Edit Content

Jacksonville Florida

Your trusted financial team

- Serving St. Augustine

- Serving Jacksonville

- Serving All of the United States Remotely

- [email protected]

- (904) 323-2069

FOLLOW US

Your trusted financial team

Did you know your Social Security benefits in retirement could be 100% tax-free?

Perhaps you didn’t even know Social Security would be taxable as many of you paid into the system for decades!

Today we will unpack how Social Security retirement benefits are taxed, and most importantly how to reduce taxes on those benefits in retirement.

A few notes for the listeners:

Provisional Income / Social Security Tax Rates for 2023

Individual

Married Filing Jointly

A helpful Kitces.com article

If you have already begun drawing Social Security, you might be surprised to learn taxes are owed on some of your benefits! After all, you’ve been paying into the system via payroll taxes, so why is your benefit also taxable? If you have yet to begin drawing Social Security yet, you can never say you weren’t told! As a result, I’m often asked if there is a way to reduce taxes on your Social Security benefits. This blog post will unpack how Social Security taxes work and how to reduce taxes on your benefits. Make sure to join our newsletter so you don’t miss out on any of our retirement planning content (click here to subscribe!). I hope you find this article helpful!

The Social Security Act was signed into law by President Roosevelt in 1935! It was designed to pay retired workers over the age of 65. However, life expectancy at birth was 58 for men and 62 for women! Needless to say, there weren’t a huge number of retirees collecting benefits for very long. As people began to live longer, several key provisions were added later. One was increasing the benefits paid by inflation, also known as Cost of Living Adjustments (COLA). Another was changing the benefits from a lump sum to monthly payments. Ida Fuller was the first to receive a monthly benefit, and her first check was $22.54! If you adjust this for inflation, that payment would be worth $420.15 today! If you compare this to the average Social Security benefit paid to retirees of $1,782/month, those early payments were chump change!

According to data from 2021, life expectancy at birth is 73.5 years for men and 79.3 years for women! In 2008, there were 39 million Americans over age 65. By 2031, that number is projected to reach 75 million people! We’ve all heard of the notion that older (more expensive) workers are being replaced by younger (less expensive) workers. While taxable wages are going down and retirees collecting benefits are increasing, the result is a strain on the system.

Social Security benefits are actually funded by taxpayer dollars (of course). If you look at a paystub, you will see FICA taxes withheld automatically. FICA stands for Federal Insurance Contributions Act and is the tax revenue to pay for Social Security and Medicare Part A. The Social Security portion is 6.2% for the employee and 6.2% for the employer, up to a maximum wage base of $160,200. So, once you earn above $160,200 you likely will notice a “pay raise” by way of not paying into Social Security any longer. Medicare is 1.45% up to $200,000, and then an additional 0.9% for wages above $200k (single filer) or $250k (married filing jointly).

Up until 2021, FICA taxes have fully covered Social Security and Medicare benefits. However, because of the challenges mentioned earlier, FICA taxes no longer cover the benefits paid out. The good news is there is a Trust Fund for both Social Security and Medicare for this exact reason. If there is a shortfall, the trust fund covers the gap. The big challenge is if nothing changes, Social Security’s trust fund will be exhausted in 2034 and Medicare’s in 2031.

The first concept to understand is that the % of your Social Security that will be taxable is based on your “combined income,” also known as provisional income. If your combined income is below a certain threshold, your entire Social Security check will be tax-free! If your combined income is between a certain threshold, up to 50% of your Social Security benefit will be taxable. And finally, if your income is above the final threshold, up to 85% of your Social Security benefit will be taxable. Here are the thresholds below.

The basic formula is to take your Adjusted Gross Income (NOT including Social Security), add any tax-exempt interest income, and then add in 50% of your Social Security benefits.

If you are retired, you likely will have little to no earned income, unless you are working part-time. Your adjusted gross income will be any interest income, capital gains (or losses), retirement account distributions, pensions, etc. This is important to note because not all retirement account distributions are treated the same! Additionally, capital gains can be offset by capital losses. So even though your cash flow might exceed these numbers significantly, you still might be able to reduce or even eliminate how much tax you pay on your Social Security Income.

Client A has the following cash flows:

The combined income in this scenario is $80,000.

Half of Social Security ($20,000) + $50,000 IRA distribution + $10,000 municipal bond income = $80k.

Notice how the municipal bond income is added back into the calculation! Many clients try to reduce taxes on their bond interest payments by investing in municipal bonds. However, it’s important to note how this interest income might impact other areas of tax planning.

In this scenario, 85% of their Social Security benefit will be taxable.

The first $32,000 of income doesn’t trigger any Social Security taxes.

The next $12,000 will include 50% ($6,000)

And finally, the amount over $44,000 ($36,000) includes 85% (85% * $36,000 = $30,600).

$6,000 + $30,600 = $36,600

If you divide $36,600 by the $40,000 Social Security benefit, it gives you 91.5%. However, a maximum of up to 85% of the Social Security benefit is taxable, so in this case, they are capped at 85% and $34,000 will be their “taxable Social Security” amount.

Client B has the following cash flows:

Client B’s provisional income is only $24,000!

Half of Social Security ($20k) + $0 retirement account distributions + $4,000 interest income = $24,000

As you can see, the Social Security benefits are identical to client A. However, the $50,000 retirement account distribution is from a Roth account, and in this case, it was a tax-free distribution. And finally, the interest income was way down because the client elected to reduce their bond allocations in their taxable account and instead owned them inside of their IRAs (which is not taxable).

So despite having essentially identical cash flows, Client B enjoys 100% of their Social Security check being tax-free! In other words, they have reduced their taxable income by $34,000 compared to client A!

A huge challenge arises for clients who are under the max 85% threshold. Each dollar that is added to their retirement income will increase how much Social Security is taxed! If someone is in the 50% range and they take an additional $1,000 from a Traditional IRA, they will technically increase their adjusted gross income by $1,500! $1,000 for the IRA distribution and $500 for taxable Social Security income!

So while you shouldn’t let the tail wag the dog, you should absolutely begin mapping out how you can make your retirement income plan as tax efficient as possible! Here are a few ways to reduce your “combined income” and thus reduce your taxes on Social Security payments.

Simply put, a Roth conversion allows you to “convert” all or a portion of your traditional IRA/401k/403b to a Roth account. Of course, you will have to pay taxes on the amount converted, but all of the growth and earnings can now be tax-free!

This is perhaps one of the most impactful strategies you can incorporate! However, you must start this strategy at the right time! If you are still employed and perhaps at the peak of your earnings, you may not benefit from Roth conversions…yet. However, if you recently retired and have yet to begin the Required Minimum Distributions (RMDs), you might find it to be a valuable strategy if you execute it properly.

One of our most recent podcast episodes is about this topic; you can listen to it here.

The RMD trap is simply the tax trap that most people with Traditional IRAs or 401ks run into. In the early years of retirement, your RMD starts out quite low because it’s based on your life expectancy according to the IRS. However, each year the amount you are required to withdraw increases. By the time you are in your 80s and even 90s, the amount you are taking out could exceed what you need for cash flows! But despite needing it for income or not, you have to withdraw it to avoid the dreaded penalties, and this could push you into higher tax brackets later in retirement. And of course, this could also increase the taxation of your Social Security check!

Roth conversions help with this, but it could also help to try to even out the distributions! Instead of just waiting for the RMDs to balloon, perhaps you devise a better withdrawal strategy to target a certain tax bracket threshold throughout your retirement.

You may have heard of the term “Asset Allocation,” which involves careful selection of asset classes that align with a portfolio’s objectives. In essence, what % of stocks, bonds, real estate, and cash does the portfolio hold? Asset Location involves selecting which accounts will own those asset classes in order to maximize tax efficiency and time horizon.

When we looked at the Social Security examples earlier, you probably noticed Client B had less taxable interest income. This is because they elected to reduce the amount of fixed income in their “taxable” account, and moved those assets into their IRAs.

