Using the Guardrail Withdrawal Strategy to Increase Retirement Income

What is a safe withdrawal rate for retirement?

There will be ongoing debates on what a safe withdrawal rate is for retirees. It’s the Holy Grail of retirement planning. After all, wouldn’t it be nice to know EXACTLY how much you could withdraw from your portfolio, and most importantly, for how long? Unfortunately, there isn’t a one-size-fits-all solution. The most popular research in this arena is Bill Bengen’s “Determining Withdrawal Rates Using Historical Data,” which coined the “4% Rule.” However, what if you need more than 4%/year to enjoy retirement? Or, what if you want to spend more early in retirement while you still can? Or, perhaps you can make other adjustments over time to improve outcomes. This is where the Guardrail Withdrawal Strategy, or a dynamic spending plan, really helps retirees’ incomes.

In Michael Stein’s book, “The Prosperous Retirement,” he categorizes retirement into the following three phases:

- “Go-go years”

- “Slow-go years”

- “No-go years”

The idea is that spending tends to go up in the first phase of retirement, and then continues to go down as we age. Sure, healthcare costs could go up later in retirement, but not at the same rate that discretionary spending goes down.

Another example where adjustments to spending occur is during a recession or bear market, like in 2020. Spending was down significantly due to global lockdowns, and for retirees, this meant a significant drop in travel expenses.

On the other hand, some years might require higher spending because of unexpected medical expenses or home repairs.

The point is, life isn’t a linear path, so why should your retirement income plan be?

Justin Fitzpatrick, the co-founder of Income Lab, and I talked about retirees’ spending powers in “Episode 14 of The Planning for Retirement Podcast.” Those of us who specialize in retirement income are familiar with the Guardrail Withdrawal Strategy. This involves setting a specified rate of withdrawal but understanding when to pivot during good and bad times.

In this article, we will discuss the background of the 4% rule and its impact on retirement planning. We will also review some of the drawbacks of the 4% rule when implementing it in practice. And finally, we will discuss the Guardrail Withdrawal Strategy, and how it can improve retirement income by simply allowing for fluidity in withdrawals.

Let’s dive in!

The 4% rule

Bill Bengen was a rocket scientist who received his BS from MIT in aeronautics and astronautics. After 17 years of working for his family-owned business, he moved to California and began as a fee-only financial planner. He couldn’t find any meaningful studies to showcase what a safe withdrawal rate in retirement would be. So, he began his own research and discovered the 4% rule, or “SAFEMAX” rule.

He looked at historical rates of return and calculated how long a portfolio would last given a specified withdrawal rate and portfolio asset allocation. In layman’s terms, he figured out how much could reasonably be withdrawn from a portfolio, and for how long. This helped solve the #1 burning question for pre-retirees; “Will I outlive the money? Or, will the money outlive me?”

The Findings

There is a ton of amazing detail in Bill’s research, the most famous being the 4% rule. The main takeaway is if a portfolio withdrawal rate was 4% in the first year and adjusted for inflation each year thereafter, the worst-case scenario was a portfolio that lasted 33 years. This worst-case scenario was a retiree who began withdrawals in the year 1968, right before two recessions and hyperinflation. This confirms that the timing of retirement is important but completely uncontrollable!

