance. If you read that article, you understand that I am agnostic as to what the solution is, but we need to have a plan.

These are some questions to get you started:

- Where will care be provided? If care is provided at home, you will likely have family providing the bulk of the care. On top of this, you might hire some professional help to give relief for the family members. If you need specialized care in a nursing home or memory care, the price tag goes up substantially. Check out Genworth’s stats on this below.

- What assets will be used to pay for care? Different accounts will have different tax consequences. Additionally, certain accounts are better to spend during your lifetime instead of leaving to your children. Make sure you designate which accounts (in order) should be spent down first if there is a long-term care need. Take a look at our article on how to divide assets in a blended family.

- What’s the strategy to mitigate the tax impact of accelerated withdrawals? You might have multiple accounts to draw from, and accelerated withdrawals on certain accounts like 401ks or IRA’s might push you into a higher tax bracket. Additionally, it could result in higher Medicare premiums as a result of “IRMAA” (income related monthly adjustment amount). Therefore, you might work with a fiduciary financial planner who also does tax planning to ensure you are making tax efficient withdrawals.

- Who is the caregiver coordinator? This job can feel like a full time job, even if the individual isn’t the one providing the care. The ongoing hiring, firing, financing, and other issues can result in major headaches for the coordinator. For blended families, what if that coordinator isn’t your biological child? Or, what if your biological child is the coordinator for your new spouse (their step parent)? These are touchy issues and can cause a divide amongst the family. It’s very important to be proactive with all of the children on who is responsible for what. You also might consider hosting a family meeting so all of the children are on the same page.

- Who is going to manage the assets? If you plan to hire professionals to provide the care, some additional asset management will need to be considered. Which investments are being sold when? How does selling those investments impact the long term viability of the portfolio? What’s the tax consequence of selling an investment to pay for care? How does selling an asset impact your legacy goals?

For traditional families with shared estate planning goals, it can be perfectly acceptable to “self-insure,” as long as the plan is laid out for the decision makers.

With blended families, particularly those with separate estate planning goals, I highly recommend Long-term Care Insurance.

The potential challenges for the adult children and your spouse are endless depending on the relationship dynamics, and insurance removes them from the equation (for the most part).

The benefits of Long-term Care Insurance for Blended Families

- Caregiver Coordinator benefit

Immediately after a triggering event, a Long-term Care policy will most likely have a caregiver coordinator benefit. This allows for the client to call the carrier, and request a specialist to come out to the home. This specialist will help create a plan to provide care within the framework of the insurance policy’s terms and budget. Additionally, they can help make recommendations on home modifications to suit the needs of the family. From there, if there is additional care needed, the family will then decide if they will pay out of pocket or coordinate efforts to provide care. Nonetheless, the family will have an objective third party to help them with these major decisions.

- A long-term care benefit pool

Some policies provide for reimbursement, some provide cash benefits immediately upon the triggering event. Either way, there is a defined pool of dollars that are specifically meant for long-term care needs. In addition, the payouts are income tax free, which will eliminate unnecessary tax increases from accelerated retirement account withdrawals. Why do you think ultra high net worth individuals own Long-term Care Insurance? Of course they could “self insure,” but they would rather keep their long term investments on their balance sheet instead of liquidating them for care.

The best part is, having a defined pool of assets will eliminate the question of “do I hire help or provide care myself?” Instead of putting your spouse or adult children at risk of carrying the weight of caregiving, the insurance essentially forces the family to hire professional help. You can’t put a price tag on preventing that burden.

- Hybrid policies

Over the years, I’ve had clients bring up the concern of “what if I never need care?” Statistically speaking, there’s a good chance you’ll need care. In fact Genworth estimates 70% of those 65 or older will need care at some point in life. But the question is valid. What if you don’t?

Hybrid policies were designed to address this issue. The gist is there is a life insurance benefit with a long-term care benefit. Some policies are life insurance focused with a long-term care rider. Others are long-term care focused with life insurance rider. Either way, if long-term care is not needed. Or, if only a portion of the benefit pool is used, there will be a death benefit when you pass away that can be left to your beneficiaries. These policies are certainly more expensive, but you get what you pay for. What’s also nice is all of the policies I am familiar with are guaranteed to not increase in premiums. This has been another pain point for the long-term care industry and these policies were also designed to eliminate that concern.

For those that are interested in leaving a financial legacy to their children, these hybrid policies are a great solution!

Final thoughts

All in all, if you are a blended family with adult children, you must absolutely have a long-term care plan. If you are similar to a traditional family in the sense of having shared estate planning goals, long-term care insurance might be optional for you. However, the tax benefits and having a dedicated plan for care makes insurance extremely appealing for all families.

For blended families with different estate planning goals, long-term care insurance is the top solution! It’s important to consult with a fiduciary financial advisor that specializes in retirement planning and specifically long-term care planning to create a plan that’s right for you. An objective third party who can review your goals and balance sheet is invaluable.

If you are interested in discussing your long-term care plan, feel free to start with a no obligation Zoom call with us! (see the link below)

Make sure to subscribe to our blog and join our Facebook group to get the latest retirement planning insights delivered to you!