Alternatively, you might have a longer time horizon with some of your accounts, like a Roth IRA. Given Roth’s tax-free nature and the NO RMDs, this account is a great “long-term” bucket for retirement income planning. As a result, you might elect to have this account ultra-aggressive and not worry much about capital gains exposure, etc.

You should take advantage of the tax characteristics of different “buckets” for retirement income planning. Not all of your investment accounts should look identical in that sense.

Perhaps one of the most UNDERRATED strategies is tax loss harvesting. Oftentimes when the market is down, people bury their heads in the sand hoping that things will improve one day. And this is certainly better than selling out and moving to cash! However, there is one step many people miss: realizing losses when the markets are down. These losses can then be used to offset capital gains, and even reduce your ordinary income!

I oftentimes hear pushback that people don’t want to offload investments at a loss because they were trained to “buy low and sell high.” This is a great point, but with tax loss harvesting, after the loss is realized, you then turn around and replace the investment you sold with something similar, but not “substantially identical.” That way, you avoid the Wash-Sale rule so you can recognize the tax loss, but you stay invested by reallocating funds into the market.

Episode 19 of The Planning for Retirement Podcast is all about this topic and you can listen to it here!

Okay, so you missed the boat on Roth conversions, and you are already taking RMDs from your accounts. Qualified Charitable Distributions, or QCDs, allow for up to $100,000/year to be donated to charity (qualified 501c3) without recognizing any taxable income to the owner! Of course, the charity also receives the donation tax-free, so it’s a win-win! I oftentimes hear of clients donating to charity, but they are itemizing their deductions. Almost 90% of taxpayers are itemizing because of the Tax Cuts and Jobs Act of 2017. QCDs can be utilized regardless if you are taking the standard deduction or not! And the most powerful aspect of the QCD is that it will reduce your RMD dollar for dollar up to $100k.

Let’s say your RMD for 2023 is $50k. You typically donate $10k/year to your church but you write a check or donate cash. At the end of most tax years, you end up taking the standard deduction anyways, so donating to charity doesn’t hurt or help you.

Now that you’ve learned what a QCD is, you go to the custodian of your IRA and tell them you want to set up a QCD for your church. You fill out a QCD form, and $10k will come out of your IRA directly to your Church (or whatever charities you donate to). Now, your RMD is only $40k for 2023 instead of $50k! In essence, it’s better than a tax deduction because it was never recognized as income in the first place!

Two important footnotes are the QCD has to come from an IRA and the owner must be at least 70.5 years old! It cannot come out of a 401k or any other qualified plan!

We wrote an entire article on QCDs (and DAFs) that you can read here.

Retirement Planning is so much more than simply what is your investment asset allocation. Each account you own has different tax characteristics, and the movement of money within or between those accounts also has tax consequences. Instead of winging it, you could save tens or even hundreds of thousands of dollars in taxes in retirement if you are proactive. However, the tax code is constantly changing! In fact, the Tax Cuts and Jobs Act of 2017 is expiring after 2025, so unless something changes, tax rates are going up for most taxpayers. Additionally, the markets are beginning to recover, so strategies like tax loss harvesting or Roth conversions become less impactful. But, there is still plenty of time and opportunity!

Thanks for reading and I hope you learned something valuable. Make sure to SUBSCRIBE to our newsletter to receive updates on me personally, professionally, and of course, content to help you achieve financial independence! CLICK on the “keep me up to speed” button below.

-Kevin

Sometimes “hanging tight” isn’t the best solution during times of volatility. We’ve had two bear markets since the Great Recession of 2008. COVID-19 was the first, and the inflation that ensued thereafter in 2021-2022 led to the second. Tax Loss Harvesting involves selling investments when they are down in value (in a taxable account) to create a realized loss for tax purposes. You can then use these losses in current or future years (retirement) to reduce taxes!

These opportunities don’t come every year, so it’s important to take advantage while you (still) can!

I hope you enjoy this episode!

Roth conversions are definitely gaining lots of popularity, especially with the Tax Cuts and Jobs Act of 2017 expiring in 2026. Because of this, I have noticed consumers believe they should automatically start converting their IRAs and 401ks to Roth accounts!

First and foremost, you have to run the numbers. For every scenario that is a “home run” like the one I’ll discuss today, there is a scenario where it does not make sense. Or, perhaps the time isn’t right (yet).

Make sure to check out this latest episode to hear the first of our three-part series from our recent educational workshop, “How to Reduce Taxes in Retirement.”

Enjoy!

Despite two major US banks failing, coupled with central banks’ attempt to fight persistent inflation, the US and International markets experienced some positive momentum!

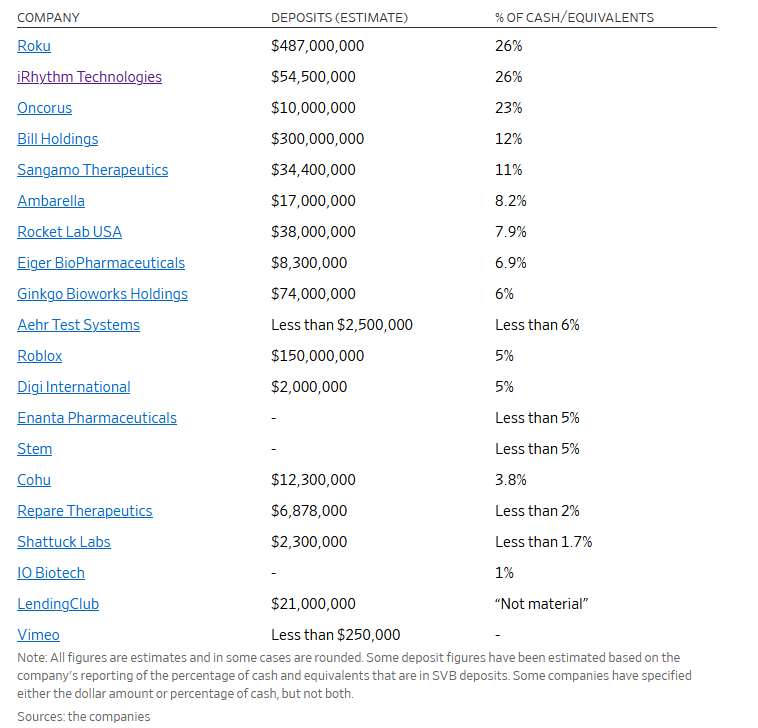

One of our recent articles was about the collapse of Silicon Valley Bank (SVB), the 2nd largest US bank failure in history. This sent a ripple effect into the banking system, particularly a flight of deposits from smaller regional banks to big banks.

JP Morgan posted a 52% jump in its first-quarter profits.

Wells Fargo topped analysts’ projections by 10 cents a share in Q1.

Citigroup also beat analysts’ estimates on revenue.

In short, customers were worried that their bank might also fail following SVB and Signature’s collapse. As I discussed in our previous post, which you can read here, SVB and Signature were heavily concentrated on client bases that had unique challenges in this economy (tech industry and crypto).

However, bank capitalization looks very healthy and has been on the uptrend since 2008 following the Global Financial Crisis. This is one positive impact of tighter regulation on big banks following The Great Recession.

Despite big banks experiencing an inflow of deposits from smaller banks, they are still facing tighter lending standards and rapidly increasing interest rates. They now have to pay us all higher yields in return for their money market or CD accounts. Smaller and more regional banks, however, will face a reduction in deposits AND increased lending standards. Regulators and board members are going to be watching like a hawk to ensure more banks don’t have the same risks that SVB and Signature Banks did.

As banks tighten their lending standards, individuals and businesses are going to struggle to get loans. Individuals who could previously afford that new or used vehicle might not qualify any longer. Or, people shopping for their first home can’t afford the mortgages given the rapid uptick in rates.