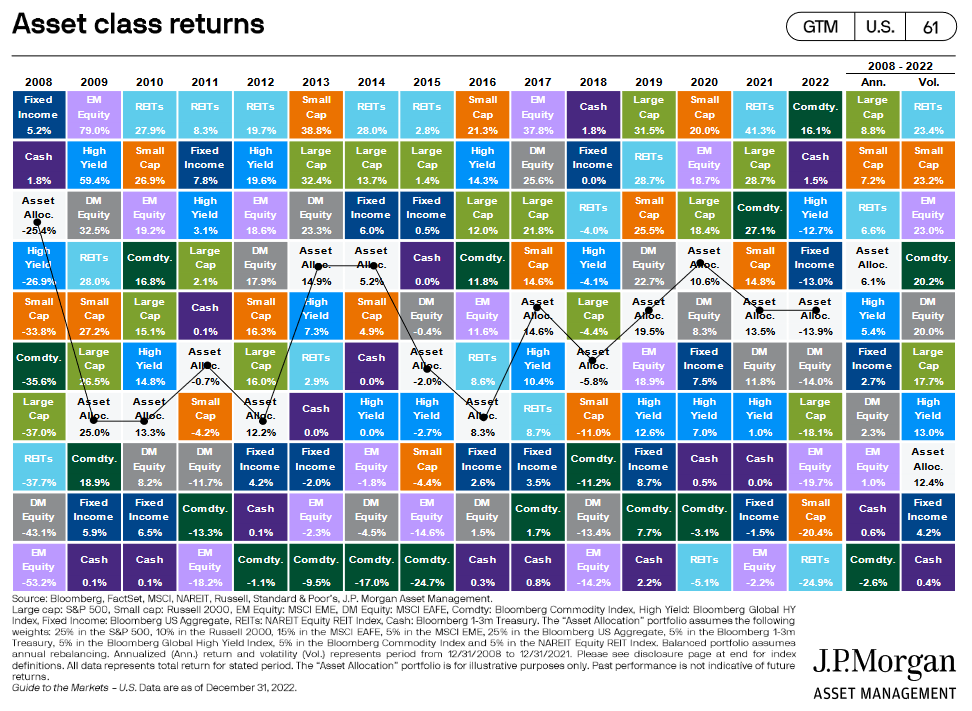

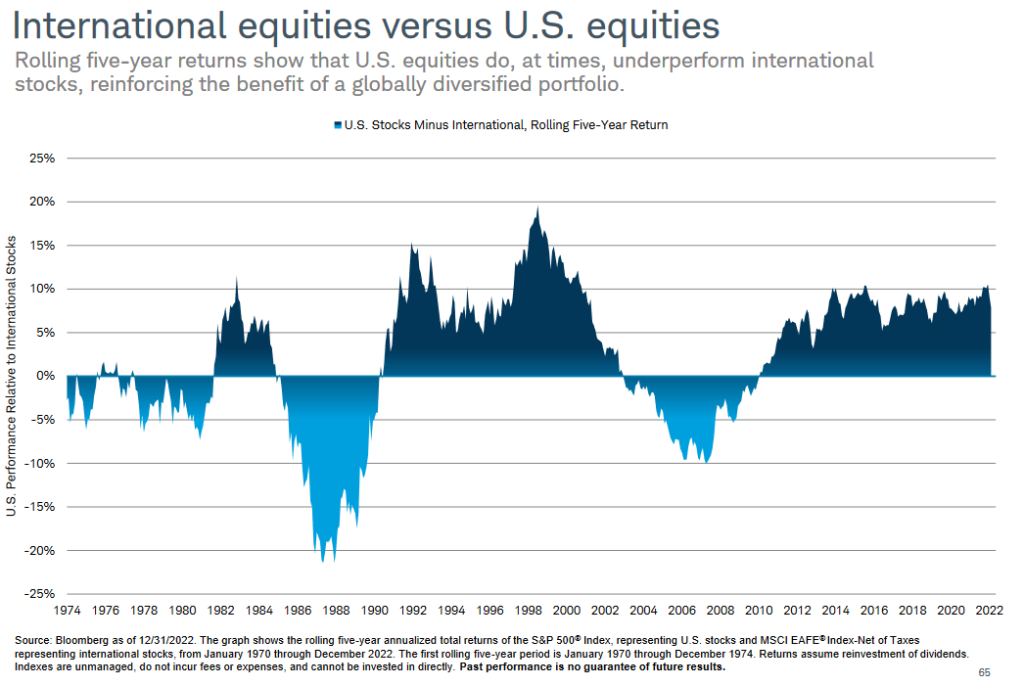

The hypothetical portfolio within the 4% rule consisted of a 50% allocation in US Large Cap Stocks and 50% in US Treasuries.