Businesses that rely on these smaller and regional banks for loans to keep their lights on or survive this challenging market will find it harder to get capital.

All of these ripple effects will contribute to a slowing economy.

But after all, this was the Fed’s goal ever since they announced their rate hike and quantitative tightening strategy back in 2021. Their main objective was to fight inflation, and they needed to slow the economy in the short run to win the battle in the long run.

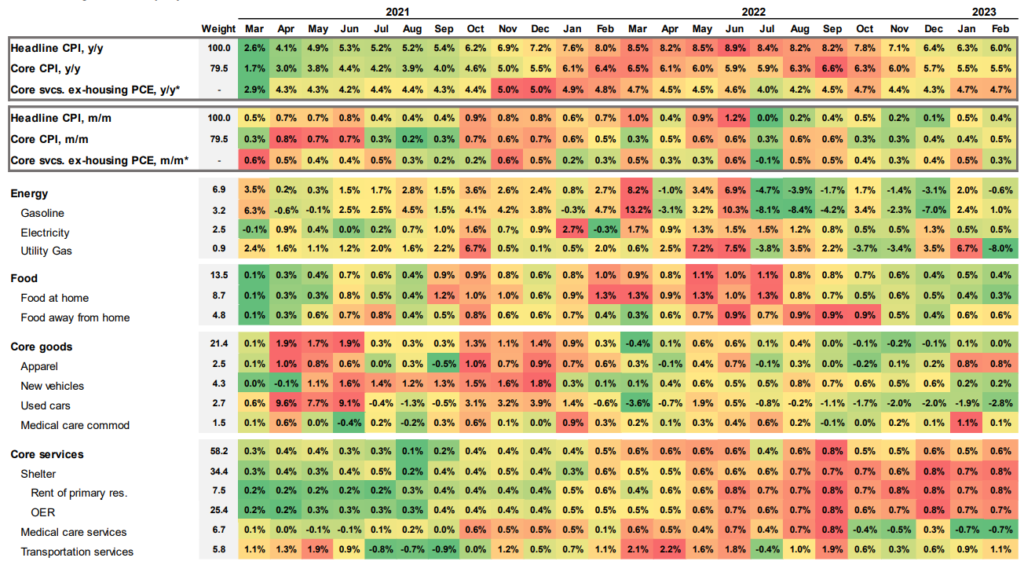

After setting 40-year highs in 2022, inflation is finally cooling a bit. The peak was 8.9% in June, but we’ve seen a gradual decline ever since. The March numbers were just released and showed a 5% year-over-year CPI figure. The Fed’s target overall is 2%, so we are still a ways from that number. Despite the trend going in the “right” direction, I don’t believe the Fed will get all the way to their 2% goal unless unemployment falls exponentially over the coming months. The cooling inflation story is the primary reason the market has rallied since the start of 2023. Inflation under check means the Feds might actually STOP raising interest rates very soon. The market is pricing in one more 0.25% rate hike and then the expectation is rates will level off and eventually fall in 2024.

The real question is, has the Fed done so much damage with its policy that they send the economy into a recession? If this happens, they could even pivot to rate cuts as early as the end of 2023 or the beginning of 2024. My hope is that they take a pause and let the economy settle itself out.

The unemployment story has been a big part of why inflation has been so sticky.

We entered 2020 with a 3.5% unemployment rate, which was a 50-year low. After topping over 10% unemployment (briefly) in 2020, the US now has a 3.6% rate. Additionally, wage growth is at 5.3%, which is above the historical average of 4%. So, if people are “working” and wages are still growing, it’s no wonder inflation has been so tough to fight. People did not stop spending money in 2022 because of prices going up. Sure, consumer discretionary categories took a hit, but the core goods and services were still being purchased at elevated prices. This is a big reason I don’t believe prices are going to come down as much as the Feds want them to. Why would corporations cut prices when their consumers have the wages to buy them?

One of the chips likely to fall is the unemployment story in big tech firms. Since 2018, Amazon and Meta (Facebook’s parent) have almost doubled their workforce. During that same period, Microsoft increased its workforce by 53%, and Alphabet by 60%! Meanwhile, Apple only grew its workforce at a moderate 20% rate.

Remember the Paycheck Protection Program in 2020? This was a federal loan to corporations to keep their employees on payroll during COVID. All they had to do was use at least 60% of those loans to cover payroll and the “loan” was forgiven. The word on the street is that big tech used their loans to go on massive hiring sprees. Not because they NEEDED that many more workers, but to reduce the talent pool for their competitors and have their PPP loans forgiven! Now that the economy is slowing, we’re seeing big tech begin layoffs. Coincidently, Apple hasn’t laid anyone off just yet.

Look at this headline from a Fortune article:

Some of the highest unemployment numbers by industry are:

Meanwhile, big tech unemployment is only at 2.6%, up from 1.5% to start the year. All of the remote workers that migrated out of the big cities during the pandemic are now experiencing some layoff concerns, and it will be very interesting to follow that narrative as big tech continues to cut their unnecessarily large workforces.

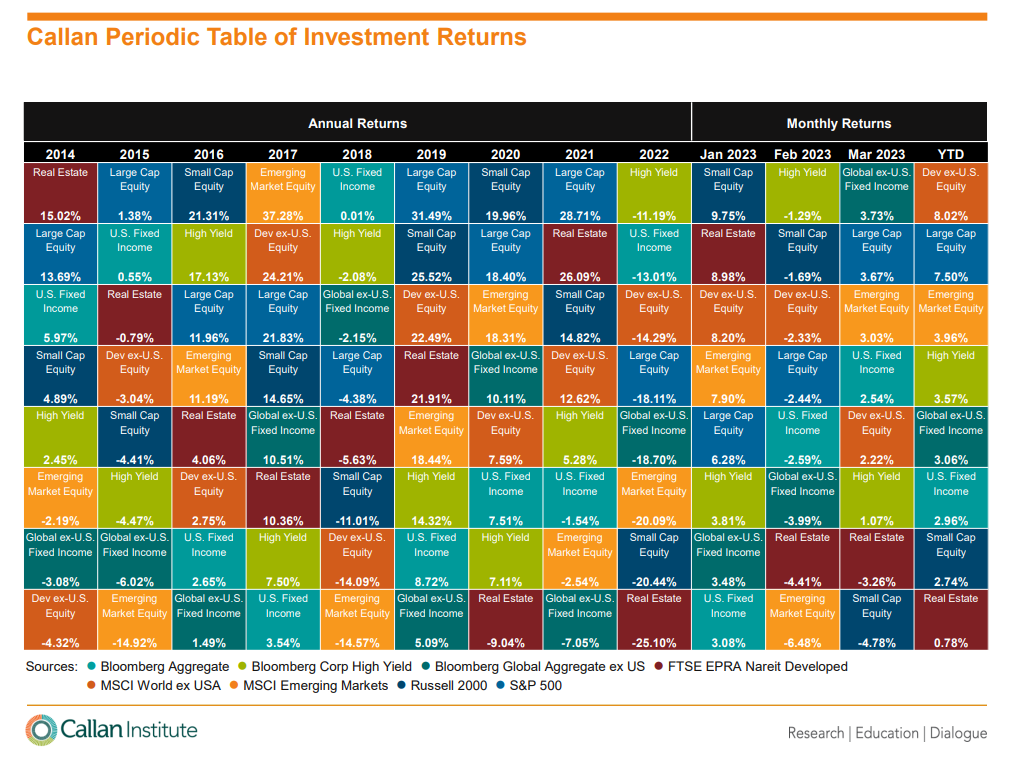

As you can see year to date, all of the major asset classes are positive. International, developed economies are in the top spot, with US Large Cap a close second. What’s very encouraging is that the fixed-income markets are now showing positive returns after a rough 2022.

During the re-balancing process for our clients at the beginning of 2023, the only asset classes we added exposure to were Large Cap Growth companies (big tech) and international equities. This isn’t to pump our chest to say “I told you so.” However, part of our process is to sell the winners and buy the losers. Big tech was the worst-performing asset class in 2022, and stock performance is a leading indicator. What I mean is, the layoffs and bad news for big tech this year were already priced into the market in 2022 (at least we hope so). We talked a lot about interest rate increases during 2021 and 2022 and how it would impact tech companies. After the brutal selloff in 2022, valuations looked much more attractive going into 2023…hence, buying the loser. So far year to date it’s paid off well, but that’s not to say there isn’t more volatility ahead for big tech with the challenging interest rate environment they face.

The same can be said about international equities as they had a rough go in 2022 but are very well positioned from a valuation perspective for the decade ahead. International stocks tend to do well during periods of high inflation, like in the 70s and 80s. However, geopolitical concerns with Russia/Ukraine and China still make international stocks much more volatile.

Attempting to time the market is very dangerous. If you look back at the past year, consumer sentiment has been at record lows. People have not been feeling good about the economy. This feeling oftentimes leads to investors flighting to safety. How many articles have you seen about I-Bonds or CD Rates over the last 12-18 months? Well, stock market returns typically accelerate very quickly after a recovery. In fact, more than 50% of the best daily S&P 500 returns occur during a bear market. So if you bailed out during 2022, you did not get the benefit of a strong Q1 in 2023!

While we are going to be experiencing a tighter economy for the foreseeable future with higher rates, there is now hope with the inflation story beginning to unfold. Let’s hope the market is correct in that the Fed will only increase rates one last time at 0.25% and be finished. The unemployment and wage growth figures will be key to watch over the coming months as that will dictate how quickly inflation comes down in late 2023.

If you are curious about how the market has impacted your financial goals, we’d love to hear from you! You can either send me an email at [email protected] or book a Zoom call with us.

Until next time, thanks for reading!

Thinking about your financial future can be mind-numbing, let alone searching for a financial advisor who can help you. Why are there so many different titles? Do they all do the same thing? Is a financial advisor a fiduciary? Are they ALWAYS a fiduciary? Finally, what differentiates advisors who work for large companies vs independent firms? In this blog post, we will unpack and answer those questions for you, and help you understand the benefits of working with an independent financial advisor.

I spent the first 12 years of my career as a financial advisor for a large broker-dealer and a large bank. In 2020, I made the decision to go independent for all of the reasons I will talk about below and I haven’t looked back. So YES, I am extremely biased in my belief that the independent financial advisor avenue is where clients are provided the best service!

Let’s start with a general lay of the land.

The Wall Street Crash in the autumn of 1929 led to an increase in regulation of the financial industry. As a result, Theodore Roosevelt officially signed the The Glass-Steagall Act of 1933, creating a clear division between different types of financial services companies. Simply put, insurance companies were then designed to sell insurance and banks were either investment banks or commercial banks. Wall Street Firms/Broker-Dealers sold securities.

Decades later, The Financial Services Modernization Act of 1999 was passed, and this law deregulated the financial services industry and essentially allowed everyone to play in each other’s sandbox. Insurance companies could now sell securities, banks could sell both insurance and investments, and brokers could now sell insurance products and act as a bank.

This led to a drastic shift in the financial advisor’s role. In the 1980’s, an insurance agent would just sell insurance. Over time the role of an insurance agent evolved, and now new hires at insurance companies are being licensed not just to sell insurance, but to sell variable products like annuities and mutual funds and even manage client assets as an investment advisor.

In the banking world, you have representatives who help customers with deposits, but they also have licensed insurance agents and investment advisors on staff. Have you ever gotten a call from your existing bank about a “wealth management” offering? If you keep a meaningful amount of cash in the bank, the goal for the wealth management team is to convince those banking clients to also purchase both insurance and investment products.

And finally, the wall street folks. These large brokers and investment banks can now sell annuities, life insurance, long-term care insurance etc.

I’m very keen on the idea of looking at everyone’s situation comprehensively. As a Certified Financial Planner, I believe we need to ensure all assets on the balance sheet are coordinated and risk is managed properly.

The biggest challenge I see, however, is that the big firms aren’t truly looking at it that way. Their main goal is to increase and diversify revenue for their stakeholders. I’ll say it again, their main goal is to increase and diversify revenue for their stakeholders. Not for you. Not for your family. But for THEIR balance sheets.

When it comes down to working with a financial advisor, there are some phenomenal advisors that work for large firms. The challenge is they all have their own metrics and minimums they must achieve in order to be successful and reap the rewards. So whether consciously or subconsciously, the consumer is always left thinking, “Is this recommendation 100% in my best interest?”

This is at the core of WHY I decided to leave a big firm and launch an independent firm. Rather than having people wonder if the recommendations are aligned with their best interests, why not simply cut out the conflicts of interest???

Let’s get into some of the reasons why working with an independent financial advisor could benefit you.

It is much more difficult to abide by a true fiduciary standard when you are acting as a fiduciary some of the time. Oftentimes advisors who are working for insurance companies or big banks might have incentives to recommend certain products. These products often follow the less arduous standard of “suitability,” and not a fiduciary standard. This means the product just has to be suitable at the time the recommendation is made. This can often lead to conflicts of interest in working with clients.

Kyle Newell, Owner and Financial Planner of Newell Wealth Management based in Orlando, Florida said this reason was a big motivator to go independent.

“My main driver in going completely independent, is the freedom to make decisions solely for the benefit of my client. No production/sales goals to hit, no shareholders to make happy, or managers to make look good to the higher-ups,” said Kyle.

When you hire an independent financial advisor, they are working for YOU, not their employer! Isn’t it nice to be sitting at the SAME side of the table as your advisor when discussing your financial future?

At most big firms, the investment models are pre-packaged for clients. The advisor might do some sort of risk questionnaire, and anyone who has the same risk score will have identical portfolios.

But what about personalization? What about taxes? What about the time horizon of different accounts? What about different financial objectives?

As an independent firm, we utilize cutting-edge research and analysis but we’re able to implement it in a way that is customized to each individual family.

I’ll give you an example.

By late 2021, we knew interest rates were going to begin to spike in 2022 (because the Fed told us so). We had used primarily bond mutual funds and ETFs up to that point as interest rates were historically low over a decade.

At the beginning of 2022, we began to transition out of the traditional mutual funds and ETFs for some of our clients and implement their own customized individual bond portfolios. Additionally, we used hedging strategies within the fixed-income space to protect against the rise of rate hikes. This helped save tens and even hundreds of thousands of dollars for clients over the past year.

This would have been virtually impossible working at a big, institutionalized firm.

The ability to be nimble and pivot during uncertain times is invaluable over the life of a client relationship.

Have you heard of the financial advisor who babysits client assets for a management fee and does NO financial planning? (I’VE HEARD A FEW STORIES!)

Consumers are getting smart and are tired of overpaying for financial advice that doesn’t deliver. Many people are learning about different models like “advice only,” “flat fee financial advisor,” or “one-time engagements.” Most of the big firms charge the traditional methods of either commission-based compensation or a percentage of assets under management. But more importantly, they don’t require any financial planning for that fee!

Jeff McDermott is the owner of Create Wealth Financial Planning, an independent firm based in St Johns, FL serving young families and professionals. He had this to say about the fee models of independent advisors;

“A client who doesn’t fit the traditional advisor mold because they don’t yet have substantial investment assets, are looking for planning to address specific needs, or possibly hourly or one-time project planning might be more likely to find a good fit in the independent financial advisor world.”

My firm, Imagine Financial Security, serves retirees and pre-retirees for a flat fee. Our firm also provides one-time financial plans to ensure clients are on track.

It’s fun to be able to serve people in different ways that are innovative and ultimately better for the client.

One of the biggest challenges as an advisor working for a large firm is adopting and adapting to new technology. Oftentimes these big enterprises have technology embedded in their systems that are years or even decades old. If they had to change their technology, it could take years to integrate properly. Imagine the impact of making a change that affects one million or two million customers!