Bill later acknowledged that adding more asset classes and increasing stock exposure would increase the SAFEMAX rates. For example, adding small-cap and micro-cap stocks increases the SAFEMAX to 4.7%!

The downsides of using the 4% rule in practice

First and foremost, I must first acknowledge that Bill Bengen’s research has made a huge impact on the retirement planning industry, and certainly in my practice personally. Every planner who focuses on retirement knows who Bill Bengen is and knows about the 4% rule.

One common mistake is most people assume the 4% rule means multiplying the portfolio each year by 4%, thus providing the withdrawal rate. Instead, 4% is the FIRST year’s rate of withdrawal. Each subsequent year, the dollars taken out of the portfolio will adjust for that year’s inflation rate. Let’s look at an example.

Let’s say you have $1mm saved. If we used the 4% rule, your first withdrawal would be $40k (4% x $1mm). In year 2, assuming inflation was 3%, the withdrawal would be $41,200 ($40k + 3% or $40k x 1.03). Well, what if year 2 involved a steep drop in your portfolio value? If you retired in 2008, and your portfolio dropped by 35%, the rate of withdrawal in year 2 would equal 6.33% ($41,200/$650k).

What about the mix of stocks and bonds?

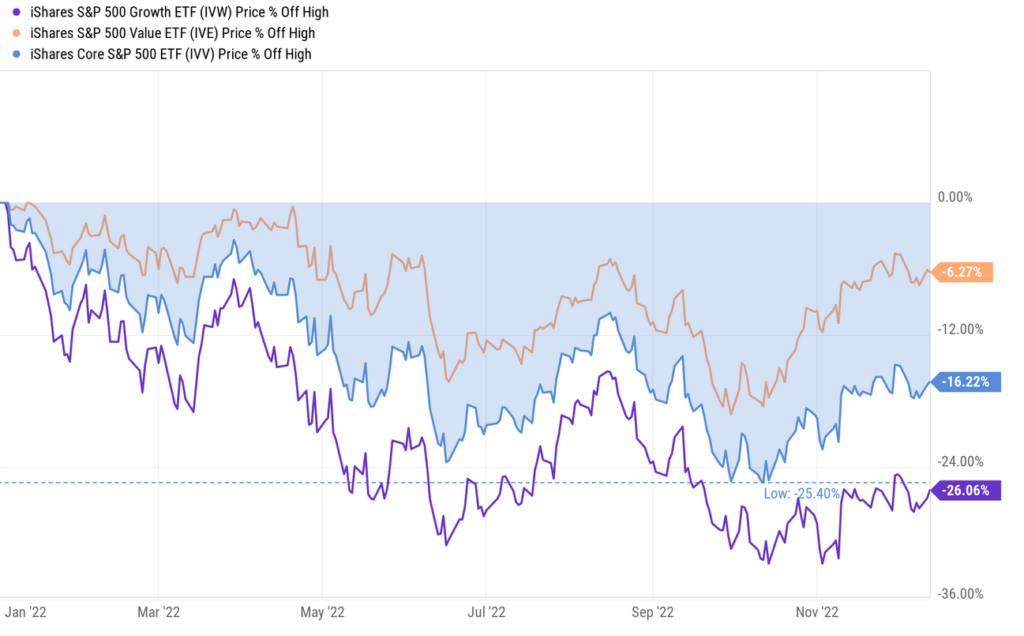

Some clients are more risk-averse than others. However, most people assume the entire study was based on a 50/50 stock and bond allocation. This is TRUE for the 4% rule, or SAFEMAX, but he also ran scenarios based on all types of allocations. He discovered that 50% is the minimum optimal exposure to stocks. However, he found that the closer you get to 75%, the more it will increase your SAFEMAX. So, in addition to adding more asset classes, as mentioned above, increasing your percentage of stock ownership could also increase the safe withdrawal rate.

Word of caution: increasing your stock exposure could certainly increase your rate of withdrawal, but it will also increase the volatility and the risk of loss in your portfolio.