Many independent firms serve fewer than 250 households making new integrations much more palatable.

“The independent advisor space has advanced significantly in technology and breadth of services available,” says Newell.

Our firm utilizes two financial planning tools to help address the needs of our pre-retirees and retirees. RightCapital allows us to model cash flows and changes in a retirement scenario using Monte Carlo analysis.

We also use Income Lab to help manage withdrawal rates for clients throughout retirement. Additionally, if there is a need to make an adjustment, Income Lab is there to ensure those are made in a timely fashion.

Furthermore, these tools allow us to model Roth conversions to identify tax planning opportunities.

This has been a game changer to add further value to the families we serve.

Speaking of Roth conversions, now we are getting to the heart of retirement planning challenges…TAX PLANNING! Once you crossover a certain asset threshold, let’s say $1mm of investment assets, taxes in retirement become a big deal. Social Security taxes, Medicare surcharges, tax bracket management, Required Minimum Distributions, and finally, death taxes. The value of maneuvering through all of these hurdles successfully in retirement is worth far more than how the investments are performing relative to their benchmarks.

Every movement of money has a tax consequence. So, wouldn’t it be nice to know what those tax consequences are before the money is moved???

Does your advisor have a copy of your most recently filed tax return? If the answer is “no,” then how in the world are they able to know what the impact of money movement is on your tax situation?

The more money you can save on taxes in retirement, the more you will have to travel or gift to your grandkids! Win-win!

If you look at the client roster of a traditional financial advisor working at a bank or broker, you will find the demographics vary widely. There might be a 25-year-old just getting started with their investing career all the way to a 65-year-old preparing to retire. This might seem great on the surface as that advisor can serve multiple demographics. However, how specialized is that advisor in working with people just like YOU? Many independent firms specialize in working with a specific age demographic, occupation, or even serving those with certain political beliefs! This specialized expertise allows for a deeper understanding of the client’s needs and ultimately adds more value to the relationship.

Think of a general practitioner vs. a specialist. If you need heart surgery, you’re probably not going to see your family doctor.

I know we’ve talked about some of the value adds and financial benefits of hiring an independent financial advisor. But at the end of the day, the relationships and families we serve are at the forefront of why we do what we do.

I was talking to a friend who works at a larger firm and he complains annually about how much his annual goal has increased.

And don’t get me wrong, I have business and personal goals myself. Any motivated individual has goals. However, when the goals get in the way of serving your clients, that’s a problem. And that is at the core of why independence is so important to me and many others who continue to break away from big firms.

When I review the list of families I serve, I get excited. Helping people plan for retirement is extremely rewarding. But furthermore, I love to help people reduce fear and start living their BEST years with the gift of time! Who wants to sit around and play with their investment portfolio (and likely screw it up), or try to find tax planning opportunities rather than pursue their passions!? Or spend more time with their families? Retirement is not the end, it’s the beginning of financial freedom! So enjoy it!

Simply put, the independent advisor movement is growing in popularity. According to Fidelity’s 2020 Advisor Movement Study, 2/3 of all advisors who left employee financial advisor arrangements in the last 5 years left for independence. And the trend is only accelerating.

Third-party organizations like XY Planning Network, NAPFA, Fee-Only Network, and Wealthtender all offer “find an advisor” search tools to help you narrow down what you’re looking for.

Our firm focuses on working with individuals and couples who are over 55 and have accumulated at least $1mm for retirement (or will have accumulated at least $1mm when they do retire). If you are curious about how we can help you, feel free to book an initial 30-minute “Mutual Fit” meeting so we can get to know one another. Also, make sure to subscribe to our blog so you never miss out on our latest posts!

Until next time.

Nobody wants to think of themselves as getting old or frail. In fact, many retirees in their 60s, 70s, and even 80s are still traveling the world. The risk of extended care will never impact them. But if you need extended care, what are the consequences to your loved ones? They are not just financial but physical and emotional.

We are honored to have Harley Gordon join us on this episode, “The Consequences of Extended Care in Retirement.”

Harley is a founding member of the National Academy of Elder Law Attorneys (NAELA), and the founding principal of the CLTC, or Certification in Long-Term Care designation. He’s recognized as one of the top 10 most influential people in the Long-term Care Industry.

We hope you enjoy this episode and hope you learn something that makes an impact.

Easy money policy beginning in 2009 led to a historical run in tech companies. Companies that rely on leverage to aggressively grow were borrowing money for next to nothing! Investors weren’t even concerned with cash flows, or healthy balance sheets. If the idea seemed like it could stick, they would take their bets. Some paid off, and some flopped. But the overall sentiment was “risk-on.”

These policies led to the success of Silicon Valley Bank, or SVB. Out of all of the start-ups in the US, SVB provides banking services to nearly half of them. Whether it was providing them loans or deposits, they were the go-to Bank for start-ups.

Instead of borrowing “free money,” they begin to use their own cash (really their investor’s cash) for operations. Why would they borrow for 8% or 9% when their cash is only earning 1% or 2%? At some point, the interest on debt isn’t sustainable.

So, they go to their bank and pull funds for their operations. After all, they still have payroll and other overhead to keep the business going.

Remember the run-on banks in “It’s a Wonderful Life?” No, they don’t keep your money in the bank! It’s invested somewhere!

In SVB’s case, over half of their assets were invested in bonds! What’s more is that the majority of these bonds had long-term maturities, over 10 years, instead of shorter-term maturities.

We talked about interest rate risk in several of our market commentaries over the last couple of years, and SVB completely missed the mark on hedging interest rate risk. Maybe they should’ve been reading our blog!

So how did they raise cash to give to their depositors?

They had to sell their bonds…

They go down, simple as that. Think about it. If you bought a 10-year treasury 3 years ago, it was yielding less than 1%. Today, new issues of 10-year Treasuries are yielding 3.7%! So, for anybody to want to buy your bond, you would need to discount it significantly. Otherwise, they will just buy a new issue for almost 4x the interest!

So, instead of SVB holding their bonds to maturity, as they intended to, they needed to sell (at a significant loss) to meet their obligations. The loss realized was $15b, which was equivalent to nearly all of its tangible capital. This led to their ultimate collapse and is the second-largest bank failure in US history (second to Washington Mutual in 2008).

I’m not putting the blame on one individual, but it’s no coincidence that the CFO of Lehman Brothers (who left Lehman right before their bankruptcy in 08) is now an executive at SVB. Additionally, the Chief Risk Officer of SVB worked for Deutsche Bank during the subprime-mortgage crisis in 2008.

Some banks are more conservative. They lend to small businesses or individuals. SVB, on the other hand, catered to start-ups in Silicon Valley. These tech start-ups have significantly more risk than the bakery shop next door. Additionally, their deposits were padded over the last two years because of the easy money policy over the last decade coupled with record amounts of stimulus.

The bottom line is that SVB got greedy. Instead of looking at the interest rate environment as a risk, they ignored it. They sought higher yields in longer-term bonds without hedging the need for short-term cash flows. They never expected a “run on the bank.”

The Federal Deposit Insurance Commission, or FDIC, officially announced on Friday that SVB was closed. This led to a selloff in stocks and of course, those holding SVB stock will lose their investment.

But what about the deposit holders and borrowers? The FDIC typically protects balances up to $250k per entity/bank. In SVB’s case, most of their customers had significantly more than the FDIC limit. After all, these are big wigs out in Silicon Valley. Not surprisingly, here comes the Government to “bail them out.” But they aren’t calling it a bailout, as we saw in 2008/2009, because they say that stock and bondholders in SVB are not protected. However, they are using “emergency-lending authorities” to make funds available to meet bank withdrawals, even those that exceed FDIC limits! In fact, 85% of the bank’s deposits were uninsured! And you can’t argue their customers don’t understand FDIC. These are some of the supposed best and brightest innovators in our country. This is absolutely a bailout; they just aren’t calling it one.

After all, SVB is an investor, just like you and me. The principles they failed to adhere to can also lead to an investor running out of money during retirement. The only difference is the Government has no interest in bailing YOU out. So, it’s important to have a plan and process while you are navigating a potential 30+ year retirement!

This is a basic principle of “Investments 101” – Don’t put all of your eggs in one basket! Diversify! In SVB’s case, they put all of their eggs in the tech start-up basket, and they had quite a run-up until 2022.

Coincidently, when I review prospective client portfolios, technology is by far the most concentrated sector. I’m not going to argue the merits of tech companies, but most banks tend to diversify their clientele. This provides less risk of one industry going through hard times.

Oftentimes people bury their heads in the sand in hopes that “things work out.” Well, if you haven’t done anything with your portfolio in a while, there is a good chance you’re overexposed to assets that are overpriced.

SVB chose not to diversify. They decided to stick with their niche, and ultimately the Fed’s aggressive rate hikes put pressure on their customers leading to the run on their bank.

When you are planning for retirement, there are two types of expenses:

For your “Known expenses,” wouldn’t it make sense to match those up with “known cash flows” and not “unknown cash flows”? Well, SVB decided to keep their bond portfolio LONG term. The longer the term of the bond, the more interest rate risk it has. It’s important to not chase rates. Just because a bond is paying a higher coupon, doesn’t mean it aligns with YOUR portfolio goals.

This is why I am a big fan of individual bonds for the “core” bond portfolio. With individual bonds, you can hold them to maturity for the “known expenses.” Sure, there is a time and place for bond mutual funds or bond etfs, but those funds have redemption risk, similar to what SVB experienced. In their minds, they wanted to hold their bonds to maturity to match up with later cash flow needs, but their customers wanted cash now.

With bond funds, what if OTHER investors who own that fund want their cash before you do? Well, these are known as redemptions and ultimately the fund may have to sell at an inopportune time, just like SVB! In essence, you lose one of the most important characteristics of a bond, the maturity date!

So, if you have a bond portfolio and are planning for retirement, you must absolutely match your bond portfolio up with YOUR time horizon and YOUR cash flow needs! This eliminates interest rate risk as much as possible. And for retirees, risk management is the name of the game.

Ok, that’s a great plan for the “known expenses,” but what about the “unknown expenses?” In retirement, things ALWAYS come up. We just don’t know what they will be, and how much they will set us back.

This is why I advocate for an emergency fund OUTSIDE of the retirement portfolio. With high-yield savings accounts offering north of 3% interest, cash can at least earn something while sitting idle. Of course, stick within FDIC limits, but anywhere from 1-2 years worth of FIXED expenses is appropriate for a retiree’s emergency fund. Unlike an investor who is still working and has time to get a new job or allow the portfolio to recover, retirees don’t have those luxuries. Sure, you could beg for your old job back, but that might not be what you WANT to do. Instead, if you have 1-2 years of fixed expenses, this will help preserve your investment portfolio from a larger-than-anticipated withdrawal.

For some, you may not want so much cash sitting around for that “what-if” scenarios, so here are a couple of compliments to a cash reserve fund:

Home Equity Lines of Credit, or HELOCs, are a great way to limit how much you keep in cash. Most people use these for home improvements, but having a HELOC can also help with your emergency fund. Let’s say 1 year of fixed expenses is $100,000. Instead of having $100k-$200k in high-yield savings, you might keep $50,000 in cash, and have a $150k HELOC for the JUST-in-case scenario. That way, your savings account can be your first line of defense. And only if needed, the HELOC can come in as a backup.

Cash Value Life Insurance is probably my favorite emergency fund vehicle in retirement. Unlike term insurance, it can act as a pool of funds available when you really need it.

And unlike a bond which can decline in value based on interest rates, cash values have a minimum guaranteed rate, so the cash can never go down. Think about the power of this tool in the market we are in now where bond prices are down over 15%!

And I’m not talking about Indexed Universal Life policies or Variable Life Policies, I’m talking about a traditional fixed product. If you build up enough cash value over time, you may only need 3-6 months of fixed expenses in cash given the rest of your cash buffer is inside of your life insurance policy. I’m going to write another article on Cash Value Life Insurance later, but it’s a great tool for the right person. But for the wrong person, it’s one of the worst products you can buy!

For what it’s worth, our firm does not sell any insurance products and we have no skin in the game. These products should also be gone over with a fine-tooth comb as they can be extremely complex.

As I began writing this piece, Signature Bank became the next casualty of the run on banks Sunday, March 12th. Their Bank was also focused on a niche, commercial real estate. However, in 2018, they decided to chase the shiny new toy, cryptocurrency, or digital assets. As concerns arose from the failure of FTX as well as SVB, customers started to pull their funds from Signature, leading to what is now the 3rd largest Bank to fail in US History.

I repeat, don’t chase the shiny new toy!

It was interesting because the stock market rallied on Monday after both SVB and Signature closed their operations. WHY??

Well, it seems that investors feel the Fed might slow their rate increases in light of the casualties it caused. Slower rate hikes mean potentially less pressure on profits and ultimately earnings. However, I don’t think we’ve seen the end of this narrative. Starting with FTX’s collapse last fall, and now these two large banks failing, other companies that are overweight in speculative investments will continue to unravel. The magnitude of these rate hikes cannot be overstated and this type of carnage has been what we’ve been concerned about since the beginning of 2022.

The story we are very interested in is the impact on small “moms-and-pops” businesses. After all, many of the customers SVB serves provides service to everyday businesses. Whether it’s payroll, cloud services, or other technology, small businesses across the US rely on tech. And if these tech companies are beginning to falter, what does that do to the economic system as a whole? Also, is this going to lead customers of other regional banks to panic? Will they take their money and put it at a larger bank or under the mattress or in cryptocurrency? This could put significant pressure on banks all over the US, which would have a trickle effect on the economy.

In the end, the Fed may not get the soft landing it wanted, but a recession may not be fully priced into the market at this point.

The one silver lining is that inflation does continue to ease, and that’s good news when it comes to what the Fed does next.

1. Are you overweight in speculative investments?

Tech, consumer discretionary, digital assets, or even speculative real estate. These assets have certainly appreciated significantly over the last decade, but things tend to fall in and out of favor. Therefore, it’s important to review and re-balance your portfolio on an ongoing basis to reduce risk. Even if your portfolio consists of several mutual funds or ETFs, it’s also very possible they are concentrated in certain sectors with higher risk.

2. What does your bond portfolio consist of?

Are the time horizons of your bond portfolio consistent with your personal retirement goals and objectives? If you need help reviewing this, consult a professional (we can help you!).

3. What major unexpected expenses might you run into during retirement?

Sure, we may not have a “run-on-your-retirement” as we had with SVB. However, I can guarantee there will be significant unknown expenses during a multiple-decade retirement. One, in particular, I can think of is the need for long-term care. This is perhaps the largest unknown expense for retirees, and the cost can drain a retirement portfolio much sooner than desired. It’s important to have a contingency plan to protect and preserve the retirement portfolio if the need for care arises.

4. Where do you bank?

The notion of FDIC has come back into play with the collapse of SVB. Are you over the $250k FDIC limit with your bank? While the Fed announced it’s going to make customers of SVB and Signature whole, that may not be the case with smaller regional banks, so it’s important to keep your safe money safe.

5. Don’t be reactive, be proactive.

News like this is never good for the markets. We have been talking about the Fed’s rate hikes for over a year and how certain sectors are going to take a hit. Now, the impact is beginning to rear its ugly head, and we might have a few more quarters of continued bad news. However, you are investing for retirement. Retirement is not just a few quarters, it’s a few decades! As long as your portfolio is aligned with your retirement goals, there is no need to make a knee-jerk reaction to the bad news. After all, if you’ve learned from the lessons SVB’s failure taught us, you can implement a successful retirement plan for “all seasons.”