This is where “risk capacity” comes into play. The more risk capacity you have, the more inclined you might be to take on more risk. The inverse is also true.

The 4% rule is also based on the worst-case scenario of historical rates of return and inflation.

The majority of the time, stocks have positive returns (80% of the time). But, what if you pick the worst year to retire, like 1968? This was a perfect storm of bear market stock performance combined with high inflation (sound familiar?). So, does that mean you should plan for the worst-case scenario? If you do, in most of the trials within Bengen’s research, the portfolios lasted well beyond 50 years resulting in a significant surplus in assets at death.

In fact, he cited that many investors did very well with a 7% withdrawal rate! My goal is to encourage my clients to ENJOY retirement, not worry about the worst that could happen!

How much of your retirement income are you willing to sacrifice just to prepare for the worst-case scenario? After all, $70,000/year is a heck of a lot more than $40,000/year from the same $1mm portfolio.

What about the impact of tax planning?

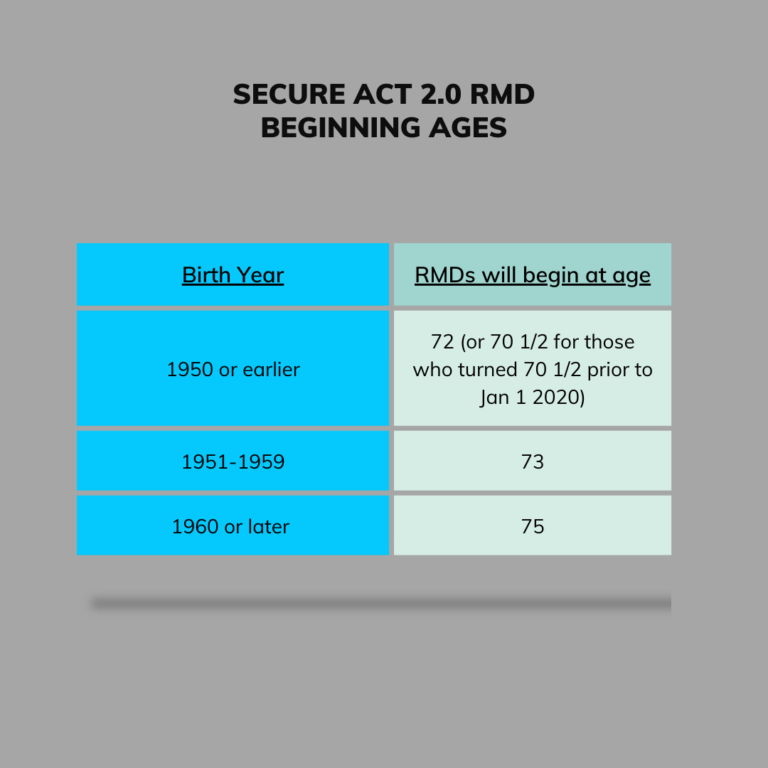

Bill Bengen’s study assumed the entire portfolio was invested in a tax-deferred IRA or 401k plan. This means that all income coming out of the portfolio was taxed at ordinary income rates! But what about those who have brokerage accounts with favorable capital gains treatment? Or better yet, what about Health Savings Accounts or Roth IRAs? These accounts have TAX-FREE withdrawals assuming they are qualified!

If smart tax planning is implemented, this could also enhance retirement income!

If you are like many of the clients we work with, the majority of your retirement savings likely consists of pre-tax 401ks and IRAs (aka “tax deferred” accounts). You might be wondering if you should take advantage of the Roth conversion strategy to improve tax efficiency during retirement. You can read more about that topic in a previous post (link here).

Sometimes, if you have a period of time with very low taxes (typically in the first 5-10 years of retirement), you can be aggressive with this strategy and significantly save on taxes in retirement and Medicare surcharges (aka “IRMAA”).

Do retirees' expenses increase with inflation?