If you have questions about how these lessons can be implemented into your retirement plan, we would love to meet you and learn more about you.

And finally, make sure to subscribe to our newsletter to stay up to date with all of our latest retirement planning content.

Until next time, thanks for reading.

It’s natural for us to think about how to GET to retirement, but not about how retirement will actually work.

The same is true for saving into a 401k or 403b plan. Most think about how to invest their 401k and maximize growth. However, what about the distribution process? And more importantly, what is the tax impact of those distributions?

Taxes are our clients’ #1 expense during retirement, and RMDs play a big part in tax planning. Naturally, I am a big advocate of having an RMD plan.

We will dive into how Required Minimum Distributions (RMDs) work and how to plan for them strategically. Thanks for tuning in!

Congratulations! Lots of blood, sweat, and tears went into a successful career, and you have saved enough to start thinking about when to retire. If you’ve been saving into a 401k, 403b, or another retirement plan through work, you’ve probably heard of Required Minimum Distributions or “RMDs.” You might be wondering;

“What are the rules for required minimum distributions?”

“How do RMDs impact my taxes?

Or, “What can I do now to prepare for RMDs?”

This article is for you! We’ll unpack all of this and provide REAL-LIFE action items to help you plan for RMDs and save in taxes!

Simply put, RMDs are the IRS’s way of saying, “the party is over.” Or in this case, the tax party is over!

When you contributed to your 401k, IRA, or 403b, you likely took advantage of a generous tax deduction up front and have never paid taxes year over year on earnings. Pretty powerful, right?

The IRS has been patiently waiting for you to start withdrawals, and RMDs are their way of starting to collect their tax revenue.

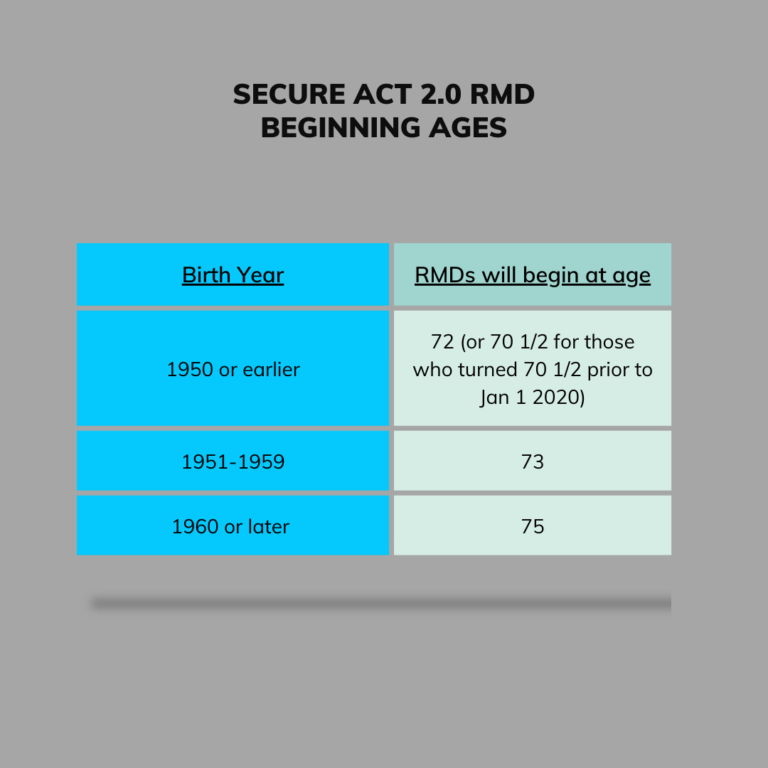

Starting in 2023, the RMD age, or “beginning date,” is the year in which you turn 73 (for individuals born before 1960). For those born in 1960 or later, the beginning date is the year you turn 75.

Just a few short years ago, the beginning date was the year you turned 70 ½. The SECURE Act of 2019 pushed the RMD age back to 72, and the SECURE Act 2.0 (just passed in December 2022) pushed it back even further. With many retirees living well into their 90s, that’s potentially 20+ years of RMDs!

These qualified plans have such powerful tax advantages because the growth year over year is not taxable! This allows for compounding interest to avoid tax drags altogether, which is unique in the investment world. However, there is a reason why our clients’ largest expense during retirement is TAXES! Our job is to minimize taxes, legally, as much as possible. Part of that job is to minimize the tax impact of RMDs in retirement.+

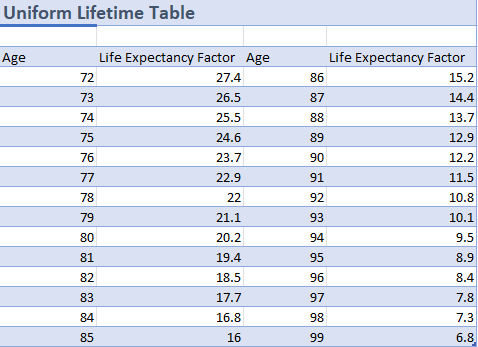

The IRS has life expectancy tables that are updated (not so frequently), and each age has an assigned “life expectancy factor.” Once you reach your beginning date, the account balance at the previous year’s close (December 31st) is divided by the life expectancy factor in the IRS tables.

Example:

You have a $1,000,000 IRA balance as of December 31st of 2022.

Assuming you turn 75 in 2023 and you use the Uniform Lifetime Table (more on this in a moment), your life expectancy factor would be 24.6.

To calculate the RMD for 2023, you would divide $1,000,000 by 24.6, which would equate to $40,650.40.

There are three types of life expectancy tables. The Uniform Life Expectancy table (used above) is for single or married account owners. However, if you are married, your spouse is the sole beneficiary of your account, AND is more than 10 years younger than you, you can use the Joint Life and Last Survivor Life Expectancy Table.

The “Single Life” expectancy is for beneficiaries of IRAs that were not the spouse and inherited the account before January 1st of 2020. For account owners who have inherited IRAs or other retirement accounts beginning in 2020, the new 10-year rule applies, which we will discuss shortly.

The older you get the higher the rate of withdrawal gets. By the time you reach 80, the distribution percentage is close to 5%/year! At 85, it’s 6.25%!

An RMD for a $1,000,000 IRA at age 85 is $62,500!

If you add in Social Security income, perhaps a pension, and other investment income, you can see how this could create a tax burden during the RMD phase. The IRS does not care if you need the income, they just want their tax revenue. And not only will your taxable income in retirement go up, but could impact how much Social Security is taxed and how much you are paying for Medicare premiums!

If you miss an RMD, there are penalties. The SECURE Act 2.0 changed the penalty to 25% from 50%, and that applies to the amount you failed to withdraw. Using our example above with a $40,650.40 RMD, a 25% penalty would equate to $10,162.60 assuming you withdrew nothing!

Needless to say, make sure you satisfy this important rule for required minimum distributions or pay the price.

RMDs need to be satisfied by December 31st each year. Some of our clients elect to take the RMD monthly in 12 equal payments; others elect quarterly. And some take it as a lump sum. The decision is cash flow driven and how much you need the RMD for income (or not). There is one exception that applies to your FIRST RMD. The first required minimum distribution can be delayed until April 1st of the following year.

Let’s say you turn 73 in the year 2024, which would make 2024 your beginning date. However, you also plan to retire in 2024 and might still have high wages to report for that tax year. In 2025, you will be fully retired and will have ZERO wages, so you decide you want to take advantage of delaying the first RMD until 2025. In this scenario, you would take the 2024 distribution by April 1st (of 2025) and of course the 2025 distribution by December 31st! In this scenario, you have two RMDs on your 2025 tax return, but your overall income perhaps is still lower because of no W2!