Another challenge of the 4% rule is the assumption that spending continues to increase at the pace of inflation each year. But what about later in retirement when travel slows down? Or, perhaps you sell the RV after years of exploring the national parks. Wouldn’t discretionary spending go down, thus resulting in a lower rate of withdrawal?

According to Michael Stein and his research, he cites that retirees go through three life stages

- Go-go years

- Slow-go years

- No-go years

In the Go-go years, spending may actually go up slightly due to the simple fact that you have more free time! You’re able to take several big trips a year, visit the grandkids often, and so on.

In the Slow-go years, expenses go down a bit and also tend to increase at a slower pace than the consumer price index. During this phase, spending can drop up to 25% and increase at a slower pace than the Consumer Price Index.

In the No-go years, spending continues to drop with the exception of the healthcare category. Healthcare expenses tend to increase in the No-go years, but proper planning can help mitigate these costs.

If we assume a static spending level and therefore a reduced SAFEMAX, this could mean clients would potentially miss out on more spending in the “Go-go years” in order to have a surplus of available spending later in retirement!

Of course, we need to have a plan to address longevity and inflation risk, as well as a plan for unexpected healthcare expenses, such as Long-term care. However, if we have those contingencies in place, I’m all for spending more early in retirement while good health is on your side.

Social Security and other income sources aren't counted

Finally, the 4% rule never accounted for a reduction of portfolio withdrawals due to claiming Social Security or other retirement income.

Let’s say you plan to retire at age 60 and delay Social Security until 70 in order to collect the largest possible benefit. Your portfolio withdrawals in the first 10 years might be 30% or even 40% higher until you begin collecting Social Security!

The 4% rule does not account for those adjustments, and therefore will result in far less spending early on.

Word of caution. Accommodating for a higher than optimal withdrawal rate for an extended period of time, like 10 years, requires significant due diligence and risk management! A downturn during this period puts your portfolio at much greater risk, so ensure proper contingencies are in place if we go through a “Black Swan” event.

What is the Guardrail Withdrawal Strategy?

At a high level, the Guardrail Withdrawal Strategy allows for adjustments based on economic and market conditions. For simplicity purposes, this means reducing or increasing spending ONLY if a withdrawal rate guardrail is passed.

If you picture a railroad track, the initial target is the dead center of the track. We will then set “guardrails” on each side (positive and negative) to ensure we stay on track and make an adjustment to spending ONLY if we cross over the guardrail.

The guardrails we like to use involve an increase or decrease in the rate of withdrawal by 20% before a change needs to be made. If the rate of withdrawal crosses over the 20% threshold, either spending goes down 10% (Capital Preservation Rule) or up 10% (Prosperity Rule).

Let’s say we started with a rate of withdrawal of 5%; the lower guardrail would be 4% and the upper guardrail would be 6%. Due to market conditions outlined earlier in 2008, let’s say that caused us to pass the upper guardrail of 6%.

This would result would trigger the Capital Preservation Rule and the client would reduce their spending by 10% during that year.

Conversely, let’s say in 2021 the lower guardrail was hit given the extreme overperformance by stocks. This would result in the Prosperity Rule and spending increasing by 10% the following year.

This research was back-tested for a retiree who began withdrawals in 1973, which hit the perfect storm of high inflation and bear market returns. Despite these challenges, the maximum initial rate of withdrawal for a retiree that year was 5.8%! (assuming the portfolio was allocated to 65% in equities and 35% in fixed income). Increasing the stock exposure to 80% increased the initial rate of withdrawal to 6.2%!

Key factors to consider when implementing the guardrail withdrawal strategy

Risk tolerance

A client’s tolerance for risk will impact the “tightness” of the guardrails as well as exposure to stocks in the portfolio.

If a client is extremely risk-averse, perhaps you set “tighter” guardrails. This will increase the number of adjustments needed over time, but it could provide some peace of mind to the client. Additionally, reducing the stock exposure close to 50% (or in some cases lower) reduces volatility in the portfolio, but will also reduce the initial rate of withdrawal.

Conversely, if a client wants to achieve a higher rate of withdrawal (or income) and is comfortable with volatility in the market, up to 80% exposure to stocks could very well be appropriate. Additionally, you could widen the guardrails in order to limit the number of adjustments in spending.

What is the desire to leave a financial legacy?

The desire to leave a financial legacy is one of the major factors when considering the initial rate of withdrawal. If this is a high-priority goal, reducing the initial withdrawal rate could certainly improve the ultimate legacy amount.

On the other hand, if leaving a financial legacy isn’t a big priority, allowing for a much higher initial withdrawal rate is a viable option.

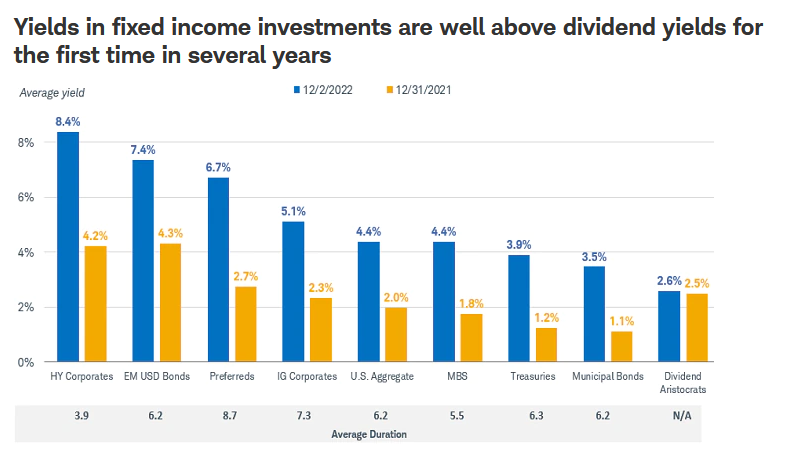

This is also where certain insurance products could be considered. For many, using a well-diversified investment portfolio with systematic withdrawals is more than appropriate. Fixed income would be used to protect withdrawals in a bear market, and stocks would be used as income during bull markets.

However, maybe having a guaranteed income stream is important to a client. In that case, consider purchasing a fixed annuity. One positive to rates increasing is that these annuity payout rates have also increased. I’ve seen quotes recently between 6%-8%/year. Many of the rate quotes, however, will not adjust for inflation. But if structured properly, this could be a nice solution to create an “income floor” over and above Social Security income.

For those of you who have a strong desire to leave a financial legacy, perhaps purchasing a life insurance policy could solve this challenge. In essence, this creates a legacy floor that can free you up to enjoy your retirement assets!

Finally, for those who have major concerns about Long-term care expenses down the road, purchasing Long-term Care Insurance could create some peace of mind. That way, the retirement income for the surviving spouse and/or legacy goals aren’t completely destroyed by a Long-term Care event.

Key takeaways and final word

There is no one size fits all retirement income plan. The 4% rule, the Guardrail Strategy, and the spending stages, all tie in differently based on your personal goals, risk tolerance, and financial situation.

Here are some key takeaways:

- The 4% rule is a sound benchmark, but following it may result in a significant surplus of unspent retirement capital over a normal life expectancy

- Retirement spending isn’t static, and using the Guardrail Withdrawal Strategy can ultimately improve your retirement income by allowing for flexibility in spending

- Successful withdrawal rates have ranged anywhere from 4%/year to 7%/year

- Risk tolerance and risk capacity drive the guardrail ranges as well as the exposure to equities in the portfolio

- Personal goals and risk factors further determine what the initial safe withdrawal rate should be

- Insurance products can help increase peace of mind and protect retirement income streams

We hope you enjoyed this article!

If you are curious about how you might incorporate guardrails into your retirement withdrawal strategy, we’d love to hear from you! You can use the button below to schedule a “Mutual Fit” meeting directly with me.

Make sure to subscribe to our newsletter so you don’t miss out on any of our retirement planning content.

Last but not least, share this with someone you know who is approaching retirement!

Thanks for reading!