If you are still actively employed and have a qualified plan you are participating in, you can avoid RMDs from those plans only. Let’s say you plan to work until 75, and you have a large 401k with your current employer and an IRA from previous retirement plans. You will still be required to make an RMD from your IRA, but you can avoid the RMD on your 401k altogether. Once you are officially separated from service, that will trigger the “beginning date” for that 401k plan.

It’s also important to note that separation from service triggers the “beginning date” for that 401k. So, assuming you deferred RMDs in your current 401k plan, and retire at 75, you can still take advantage of deferring the first RMD until April 1st following the year you separated from service.

Finally, this rule does NOT apply to Solo 401ks or SEP IRAs. These plans are for self-employed individuals, and RMDs can’t be delayed simply because they are still working.

You might be wondering if you have multiple retirement plans, can you just pull the RMDs from one account?

My favorite answer is, “it depends.”

If the multiple retirement plans have identical plan types (perhaps they are all 401ks or all 403bs), then “yes, you can aggregate the RMDs.” If there are different plan types, like one IRA and one 401k, those plans each have their own RMD and must be satisfied separately. Let’s look at two examples:

Scenario 1: Joe has two IRAs, each with RMDs:

IRA RMD #1: $10,000

IRA RMD #2: $25,000

Total IRA RMD = $35,000

He can satisfy the entire $35,000 from either or both accounts.

Scenario 2: Joe has one IRA and one 401k each with RMDs:

IRA RMD #1: $10,000

401k RMD #2: $20,000

Each RMD would need to be satisfied separately because they are not identical account types.

In January 2020, the SECURE Act of 2019 went into law. Part of the plan to pay for the bill was to accelerate distributions for beneficiaries of IRAs and 401k plans.

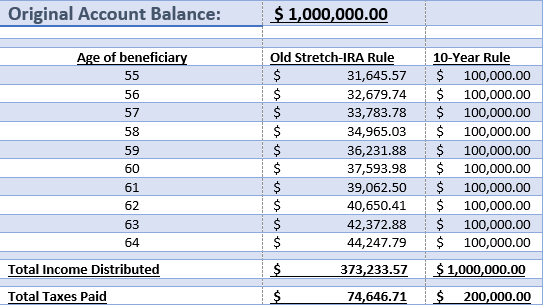

Under the previous law, a beneficiary other than the spouse could “stretch” the IRA based on THEIR life expectancy. Assuming the non-spouse beneficiary was much younger (like an adult child), the RMD would be reduced significantly after the original owner’s death. This is when the Single Life Expectancy table is used, as we alluded to earlier.

Let’s look at an example:

An original account holder has a $1mm IRA and is 80 years old. Their RMD would be $1,000,000 / 20.2 = $44,504.96. Before 2020, if that account owner passed away and their 55-year-old daughter inherited the account, her RMD would be $31,645.57. That’s a reduction of almost $13,000 of taxable income! In essence, it allowed the new owner to “stretch out” the distributions over a much longer period of time and thus preserving the tax-deferred status for longer.

The SECURE Act of 2019 eliminated the stretch IRA for MOST beneficiaries. I wrote about this in a previous post, “The Tax Trap of Traditional 401ks and IRAs,” but most beneficiaries other than the spouse will follow the “10-year rule.”

The 10-year rule states that a retirement account must be fully liquidated by the end of the 10th year following the owner’s death. The exception to the 10-year rule is for those who are “eligible designated beneficiaries.” These individuals are essentially a spouse, a beneficiary who is disabled or chronically ill, or a beneficiary who is fewer than 10 years younger than the IRA owner.

Everyone else will follow the 10-year rule.

If the IRA owner passed away on or after the beginning date, RMDs must continue during years 1-9, and then the full balance must be liquidated in year 10. If the IRA owner passed away before their beginning date, there are no RMDs until year 10, when the account needs to be fully liquidated.

It might be tempting to stretch the 10-year rule until the 10th year, but this would result in significant taxes owed that year. Instead, you might consider taking somewhat equal distributions in years 1-9 and distributing the remaining account balance in year 10 to avoid a huge tax bill.

As you can see by the (overly simplified) chart below, this has significantly increased the size of distributions required after the account owner’s death and ultimately results in higher taxes.

If you are like many of our clients, the bulk of your retirement savings might be in tax-deferred 401ks or IRAs. However, newer plans like Roth IRAs and other Roth retirement plans have NO RMDs! Therefore, one way to minimize the RMD impact is to increase the proportion of Roth accounts on your balance sheet. There are two ways to do this:

Perhaps you believe your tax bracket will go up due to RMDs. Maybe you saved diligently into 401ks and IRAs and your RMD will be high enough to push you into the next tax bracket.

Also, healthcare is a big expense in retirement! Many people don’t realize that your Modified Adjusted Gross Income (“MAGI”) will impact how much you pay in Medicare Part B and D premiums (known as “IRMAA”)! The base premium for Medicare Part B is $164.90, but this can increase as high as $560.50 depending on your MAGI! Multiply this by 2 for Married Couples and we are talking over $12k/year in premiums alone!

Therefore, you might consider taking small bites at the apple now (pay some additional taxes now), so you don’t have a huge tax drag when RMDs kick in.

This is perhaps my favorite tax strategy for retirees. QCDs allow for up to $100,000 to be donated to a qualified charity from your IRA. You have to be at least 70.5 years old, and it has to come from YOUR IRA (not an inherited IRA). This also means you cannot use 401ks or 403bs for QCDs!

While you can start this strategy at 70.5, this has the most impact on those already taking RMDs.

Because of the increase in the standard deduction, the majority of taxpayers are NOT itemizing deductions. If you’re not itemizing deductions, the gift you made to your favorite charity is NOT deductible! Instead of donating cash, a QCD will allow you to use some (or all) of your RMD to contribute to your favorite charity (or charities). The best part; is there is NO impact on itemizing or using the standard deduction! The amount donated via QCD reduces your RMD dollar for dollar (up to $100,000), which is in essence BETTER than a tax deduction! Let’s look at how this works.

Bill’s RMD for 2023 is $50,000.

Bill loves donating to his local animal shelter which is a qualified 501(c)(3). He typically sends a check for $5,000, but he does not have enough deductions to itemize on his tax return. Instead of sending a check, Bill fills out a QCD form with Charles Schwab (where his IRA is) and tells them to send $5k from his IRA directly to the shelter. The QCD is processed, and now Bill’s remaining RMD is only $45,000 for 2023! See, better than a tax deduction!

It’s important to note that the charity has to be a US 501(c)(3) to be eligible for a QCD, and this excludes Donor Advised Funds and certain charities.

RMDs will likely always be a part of our tax code. As you can see, however, the rules are changing frequently! Instead of being reactive, begin planning for how to deal with your RMDs well before you start them!

Here are some action items and questions to consider:

1. Run a projection for what your RMD will be at your beginning date

2. Does your RMD provide a surplus of income? Or, do you need your RMD to maintain your retirement lifestyle?

3. If your RMD provides a surplus of income, consider increasing Roth contributions and reducing Pre-tax contributions. Or, consider converting some of your pre-tax balance to Roth when the timing is right. Typically a great time to look at this is when you retire and have a window of time (let’s say 4-5 years) before starting RMDs!

4. If you are already taking RMDs, determine if QCDs are a viable option for you to consider

5. If leaving a financial legacy is important, consider the tax implications of leaving retirement accounts to the next generation. Are your children in higher tax brackets? If so, you might want to consider the impact the 10-year rule will have on their tax bill.

6. Do you believe your tax rate (or perhaps tax rates in general) will be higher or lower in the future?

It’s important to have a plan and consult with a financial professional who understands taxes in retirement! If you have questions about how to address your RMD strategy, reach out to us and schedule an initial “Zoom” meeting! We would love to get to know you and learn how we can help with your retirement journey.

And as always, make sure to subscribe to our newsletter to stay up to date with all of our latest retirement planning content!

Until next time, thanks for reading!

Copyright © 2020 imagine financial security. All Rights Reserved. Website by Justin Bordeaux